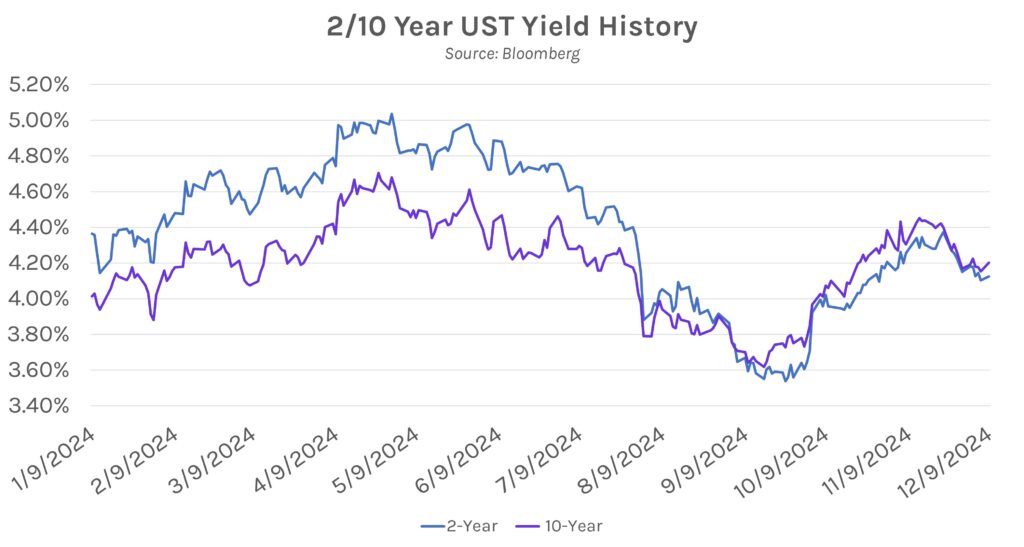

Rates rise gradually ahead of upcoming CPI print. Rates rose across a steepening curve today, with the short end closing 2 bps higher while the long end climbed 4-5 bps. The move occurred gradually and without a clear catalyst, and the 2-year and 10-year Treasury yields are now 4.13% and 4.20%, respectively. Markets are also eyeing Wednesday’s consumer inflation report, where core CPI is expected to remain at 3.3% YoY and 0.3% MoM. Elsewhere, oil prices rose today on rising tensions in Syria following the ousting of President Bashar al-Assad.

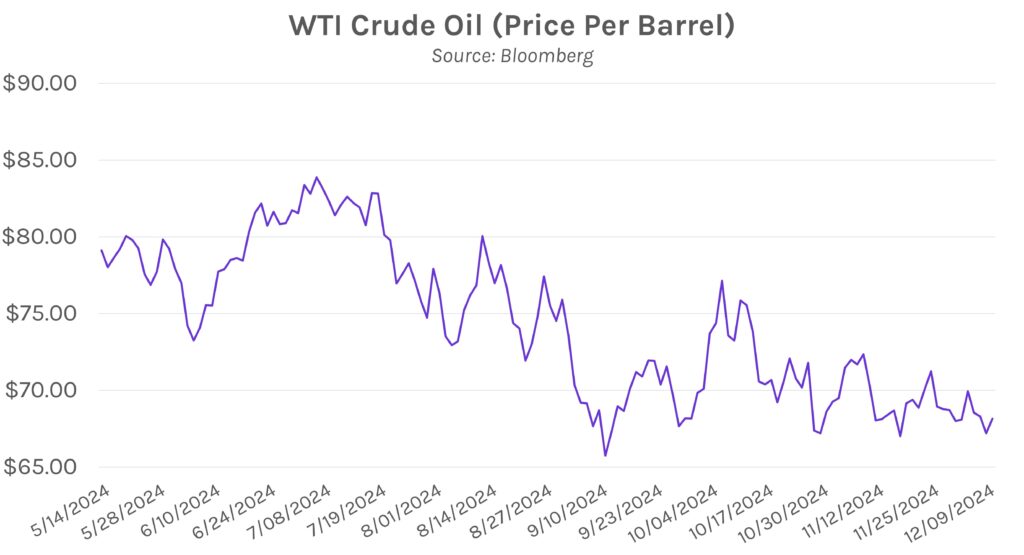

Oil prices under additional pressure following chaos in Syria. Syrian President Bashar al-Assad’s dynasty collapsed this weekend, forcing him to flee to Russia. Attention has now turned to how renewed turmoil in Syria could affect oil supply and global markets. WTI and Brent crude prices climbed over 1% today, now at $68 per barrel and $72 per barrel, respectively. WTI crude oil is up ~3.6% from year-to-date lows reached in September but remains ~20% below April highs of ~$87.

NY Fed survey shows consumer positivity. Overall, consumers were upbeat about the future per the NY Fed’s consumer expectation survey released today. The share of households expecting a better financial situation during the next year rose to ~38%, the highest level since February 2020, and respondents saw lower chances of missing a minimum debt payment. On inflation, expectations climbed from 2.9% to 3.0% over the next year, also rising over three- and five-year horizons. This was somewhat offset, however, by an improved outlook for household income growth.