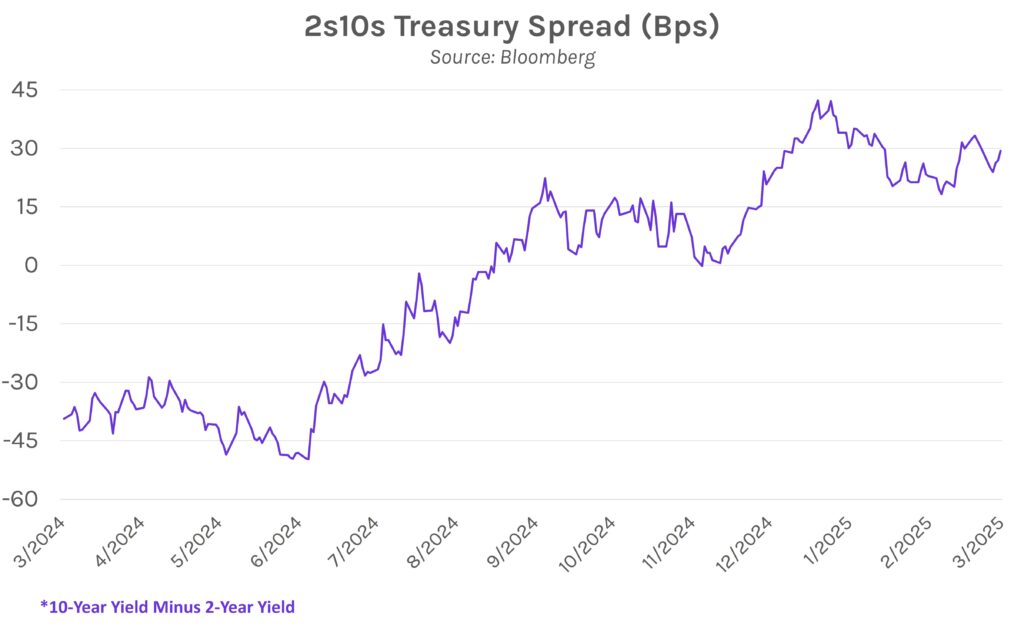

Yields mixed across a steepening curve. Rates have remained nearly unchanged since Wednesday’s FOMC meeting, where the Fed reaffirmed expectations for two rate cuts this year while emphasizing a patient approach toward monetary easing. Yields fell 1-3 bps at the front end of the curve and climbed 1-4 bps at the long end today, pushing the spread between 2-year (3.95%) and 10-year (4.25%) yields to 29 bps. Meanwhile, equities rallied after facing additional volatility from the expiration of ~$4.5 trillion of equity options today. The NASDAQ climbed +0.52% today and +0.17% this week while the S&P 500 rose +0.08% today and +0.51% this week.

President remains flexible on China tariffs. During a speech from the Oval Office today, President Trump doubled down on the April 2nd deadline for a range of new tariffs to begin. He added that there may be “flexibility” on Chinese tariffs and said that he is open to talking with Chinese President Jinping, but qualified the comments by saying that tariffs will be reciprocal. Markets reacted positively immediately after the comments despite the vague messaging, interpreting the remarks as a sign that levies could be more muted than expected.

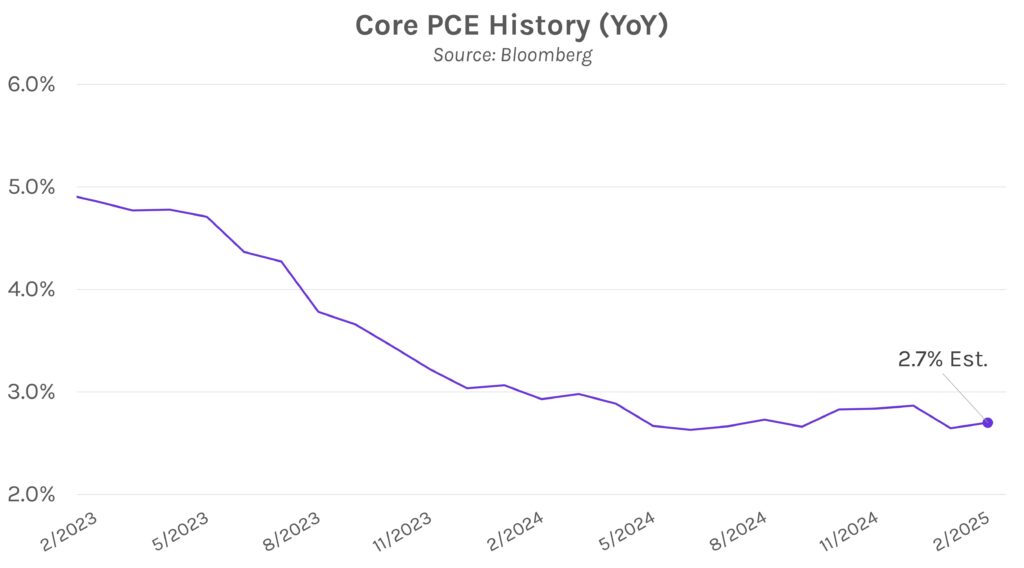

PCE and GDP headline the week ahead. Markets are looking ahead to next week’s data slate, especially after the Fed released updated forecasts at Wednesday’s FOMC meeting. The Fed now projects core inflation to be 2.8% over 2025 (versus 2.5% previously) and 2025 GDP growth of 1.7% (versus 2.1% previously). Next Wednesday’s Q4 2024 GDP data is expected to confirm previous estimates of 2.3% while core YoY PCE is expected to climb by 0.1% to 2.7% in February. The Fed noted that they expect tariffs to have an inflationary impact, though Chair Powell said his base case is for the effects to be “transitory.”