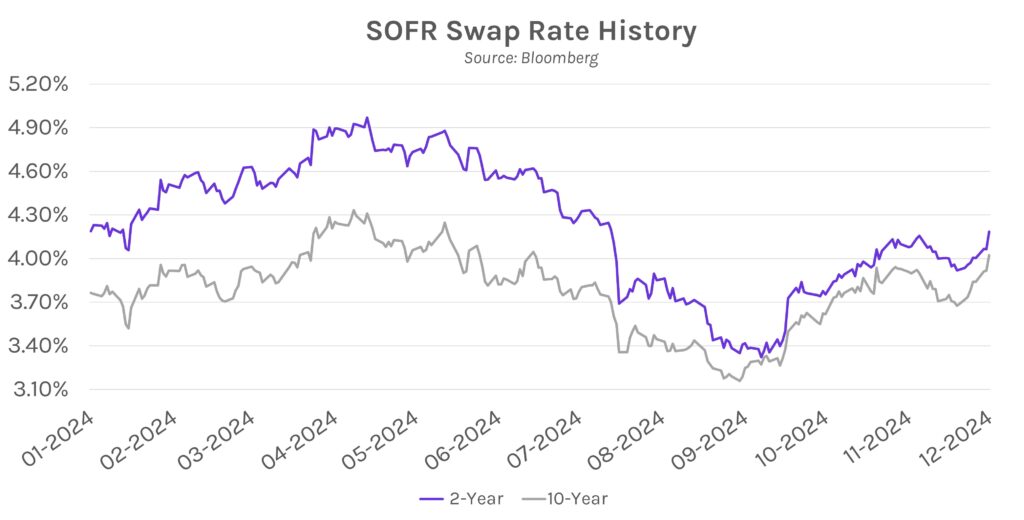

Rates soar after Fed meeting. Rates jumped ~9-15 bps higher across the curve after the Fed signaled a more cautious approach to future rate cuts than markets expected. 2- and 10-year swap rates closed at ~4.19% and ~4.02% today, respectively, surpassing post-election peaks and reaching their highest levels since July. Equities suffered today on the Fed developments, with the S&P 500 falling ~2.95% to log its worst daily session since August, and the NASDAQ ending the day ~3.60% lower.

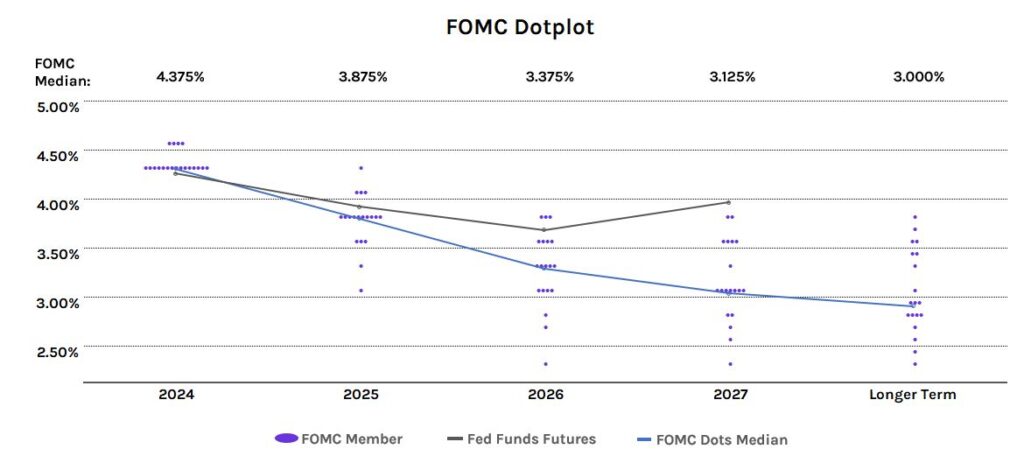

Fed to remain cautious before more cuts. The FOMC delivered a 25bp cut today as expected, but a dissenting vote from Cleveland Fed President Hammack emphasized that future rate cuts aren’t certain. The Fed raised its median rate forecasts over the next three years by more than expected, implying only two more quarter-point rate cuts in 2025, and raised its longer-term policy rate expectation from 2.9% to 3.0%, in-line with forecasts. At his press conference, Chair Powell laid the groundwork for potential rate pauses in the coming months. He said that the Fed’s stance is now “significantly less restrictive” and therefore the Fed can “be more cautious as we consider further adjustments to our policy rate.” A side-by-side comparison of the December and November FOMC meeting statements can be read here.

Road to the next Fed decision begins with this week’s data. Markets will now attempt to gauge how the Fed will act during the coming months. Currently, futures markets are fully pricing in a Fed pause in January and see another pause in February as 58% likely. It isn’t until June when real conviction around another rate cut emerges. However, the past shows that market pricing could change dramatically based on the results of upcoming economic data releases, starting with tomorrow’s GDP and Friday’s PCE. Futures-implied odds of a December cut changed ~15% and ~10% following the latest labor and CPI data, respectively.