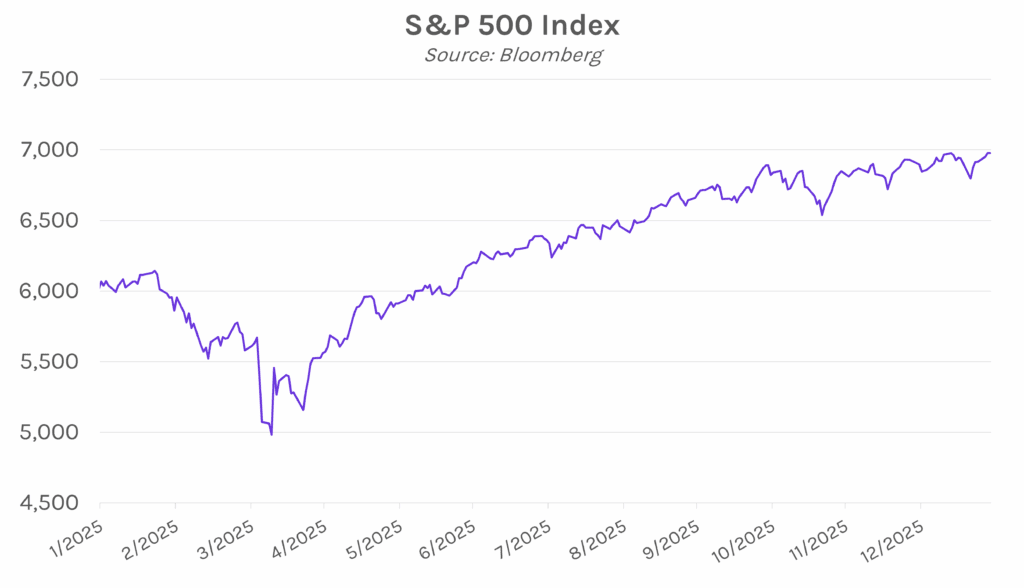

Yields close flat as Fed leaves rates unchanged. Treasury yields edged higher leading into the FOMC decision and press conference today, up ~2bps across the curve. The Fed then voted to hold policy rates steady and offered little insight into the potential timing for another rate cut, failing to trigger meaningful rate movement. Yields closed little changed across the curve, with the 2-year yield at 3.57% and the 10-year yield at 4.24%. Meanwhile, the S&P 500 closed nearly flat at 6,978, despite briefly rising above the 7,000 level early in the session on a tech-led rally. Gold surpassed the $5,400 price level as the precious metals surge continued.

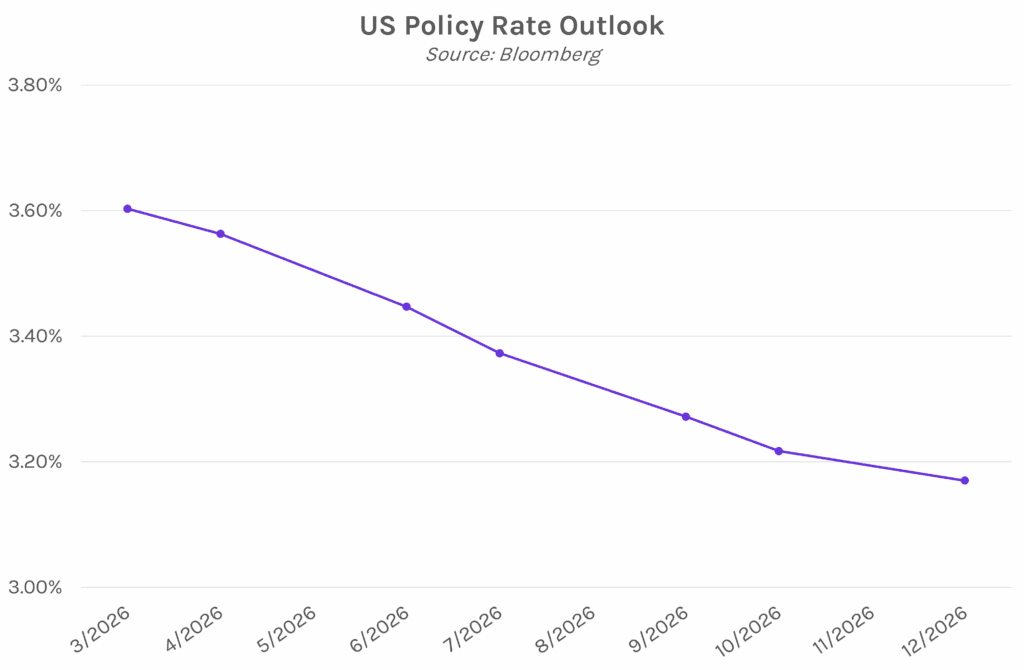

Fed votes to hold rates on easing labor market concerns. For the first time since July, following 75 bps of cuts, the FOMC voted today to hold its target benchmark rate between 3.50% and 3.75%. The vote came 10-2, with Fed Governors Miran and Waller dissenting in favor of a quarter-point cut. This marked Miran’s fourth consecutive dissent, though he’d previously done so in favor of a half-point cut. The post-meeting statement said, “Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization.” In his post-meeting remarks, Chair Powell described “clear improvement” in the US economic outlook for 2026. Based on Powell’s remarks and the committee’s easing labor market concerns, markets are not pricing in a full rate cut until at least June. The full FOMC statement with a side-by-side comparison from the last meeting can be read here.

Dollar sees biggest one-day gain on Bessent’s comments. After a week of declines, the dollar saw its largest one-day gain since November as US Treasury Secretary Scott Bessent said that “the US always has a strong dollar policy” and specified that the US was “absolutely not” intervening in the Japanese currency market. The Bloomberg dollar index rose 0.4%, reversing some of this week’s losses that stemmed from concerns about the administration wanting a weaker dollar to boost exports and potential US intervention on the Japanese yen. Despite Bessent’s comments, the dollar is still ~1% lower on the week, now at 1,179 after hitting a multi-year high of 1,310 in February 2025.