3 Things to Know:

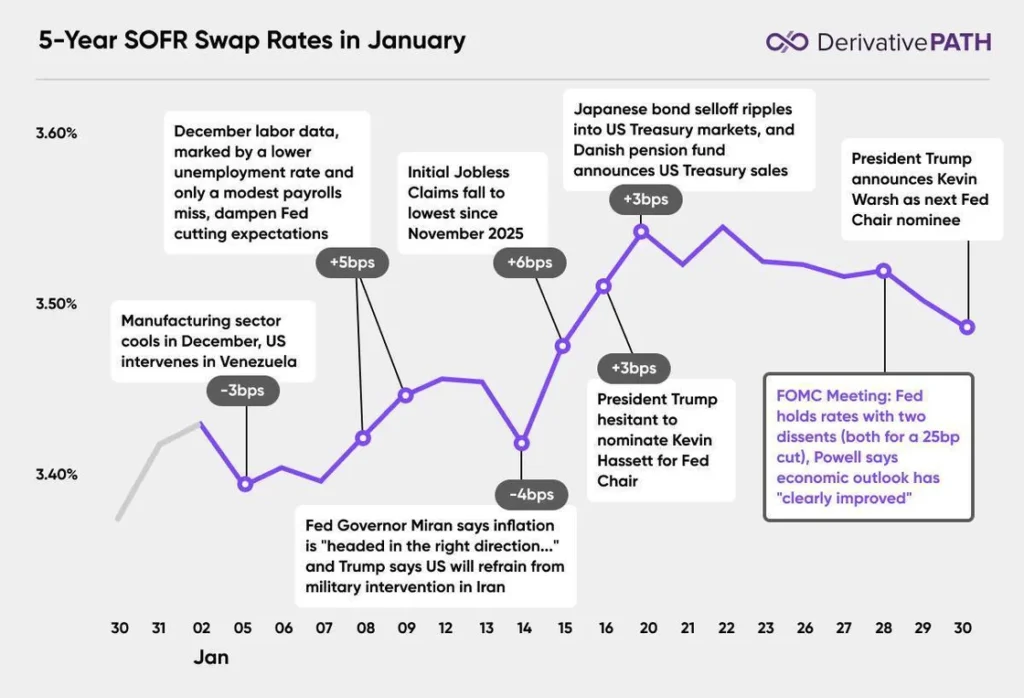

- Rates swing higher. Rates reversed early declines to climb 5 bps, remaining at their highest levels since last August.

- Policy and geopolitical risks intensify. Uncertainty grew as President Trump changed his mind on the new Fed Chair, formally announcing Kevin Warsh as the nominee. At the same time, markets weighed the possibility of US interventions in Venezuela, Iran and Greenland.

- Fed holds rates. The FOMC left rates unchanged for the first time since last July, with two dissenters in favor of a 25bp cut. At his press conference, Chair Powell noted an improved economic outlook and diminished labor market risks.

Explore More:

- Manufacturing Results and Venezuela News (-3 bps)

- December Labor Results (+5 bps)

- Miran and Trump Comments (-4 bps)

- Initial Jobless Claims (+6 bps)

- Trump Hesitates on Hasset Nomination (+3 bps)

- Global Bond Selloff (+3 bps)

- January FOMC Meeting

- Kevin Warsh Fed Chair Announcement

415-992-8200

sales@derivativepath.com