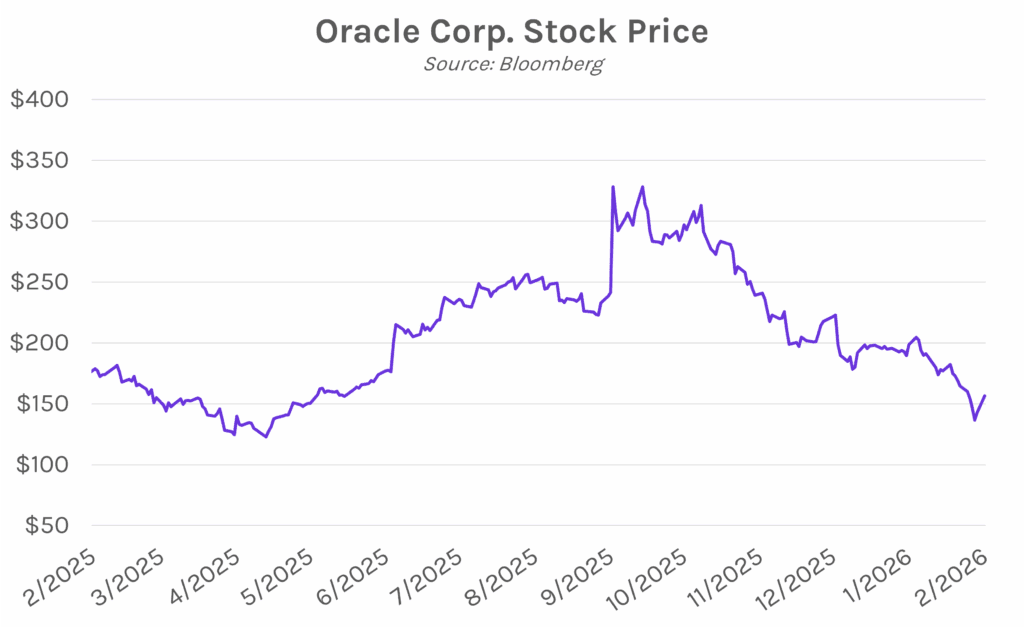

Yields little changed ahead of data-heavy week. Treasury yields declined 2-3 bps from intraday highs this morning after National Economic Council Director Hassett warned that he anticipates lower jobs numbers in the near-term. The yield curve closed nearly flat, with the 2-year yield at 3.49% and the 10-year yield at 4.20%, as markets look ahead to a busy week of economic data. The January jobs report will be released on Wednesday, where nonfarm payrolls is expected to show 68k jobs added, followed by CPI on Friday, with core inflation expected to cool to a 2.5% annualized pace. Meanwhile, equities continued Friday’s rally, driven by strength in AI names, with Oracle Corp. up nearly 10% and the technology-heavy NASDAQ up 0.90%.

Hassett downplays concerns about expected labor market slowdown. National Economic Council Director Kevin Hassett said this morning on CNBC that a slowdown in job growth over the coming months may stem from low population growth. He specified, “I think that you should expect slightly smaller job numbers that are consistent with high GDP growth right now” but caveated, “One shouldn’t panic if you see a sequence of numbers that are lower than you’re use to, because… population growth is going down and productivity growth is skyrocketing.” The remarks come ahead of Wednesday’s January jobs data, which is expected to be mixed. While the unemployment rate is forecasted to hold steady at 4.4%, payroll data for the 12-month period ending March 2025 is expected to show sizeable downward revisions, with estimates of 863k fewer jobs added than initially reported.

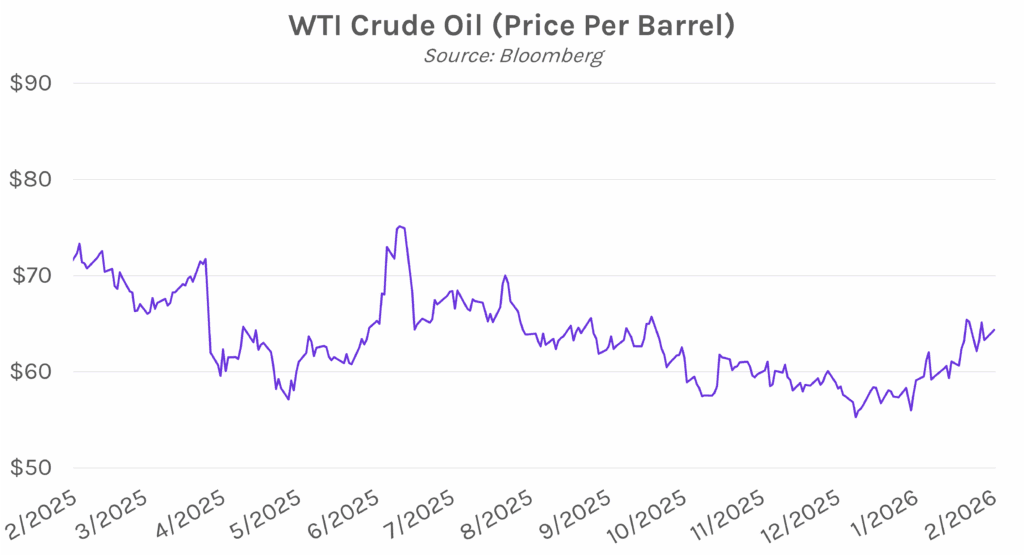

Oil rises as US advises ships to avoid Iran. The US Department of Transportation released a maritime advisory today, telling American ships to avoid Iranian waters when traveling through the Strait of Hormuz due to an incident last week where Iran’s Islamic Revolutionary Guard Corps harassed a US ship traveling through the strait. The notice triggered market concerns over the critical Hormuz waterway, where nearly a third of the world’s oil travels through. Oil prices rose, with WTI crude futures up 1.3%, above $64 per barrel. Today’s development was a reversal of last Friday’s optimism that stemmed from “positive” discussions between the US and Iran. President Donald Trump said there will be another meeting this week.