3 Things to Know:

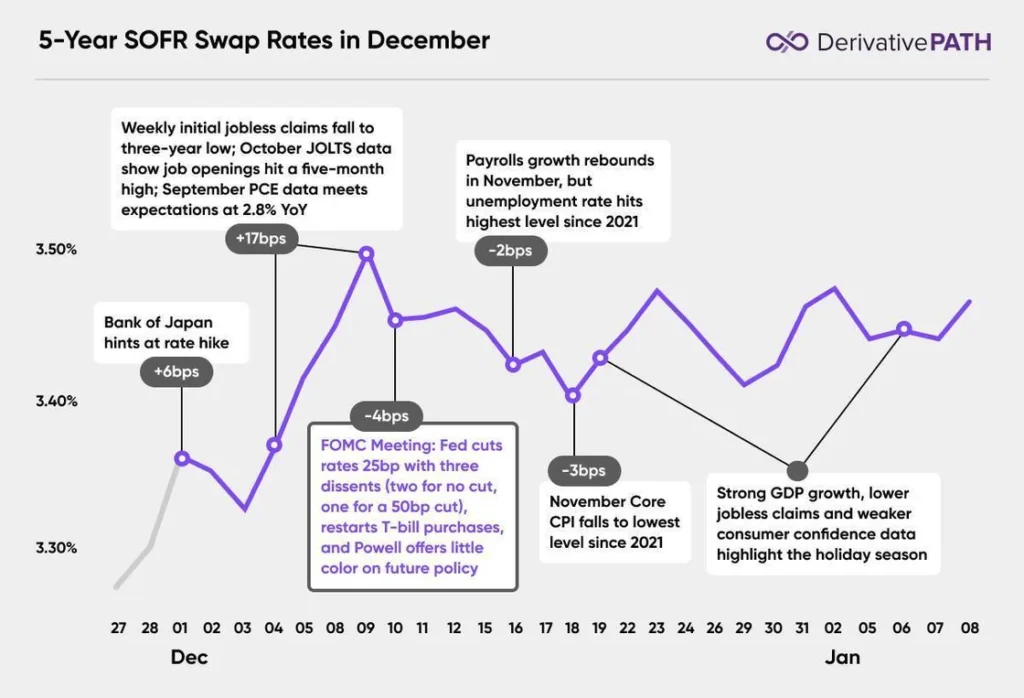

- Rates hit multi-month highs. Rates climbed ~20 basis points to start December, reaching the highest levels since August, and remained around those levels throughout the rest of the month.

- Markets expect less rate cuts. Leading up to the FOMC meeting, markets repriced expectations for Fed rate cuts in 2026, fueled by strong labor and in-line PCE inflation data. Futures markets now see one or two 25 basis points cuts in 2026, vs. two or three at the start of December.

- Fed division grows. The FOMC delivered a 25 basis point rate cut in December, but the decision featured three dissenters, the most since 2019. Powell emphasized that the cut was a “close call” and didn’t offer much clarity on the road forward.

Explore More:

- Bank of Japan Rate Hike (+6 bps)

- Early December Data (+17 bps)

- December FOMC Meeting (-4 bps)

- November Labor Data (-2 bps)

- November CPI (-3 bps)

- Late December Data

Contact us:

415-992-8200

sales@derivativepath.com