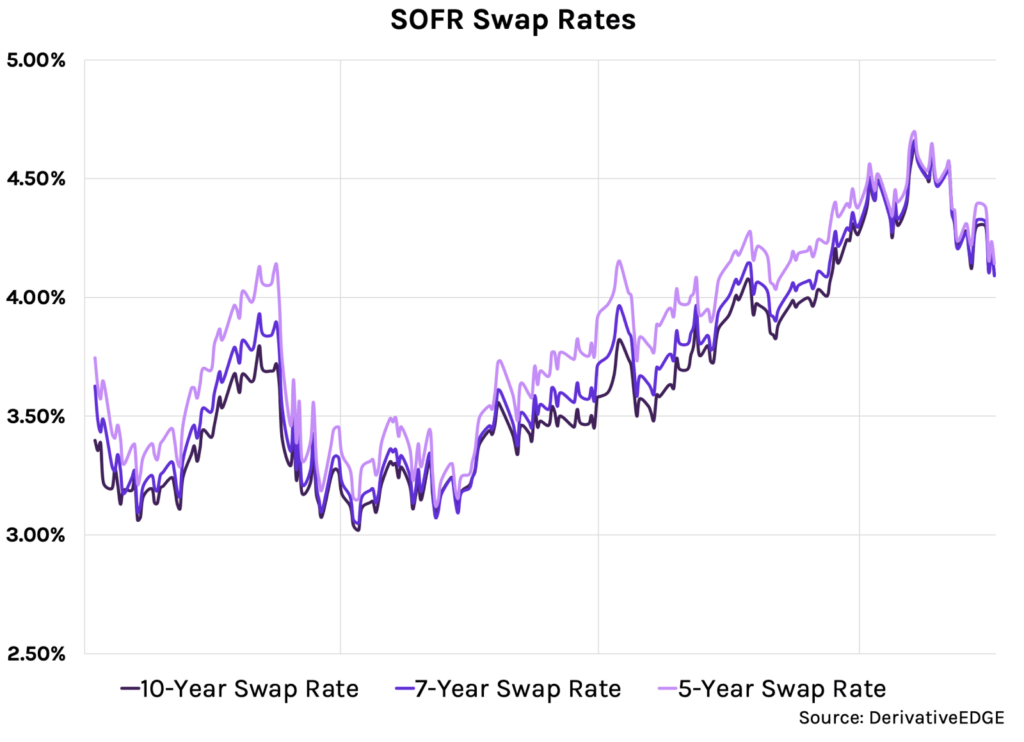

Hedging against higher rates remained a focus for banks in Q3 based on our review of hundreds of earnings calls and disclosures. Over two-thirds of the derivative strategies discussed on earnings calls were those that protected against rising rates, unsurprising given the 50-75 basis point increase in swap rates last quarter.

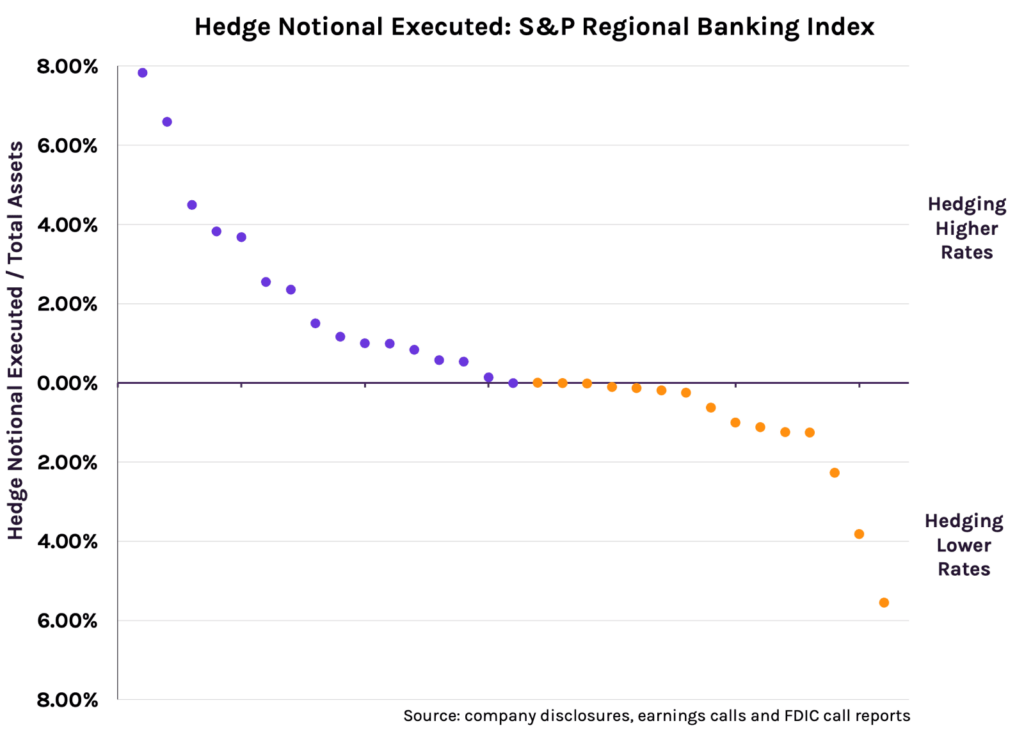

The benefits of pay-fixed swaps, caps and swaptions remained two-fold in Q3. Some institutions executed hedges to protect investment portfolios and in turn capital from higher rates. Others established hedges to protect net interest margin as deposit costs continued to climb faster than loan yields. Our analysis of banks within the S&P Regional Bank Index showed not only the prevalence of rising rate hedges, but that these trades were twice the size of hedges against falling rates when normalized for bank size.

However, sentiment may be shifting following the FOMC’s “dovish pause” and the soft inflation data from last week.

As the market digests the potential for rate cuts in 2024, hedges against rate declines have garnered more attention. We recently outlined several cost effective hedging strategies to insulate earnings from lower rates. Notably, many of the banks that described downside hedging strategies on Q3 earnings calls utilized floors, collars and forward-starting interest rates swaps- allstructures that minimize the initial cost of hedging.

To read our full summary of all bank hedging commentary from Q3 earnings calls, click on the link below: