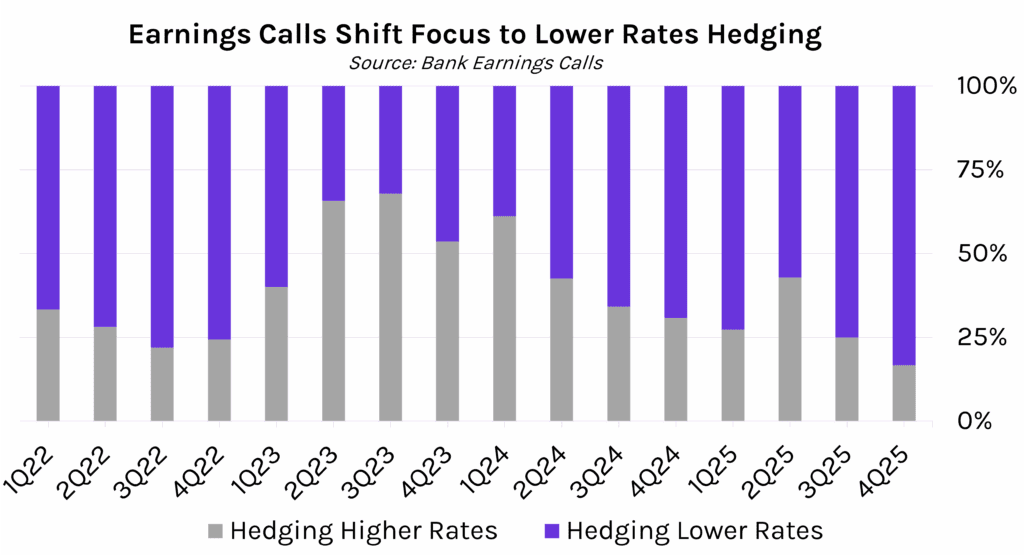

While we continue to see a mix of hedge direction in our client flows, earnings call commentary pointed to a clear focus on declining-rates hedges among larger publicly-traded banks. Notably, many receive-fixed swaps are becoming accretive to earnings after Fed rate cuts. The breadth of optimism around customer hedging programs is also worth highlighting. Over 40 institutions mentioned customer swap programs in their earnings calls, some highlighting 200%+ increases in non-interest fee income.

Here are a few ALM hedging strategies that we found interesting:

- Flagstar Bank, National Association: terminated existing pay-fixed swaps for a gain of $20 million.

- Regions Financial Corporation: executed forward-starting receive-fixed swaps to protect against falling rates.

- Metropolitan Bank Holding Corp.: swapped $1 billion of indexed deposits to fixed to reduce sensitivity to rising rates.

Read on for our complete summary:

Rising Rates Hedging

| Bank of Hawaii Corporation | Pay-Fixed Swaps | “We made no changes to our interest rate swap portfolio during the quarter, and we finished the year with an active pay-fixed receive-flow portfolio of $1.5 billion at a weighted average fixed rate of 3.5%… In addition, we have $500 million of forward starting swaps at a weighted average fixed rate of 3.1%. $300 million of these forward swaps will become active during the first half of 2026, while the remaining $200 million will become effective during the third quarter.” |

| Metropolitan Bank Holding Corp. | Pay-Fixed Swaps | “As our balance sheet remains modestly liability sensitive and more than $2 billion of our indexed deposits repriced on the first business day of the month… the benefit of the mid-December reduction in the Fed funds target rate will only become apparent in the first quarter. We have $1 billion of hedged indexed deposits, which display positive carry down to the Fed funds effective rate of approximately 3.50%.“ |

| Southside Bancshares, Inc. | Pay-Fixed Swaps | “…the unrealized gain on the fair value hedges on municipal and mortgage-backed securities was approximately $788,000 compared to $905,000 linked quarter. This unrealized gain more than offset the unrealized losses in the AFS securities portfolio.“ |

Declining Rates Hedging

| Associated Banc-Corp | Receive-Fixed Swaps | “We’re protecting our variable rate loan portfolio by maintaining receive-fixed swap balances of approximately $2.45 billion… While we’re still modestly asset sensitive, a down 100 ramp scenario represents less than a 1% impact to our NII as of Q4…” |

| BankUnited, Inc. | Declining Rates Hedges | “…you see margin improvement only going from 3.06% to 3.20%… our numbers aren’t very sensitive, whether it’s 1 cut or 2 cuts or 3 cuts, the balance sheet is fairly hedged.“ “We have hedged ourselves as best as we can, and we’re not worried about rate cuts being a little bit more or a little bit less. But if there’s something crazy, if there are — if interest rates go back to 0 or something like that, that will impact our earnings and everyone’s earnings.” |

| Citizens Financial Group, Inc. | Declining Rates Hedges | “You know that we’re also slightly asset sensitive, and our view is that rates will come down, but maybe not as much as feared initially… over time, we’ve continued to, I think, be very disciplined in our hedging actions. And so we’ve been adding in hedges at attractive rates.“ “Our net interest margin continues to steadily expand… 3 basis points of the margin expansion was driven by the benefits of noncore runoff and reduced impact from the terminated swaps, what we refer to as time-based benefits.“ |

| East West Bancorp, Inc. | Declining Rates Hedges | “…rates came down over the course of the year… what we have indicated previously was essentially the hedges we have on today are in the money today. And so we are now in a position where we expect to have those tailwinds as we look forward into the — into 2026 in addition to the fact that we expect more rate cuts to come. We’ve got about $1 billion of swaps at roughly like a 370, 380 level. And those will be — those are in the money today.“ “The market is there for us and — but East West has a very, very strong discipline of our overall asset liability management.” |

| Fifth Third Bancorp | Declining Rates Hedges | “…we are going to take some action through some swaps and some hedges. We’ll probably still be a little bit asset sensitive… but we’ll be in a good manageable position that will be in line with our rate outlook.“ |

| FirstSun Capital Bancorp | Declining Rates Hedges | “…First Foundation’s balance sheet is a term asset, short-funded kind of structure. We’re certainly taking action to reduce some of that…both with hedging and with the activity that we’re working on together, I think we feel good about the progress being made.“ |

| Flagstar Bank, National Association | Pay-Fixed Swap Unwinds | “Net interest margin improved 23 basis points quarter-over-quarter to 2.14% when including a gain of $20 million for the tearing up of hedges tied to long-term FHLB advances that we restructured at the end of the quarter.“ |

| M&T Bank Corporation | Receive-Fixed Swaps | “The net interest margin was 3.69%, an increase of 1 basis point from the prior quarter. This improvement was driven by a… positive 3 basis points from a reduction in negative impact of our interest rate swaps…“ |

| Northern Trust Corporation | Receive-Fixed Swaps | “We issued $1.25 billion in new debt in November, $500 million in senior and $750 million in sub debt. The debt was swapped to floating and proceeds were invested in floating rate securities at a positive carry.” |

| Regions Financial Corporation | Receive-Fixed Swaps | “…asset repricing is exposed to middle and long-term rate fluctuations. To mitigate a portion of this exposure,we added $3.5 billion of forward starting receive-fixed swaps scheduled to begin throughout 2026. These hedges, distinct from our short-term rate protection, are intended to lock in rate levels on future loan and securities production.” |

| S&T Bancorp, Inc. | Receive-Fixed Swaps | “…we’re also getting benefit from this receive swap book that we have. So that’s been helping a lot to support the lack of declines on the asset side.“ |

| Texas Capital Bancshares, Inc. | Receive-Fixed Swaps | “During Q4, $250 million in swaps matured at a 3.4% receive rate, replaced this with $1 billion in receive-fixed SOFR swaps executed at 3.41%, becoming effective in Q4, an additional $400 million in swaps at a 3.32% receive rate became effective in early Q1.“ |

| The PNC Financial Services Group, Inc. | Receive-Fixed Swaps | “We have for — just as an ongoing program, and we did this in ’25, and we’ve done a lot of it in ’26, we lock those forward maturities at opportunistic times with forward starting swaps, right? So we kind of say, look, we’re pretty good independent on what rates does, that’s because we’ve taken advantage and locked a lot of that forward…” |

| Truist Financial Corporation | Receive-Fixed Swaps | “In terms of the active receivers, Q3, Q4 was actually flat around $50 billion. And you see that sort of gradually phase in throughout the course of ’26… I think we end the fourth quarter a little over $100 billion.“ |

| WSFS Financial Corporation | Declining Rates Hedges | “…we’re trying to manage the interest rate cuts that are — that we’re forecasting or assuming in outlook for next year… on the hedging program, we are — to give a quick update there, we have about $1.3 billion of hedges that are currently in the money. And with another rate cut, we would have $1.5 billion of hedges that are in the money.“ |

Customer Hedging Programs

| Alerus Financial Corporation | Customer Hedging | “…we saw approximately $1 million in swap fee income this quarter. As a reminder, swap fee income tends to be lumpy from quarter-to-quarter.” |

| Atlantic Union Bankshares Corporation | Customer Hedging | “Fee income was strong, primarily driven by loan-related interest rate swap fees… We expect ongoing growth in this area, though it’s important to note that swap income may vary from quarter-to-quarter.” |

| Bank OZK | Customer Hedging | “…our loan syndication and Corporate Services business line within CIB was planted about 18 months ago and continues to build… It includes our interest rate hedging program… and also include some foreign exchange capabilities… we’re starting to see some nice penetration, for instance, with the interest rate hedging providing caps to our RESG customers, whether that be that or swaps that we’re providing to some of our community bank customers.” |

| Bridgewater Bancshares, Inc. | Customer Hedging | “…we’re really pleased with the progress that we’ve made just on educating the banker teams on how to sell through that product and educating our clients on the benefits of leveraging interest rate swaps on some of their transactions. So we expect it to be a bigger piece of the business overall.” “We expect swap fees to continue to be a portion of the revenue story in 2026. But given the shape of the yield curve and the current environment, we would expect them to slow a bit.” |

| Business First Bancshares, Inc. | Customer Hedging | “Core noninterest income results for the fourth quarter were better than we expected, primarily due to swap fee revenue, which was about $1 million higher than expected.“ “It’s not just about the economic opportunity for the fee generation. It’s also an opportunity to offer the client more options even while we put ourselves in a better place to manage our interest rate risk.” |

| Byline Bancorp, Inc. | Customer Hedging | “Tom mentioned swaps and derivatives and things of that sort. So we want to continue to do as much as we can there. Obviously, that’s a bit of a rate sensitive dynamic, but we certainly want to continue to offer those products and services and take advantage of situations where we can do that.“ “Swap income was up nicely for the quarter as we continue to focus on growing other fee income categories.” |

| Camden National Corporation | Customer Hedging | “Our fourth quarter noninterest income included… elevated fees earned on back-to-back loan swaps, which totaled $594,000 in the fourth quarter.” |

| Columbia Banking System, Inc. | Customer Hedging | “Q4 was an absolute banner finish to the year. And we talked a bit about swap syndications and some of those items… but those elements were high watermarks for the quarter.“ “Of the $16 million sequential quarter increase in operating noninterest income… $3 million was driven by higher customer fee income, most notably in swap and syndication banking revenue…” |

| East West Bancorp, Inc. | Customer Hedging | “In 2025, fee income grew by a robust 12%… we achieved record fee income levels in 2025. Our performance over the past year was driven by sustained quality execution across wealth management, derivatives, foreign exchange deposit fees and lending fees” |

| Eastern Bankshares, Inc. | Customer Hedging | “Investment advisory fees increased $1.1 million to $18.6 million due to… interest rate swap income, which increased $500,000 to $1.4 million, the highest level since the third quarter of 2023, which benefited from our hiring last year of an experienced leader to head up foreign exchange and derivative sales.” |

| F.N.B. Corporation | Customer Hedging | “Capital markets income included higher swap fees…“ |

| FB Financial Corporation | Customer Hedging | “Noninterest income improved in the quarter as we saw stronger swap fees and investment services revenue…” |

| Financial Institutions, Inc. | Customer Hedging | “Commercial back-to-back swap activity was again strong in the quarter with associated fee income of $1.1 million, up $463,000 to more than 31% from the third quarter. Full year 2025 swap fee income of $2.5 million was up $1.8 million from the prior year. We expect swap fees to moderate to a range between $1 million and $2 million, which is more in line with the 2022 and 2023 levels experience.” |

| First Bank | Customer Hedging | “Noninterest income totaled $2.3 million in the fourth quarter of 2025 compared to $2.4 million in the third quarter. The decrease of $138,000 mainly reflected lower gains on recovery of acquired loans, but this was partially offset by higher loan swap fees…“ |

| First Business Financial Services, Inc. | Customer Hedging | “These include lower SBA gains, which resulted from the government shutdown and lower swap and loan fees, which could be highly variable and declined from the third quarter. As a reminder, swap fees were unusually high in the linked quarter.” |

| First Commonwealth Financial Corporation | Customer Hedging | “SBA gain on sale income increased by $800,000, but this was more than offset by a $700,000 decrease in wealth advisory fees and a $200,000 decrease in swap fees.“ |

| First Interstate BancSystem, Inc. | Customer Hedging | “[Fee income] implies some modest growth year-over-year… I think longer term, we think there’s opportunities in some of the underlying areas such as swap fees and things like that.” |

| FirstSun Capital Bancorp | Customer Hedging | “…we had a really nice quarter with noninterest revenue totaling $26.7 million or roughly $400,000 more than Q3 and up almost 24% over the fourth quarter of ’24. The sequential growth in the fourth quarter of ’25 was largely driven by our loan syndication and swap revenue streams…“ |

| Fulton Financial Corporation | Customer Hedging | “…on the swap income, that really tracks with originations, and it’s typically the larger deals that would have a swap versus a fixed rate, so that you’re right, that does bounce from quarter-to-quarter and it really ties and correlates to originations and some larger originations. So it’s natural as you seeing growth and origination accelerate in the fourth quarter. That’s pretty in line with what we would expect from the derivatives too.” |

| Hope Bancorp, Inc. | Customer Hedging | “In the fourth quarter of 2025, we realized growth across a number of fee income lines and strength in customer level swap fees was a highlight… For example, customer level swap fees were $6 million for the full year of 2025, an increase of 270% from $1.6 million in 2024.“ |

| KeyCorp | Customer Hedging | “…corporate service fees increased by 20% and 17% year-over-year, respectively. The increase in… corporate services income was driven by higher loan commitment fees and client FX and derivatives activity.“ |

| M&T Bank Corporation | Customer Hedging | Q: “…trading revenues has stepped up each of the last 2 quarters to $18 million to $19 million. Remind me like has there been a change in kind of the efforts there or any small deal that would reset this level higher versus just kind of quarter-to-quarter volatility?” A: “…that specifically is our customer swap book. But what you see there is really just a precursor of something that’s greater overall… [our capital markets and investment banking area] had a record year of revenue this past year.[They’re] going to have a really strong year, probably another record in 2026.“ |

| OceanFirst Financial Corp. | Customer Hedging | “We continue to see strong swap demand linked to our commercial growth and look for that to continue in the coming quarters.” |

| Origin Bancorp, Inc. | Customer Hedging | “…I actually just think [swap fees] was extraordinary in the third quarter, to be honest with you. I think it kind of came back and normalized a little bit… I think our swap and loan fees were up 59% kind of year-over-year.“ |

| Orrstown Financial Services, Inc. | Customer Hedging | “…swap fees were $1.1 million in the quarter… swap fees can be — can change from quarter-to-quarter.” |

| Pinnacle Financial Partners, Inc. | Customer Hedging | “…we’ve had over 15% growth in swap fees. But the capital markets platforms are a great area to show what are the opportunities for revenue synergies because we have the effectiveness of the swap delivery.” |

| Regions Financial Corporation | Customer Hedging | “Adjusted non-interest income increased 5% in 2025, but declined 6% versus the third quarter… Real estate capital markets and commercial swap activity was further impacted by the temporary government shutdown.“ |

| SmartFinancial, Inc. | Customer Hedging | “Operating noninterest income reached $8.2 million, surpassing our expectations due to elevated mortgage banking revenue and customer swap fees…“ |

| Southside Bancshares, Inc. | Customer Hedging | “Other noninterest income decreased primarily due to a decrease in swap fee income.“ |

| SouthState Bank Corporation | Customer Hedging | “We had 75 basis point decrease in rates that was helpful for that business. The interest rate swaps were up $4 million quarter-over-quarter… as we think about those businesses from quarter-to-quarter move up and down, I would look at that business kind of on the average of the year…” |

| Third Coast Bancshares, Inc. | Customer Hedging | “We’re pretty optimistic on noninterest income… All the swap fees, anything like that, the more volume we have, the more money we make there.“ |

| UMB Financial Corporation | Customer Hedging | “Fee income, excluding these valuation changes was $196.2 million, a decrease of $11.2 million from the third quarter. The largest drivers were… a $2.9 million decrease in derivative income from elevated 3Q levels…“ |

| United Community Banks, Inc. | Customer Hedging | “…with the volumes that we’re expecting next year, you’re going to see strong growth in our customer swap businesses.“ |

| USCB Financial Holdings, Inc. | Customer Hedging | “Swap fees remain attractive to our clients in the marketplace.” |

| Valley National Bancorp | Customer Hedging | “While fourth quarter fee income benefited fromabnormally high commercial loan swap activity, and to a lesser extent, valuation gains on fintech equity investments, which may not recur, we anticipate high single-digit growth in 2026.“ |

| Washington Trust Bancorp, Inc. | Customer Hedging | “Q4 loan-related derivative income was up by $810,000 in the quarter.“ |

| Webster Financial Corporation | Customer Hedging | “…the higher origination activity that we saw, on the growth that we saw in C&I and in CRE, we do get a fair amount of swaps, syndications and FX business as well.“ |

| Wesbanco, Inc. | Customer Hedging | “We again saw a nice improvement in gross swap fees, which increased $2.1 million year-over-year to $3.4 million in the fourth quarter and doubled to $10 million for the full year reflecting both the interest rate environment and traction within our newest markets.” |

| WSFS Financial Corporation | Customer Hedging | “Noninterest income increased by $100,000 in 2025, primarily due to an increase from fees from swap referrals…“ |

Reach out with any questions or for pricing on specific structures

212-651-9050