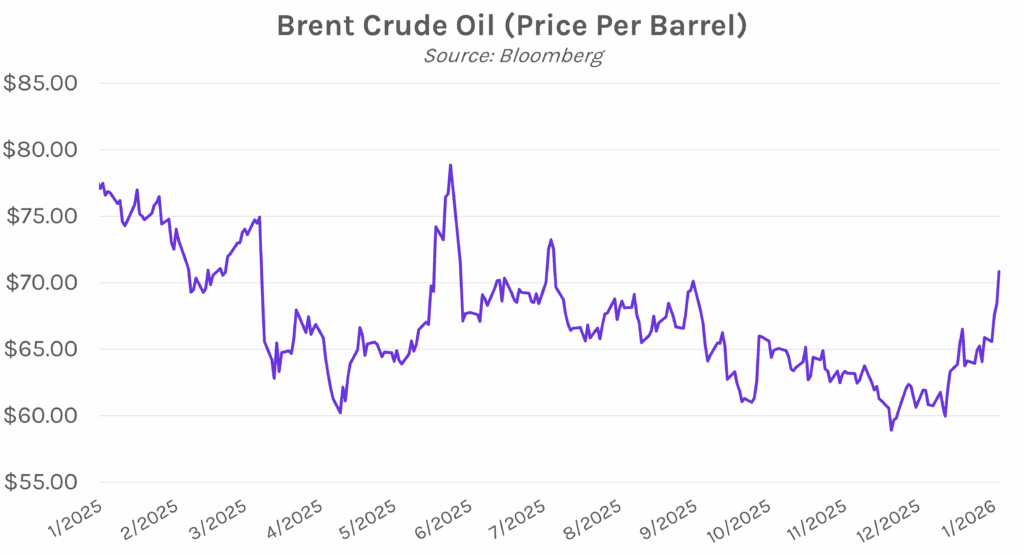

Yields inch lower as risk assets slide. Treasury yields were nearly flat this morning after a muted reaction to initial jobless claims data, which came in at 209k versus the 205k forecast. However, yields later declined ~3 bps as risk assets sold off, led by Microsoft plunging over 10% on weak earnings and heavy AI spending that triggered market concerns. The 2-year and 10-year yield closed 1bp lower at 3.56% and 4.23%, respectively. Meanwhile, the S&P 500 closed only 0.13% lower despite earlier declining ~1.5%, with a strong outlook from Meta Platforms Inc. helping to drive the reversal. Meanwhile, Brent crude climbed above $70 as President Trump threatened military strikes on Iran if they did not agree to a nuclear deal.

Trump to announce Fed Chair nominee next week. President Donald Trump shared that next week, “We’re going to be announcing the head of the Fed, who that will be, and it will be a person that will, I think, do a good job.” Trump also reiterated his desire for lower policy rates, saying, “We should have the lowest interest rates anywhere in the world. They should be two points and even three points lower.” According to Treasury Secretary Scott Bessent, Trump is considering four candidates, who are rumored to be Fed Governor Christopher Waller, former Fed Governor Kevin Warsh, Blackrock Inc. executive Rick Rieder, and National Economic Council Director Kevin Hassett. Hassett was previously seen as the leading contender until earlier this month when Trump indicated that he would prefer to keep him in his current role.

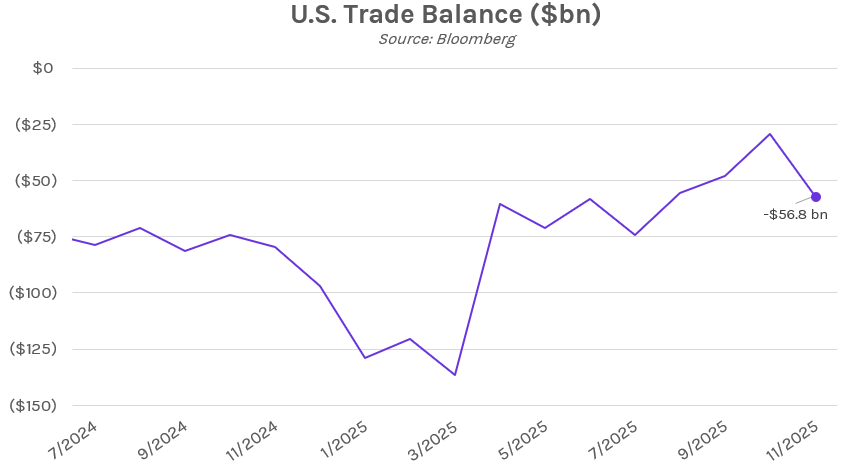

US trade deficit nearly doubles versus the prior month. The US trade deficit for November came in at $56.8 billion today, above estimates of $44.0 billion and the prior month’s $29.4 billion. The 94.6% monthly change was the largest since 1992, however October’s trade balance was much smaller than recent averages and the lowest since 2009. November’s increase was driven by an overall uptick in imports, which grew by 5% on a boost in capital goods, including computers and semiconductors, and a surge in inbound pharmaceutical shipments. Meanwhile, the value of goods and services exports fell by 3.6%. While trade data has been prone to volatility in recent months due to President Trump’s tariff announcements, implementations, and reversals, today’s release will help firm up GDP estimates, with fourth quarter growth now predicted to be 4.2%.