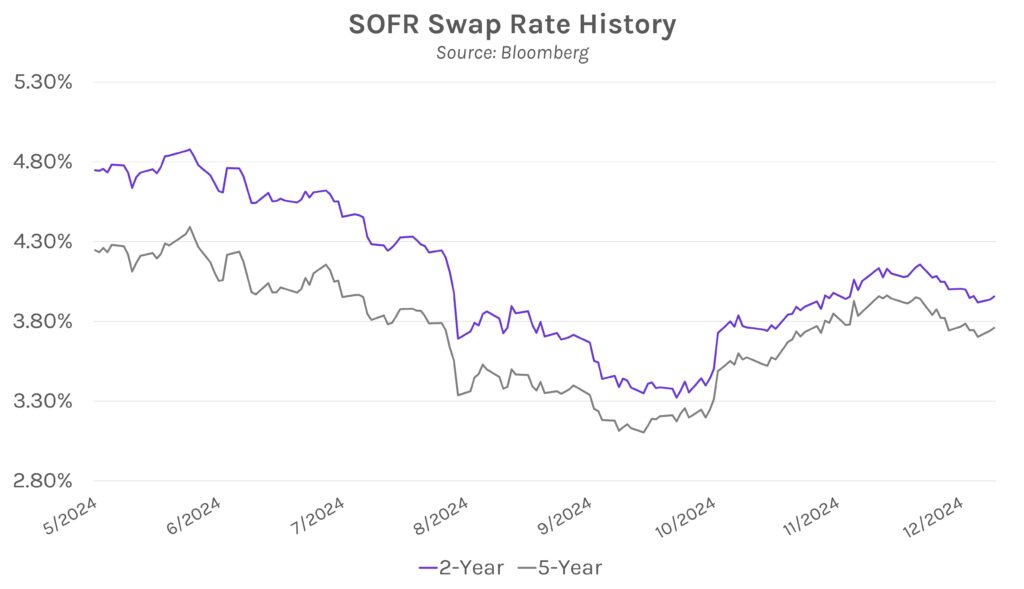

Rates rise slightly for the second consecutive session ahead of CPI. Rates markets remained quiet today ahead of tomorrow’s CPI and Thursday’s PPI data. Rates closed 1-3bps higher across the curve after a ~2bp decline in the afternoon following a $58B 3-year Treasury auction. Fed Funds futures currently have a 25bp rate cut priced in as 86% likely next week, rising from the 71% odds immediately following November’s FOMC meeting.

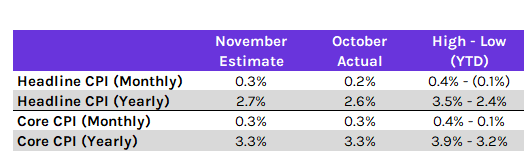

CPI is on deck. Consumer inflation is expected to have accelerated or been flat across all readings from October to November, with core CPI forecasted at 3.3% YoY and 0.3% MoM. Headline figures are expected to rise 0.1% to 2.7% YoY and 0.3% MoM, where the latter would be the highest level since April. The data would extend the past several months of idle progress in the fight against inflation, though Fed officials remain intent on continued rate cuts throughout the year ahead.

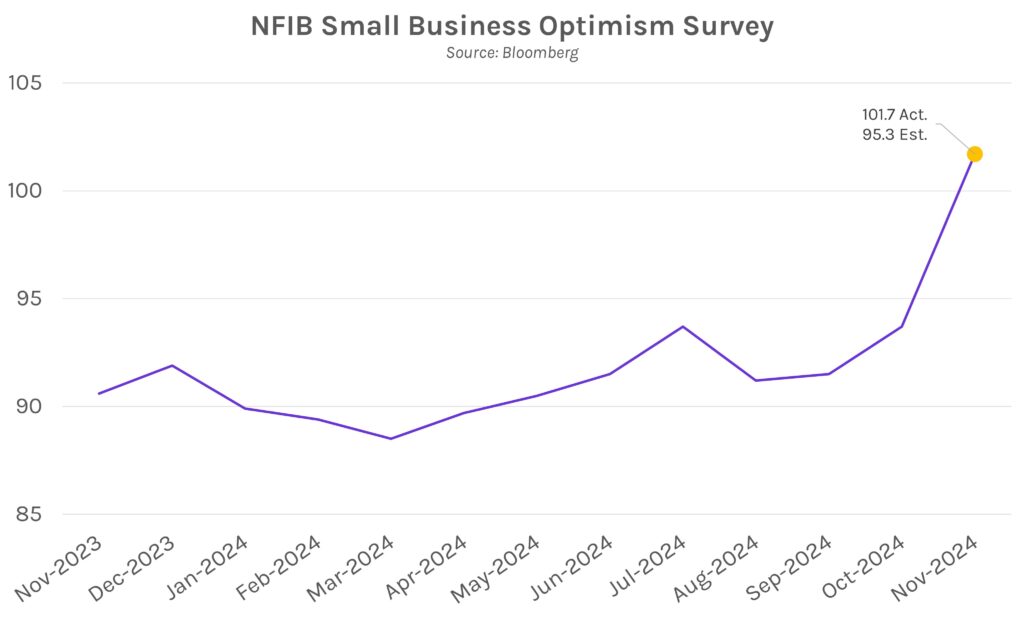

Small business survey shows optimism about the future. Small business outlooks improved in November, per National Federation of Independent Business (NFIB) small business optimism data released today. The overall optimism index climbed 8 points on the month to its highest level since June 2021, landing at 101.7, entering new territory after ranging between 88.5 and 93.7 over the past two years. The recent election outcome was largely viewed as driving the overall increase, signaling a shift to pro-growth economic, tax and regulation policies. As for risks, labor and inflation concerns remained the top two challenges respondents face while operating their businesses.