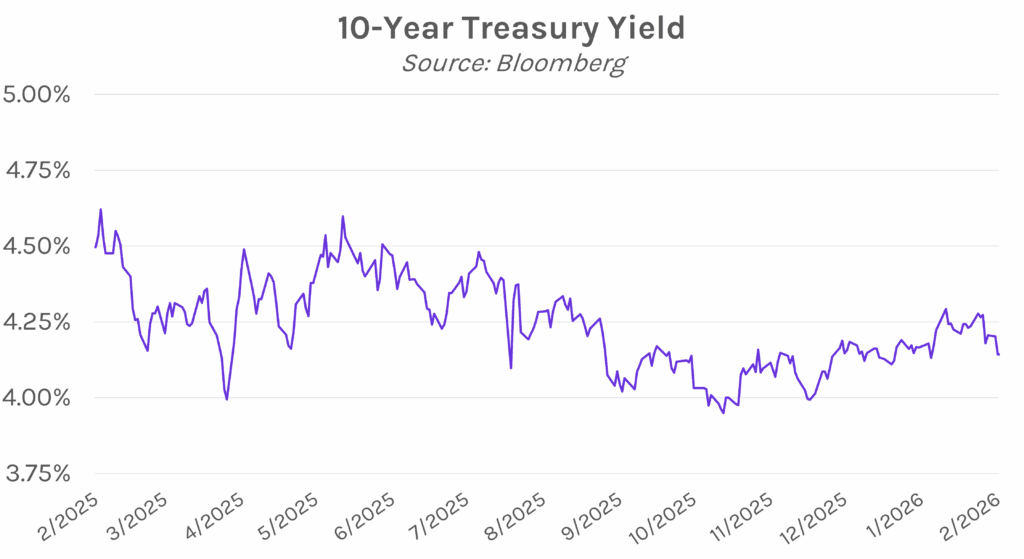

Yields drop on stagnant retail sales data. Treasury yields tumbled in the aftermath of retail sales data, which fell below expectations and showed stagnation in December. Rate volatility was muted throughout the remainder of the session, with the 2-year yield closing 3 bps lower at 3.45% and the 10-year yield 6 bps lower at 4.14%, near its lowest level in nearly a month. Market focus is now geared toward tomorrow’s jobs report, where a miss could further drive risk-off sentiment after last week’s JOLTS job openings print fueled a ~10bp decline in rates. Meanwhile, equities halted their recent two-day rally that brought them back to hovering near all-time high levels, with the S&P 500 and NASDAQ down 0.33% and 0.59% on the day.

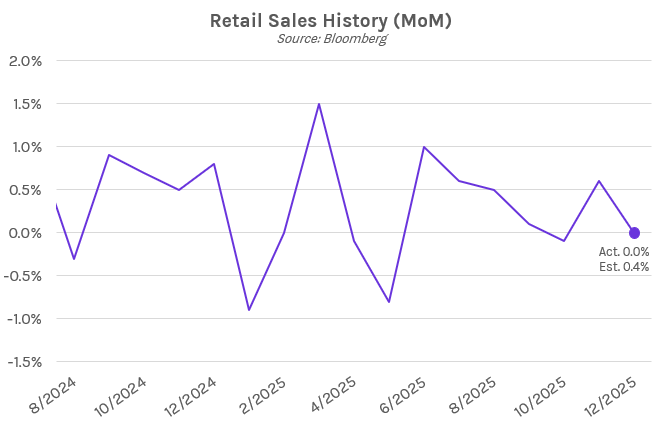

Retail sales unexpectedly drop in December. Headline retail sales were flat in December from November, posting 0.0% growth that was well below expectations of a 0.4% increase and November’s 0.6% jump. Eight of thirteen retail categories saw declines, including clothing and furniture stores. Spending at restaurants and bars, the only service sector in the retail sales report, fell 0.1% after spiking in November. Excluding autos and gasoline, retail sales were also flat MoM, below estimates of a 0.4% increase and the prior month’s downwardly revised 0.3% rise. Today’s data is a sign that consumer spending fizzled out to end the year after a strong start to the holiday shopping season. However, some experts predict that tax refunds will help boost demand in the coming months, even as consumer spending concerns linger.

Fed’s Hammack, Logan sees near-term policy rates on hold. Cleveland Fed President and FOMC voter Beth Hammack said that policy rates can potentially be held steady for an extended period as officials evaluate economic data. Hammack explained, “Rather than trying to fine tune the funds rate, I’d prefer to err on the side of patience as we assess the impact of recent rate reductions and monitor how the economy performs.” Hammack most recently voted in favor of holding rates steady at the January FOMC meeting. Meanwhile, FOMC voter and Dallas Fed President Lorie Logan spoke in favor of holding rates steady, absent any “material” shifts weaker in the labor market.