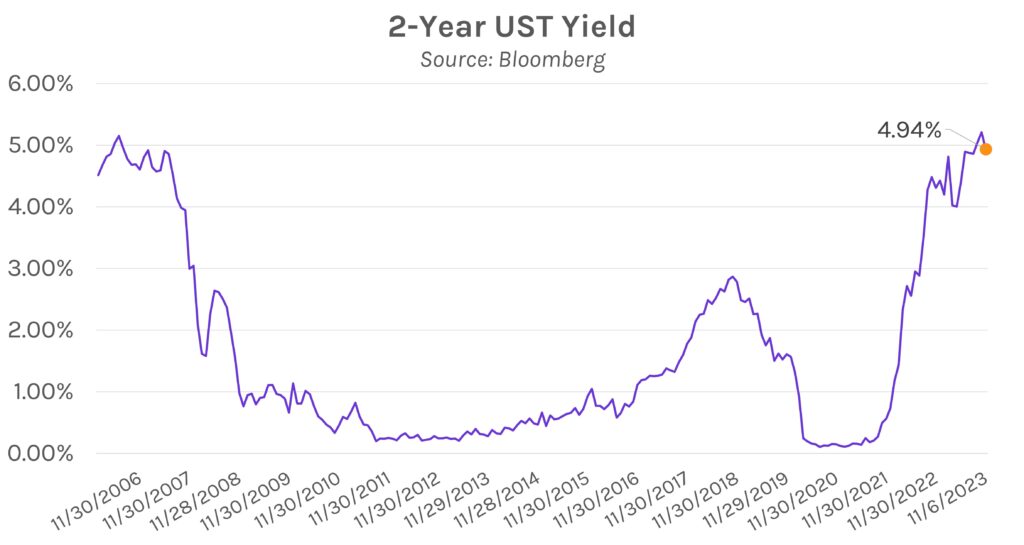

Yields reverse course from last week’s rally. Swap rates and UST yields bear flattened today after falling significantly last week, though rates remain well below their highs before last week. The short-end of the curve was most affected, the 2y UST yield now at 4.94% after a ~10bp rise. While much of the move could be attributed to a reversal of last week’s action, a slew of corporate debt issuances and incoming UST auctions played a role as well. Meanwhile, markets await Chair Powell’s string of speeches that will begin on Wednesday and continue on Thursday, while other Fed officials will make public comments tomorrow.

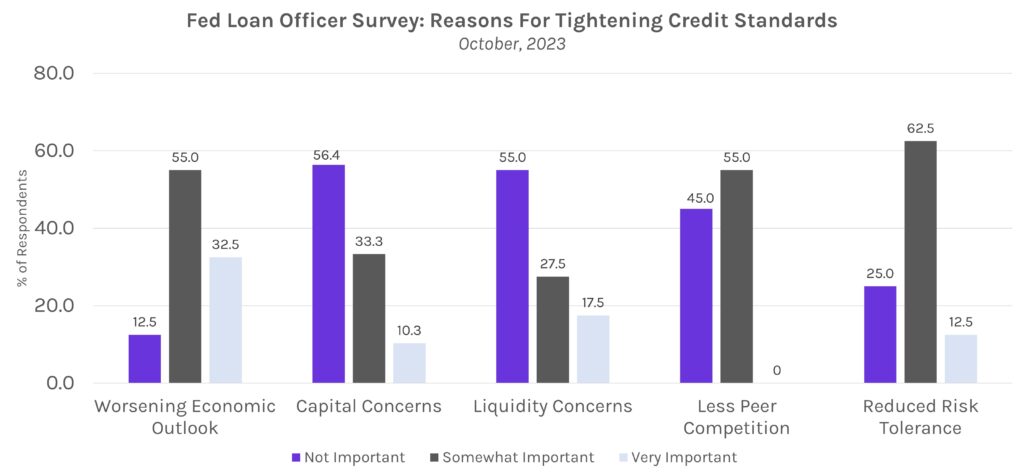

The latest SLOOS survey shows demand weakness and credit tightening. The October 2023 Senior Loan Officer Opinion Survey (SLOOS) showed weaker C&I and CRE loan demand, along with credit tightening. C&I tightening was attributed to a worsening economic outlook, less risk tolerance and less competition. CRE tightening was reported across all types of CRE loans, and reduced demand was similarly observed across subcategories. Among banks that eased lending standards, on the other hand, the most frequent reason was an improvement in credit quality and a more certain economic outlook.

Hedge funds push UST shorts to highs since 2006. Hedge funds apparently heard and bought the “higher for longer” narrative that has been discussed over the past months; according to an October 31st aggregate of CFTC figures, leveraged funds increased their net short UST futures positions the most since 2006. That makes last week’s price action especially painful, as USTs rallied dozens of basis points across the curve.