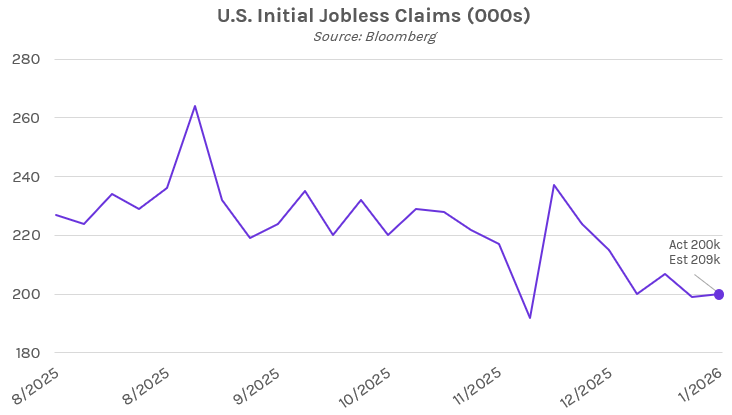

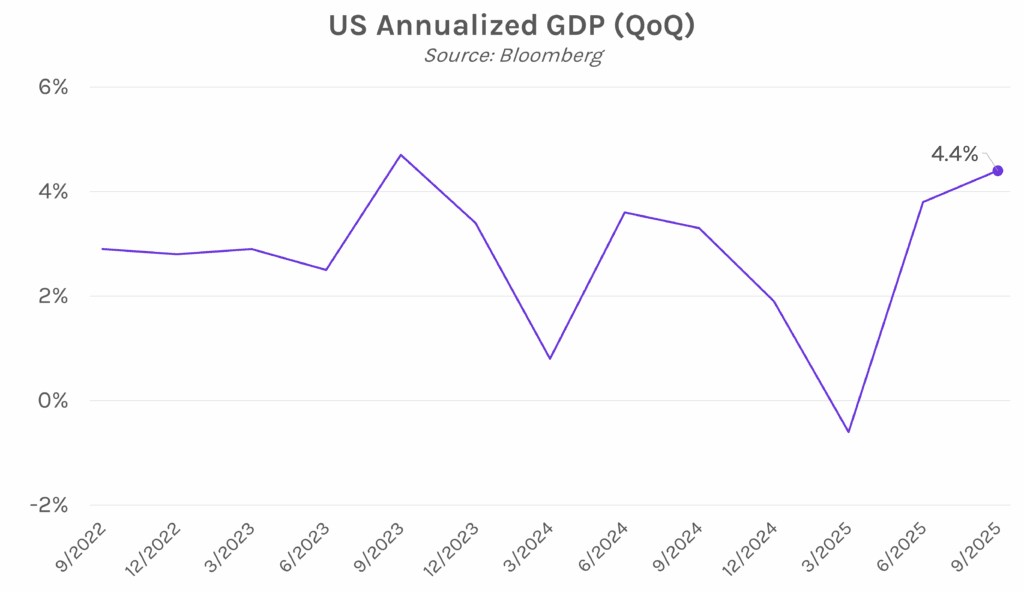

Yields rise on positive economic data. Treasury yields climbed higher this morning as third quarter GDP came in stronger than expected and initial jobless claims data steadied. Yields were little changed after PCE data met expectations across all readings. Yields traded in a tight ~2 bp range for the remainder of the session, and the 2-year yield ultimately closed 2 bps higher at 3.61%, while the 10-year yield closed nearly flat at 4.24%. Meanwhile, equities rose on today’s economic data, with the S&P 500 and NASDAQ up 0.55% and 0.91%, respectively.

US economy expands at fastest pace in two years. Inflation-adjusted GDP expanded at a revised 4.4% annualized rate in 3Q 2025, the fastest level in two years and slightly higher than the 4.3% pace initially reported. Growth was supported by stronger exports and smaller inventory drag, as companies decreased their imports following a rush earlier in the year to get ahead of President Trump’s global tariffs. The report also showed that consumer spending, the main driver of economic growth, grew at a 3.5% annualized pace in the third quarter. Additionally, business investment posted 3.2% growth, largely stemming from continued investment in computer equipment. Investment into data centers, which are a critical component of AI infrastructure, hit all-time highs.

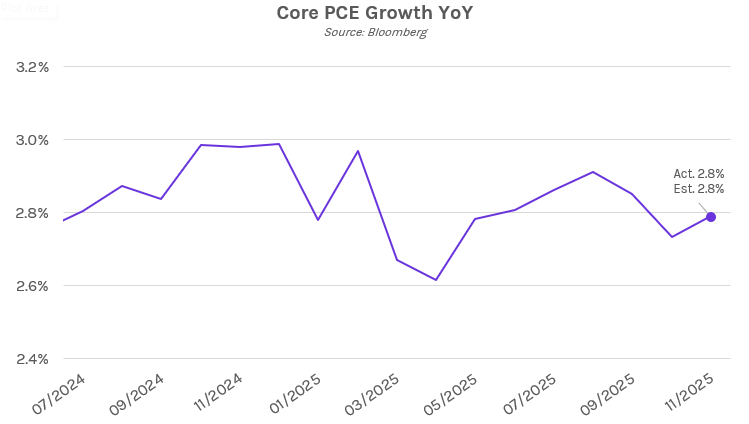

Personal spending, PCE data land as expected. November data released today showed that personal spending increased 0.5% versus October. Real personal spending, which is inflation adjusted, increased 0.3% for the second straight month, with both readings in line with estimates. Spending on goods in November hit the highest level since July, led by cars, apparel, and gas, while services spending decreased versus October. Also today, headline PCE showed prices increased 0.2% MoM and 2.8% YoY in November. Core PCE, which excludes the often-volatile food and energy sectors, increased 2.8% YoY, a slight uptick from October. Today’s prints suggest consumer spending remained strong through the end of 2025 despite lingering inflation concerns, as the data reinforced market expectations that the FOMC will vote to hold policy rates steady at next week’s meeting, with officials citing a stabilizing labor market and sticky inflation.