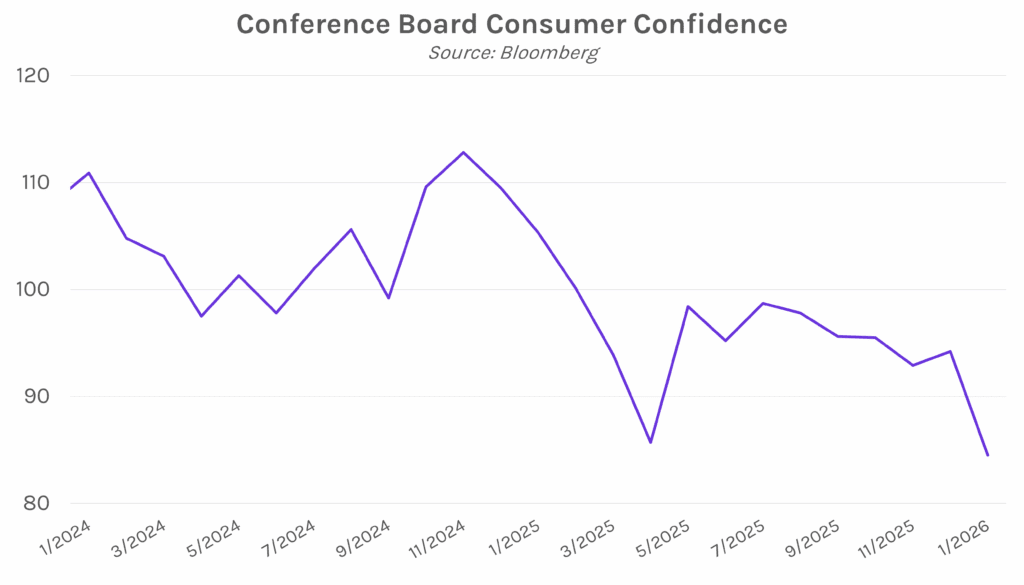

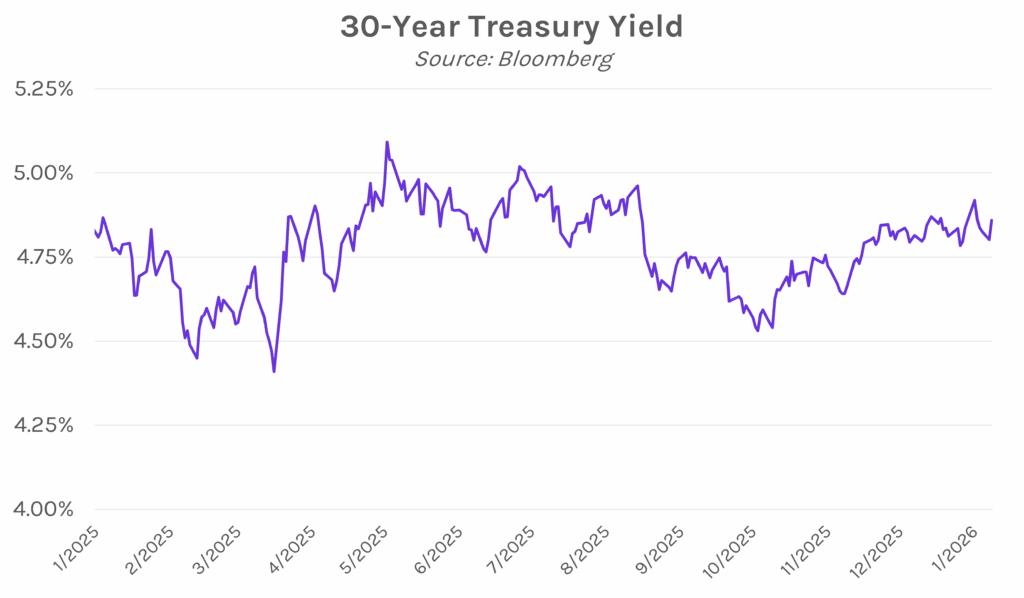

Yield curve steepens as longer-dated yields soar on continued selloff of US assets. Treasury yields traded in a tight 1-2 bp range overnight before declining ~3 bps from intraday highs, largely driven by consumer confidence data that dropped to its lowest since May 2014. Shortly after, the yield curve steepened as longer-dated yields soared while volatility at the front-end remained subdued. The 2-year yield closed 2 bps lower at 3.57%, while the 30-year yield closed 6 bps higher at 4.86%. Meanwhile, the S&P 500 climbed toward record highs, closing 0.41% higher at 6,979. Gold continued to rally, hitting a new all-time high and closing at $5,180 an ounce.

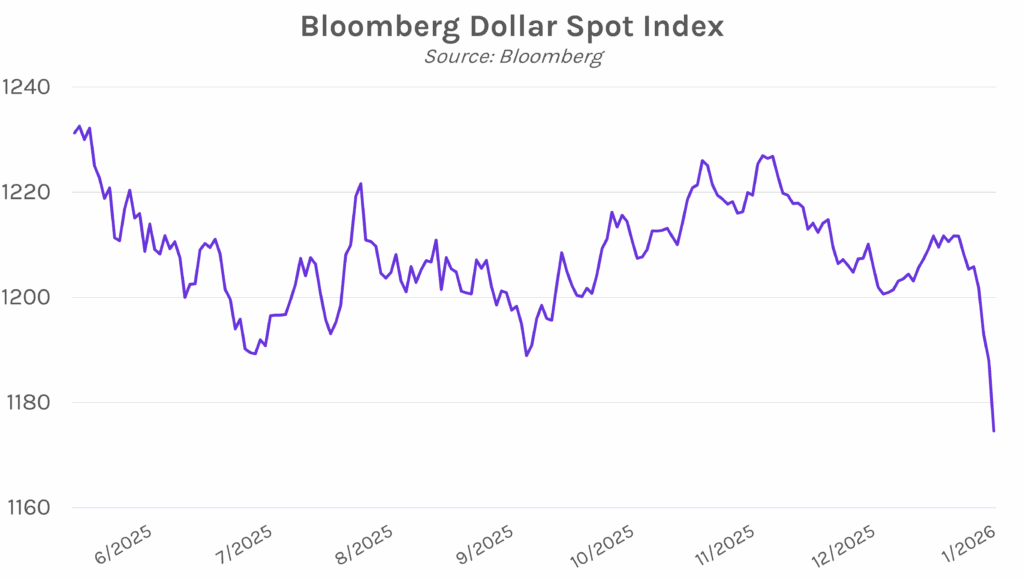

Dollar slump continues. The dollar continued to weaken today, hitting the lowest level since early 2022, after President Donald Trump indicated that he isn’t concerned about the current four-day selloff. Speaking to reporters, he said, “No, I think it’s great. I think the value of the dollar – look at the business we’re doing. The dollar’s doing great.” After his comments, the Bloomberg Dollar Spot Index fell as much as 1.2% to hit a new session low. Part of the recent decline in the dollar was caused by a sudden rebound in the Japanese yen last week that led traders to believe there would be a potential intervention coordinated by the US to support the currency. Additionally, recent threats over Greenland and potential political pressure on the Fed have led to perceived heightened US policy risks.

Consumer confidence plunges to lowest level in over a decade. At 84.5, the Conference Board gauge for consumer confidence in January came in below estimates of 91 and the prior month’s 89.1, marking the lowest level since May 2014. The measure of present conditions hit a 5-year low at 113.7, below December’s upwardly revised 123.6. Further, consumer expectations for the next six months fell to the lowest level since April, at 65.1. Consumers cited labor market concerns and high prices, frequently mentioning gas and grocery prices. Politics, the labor market, and health insurance costs also contributed to pessimism. Consumer confidence fell broadly across age and household income brackets, as fewer Americans expect wages to increase in the coming months and more are cutting back on big-ticket items.