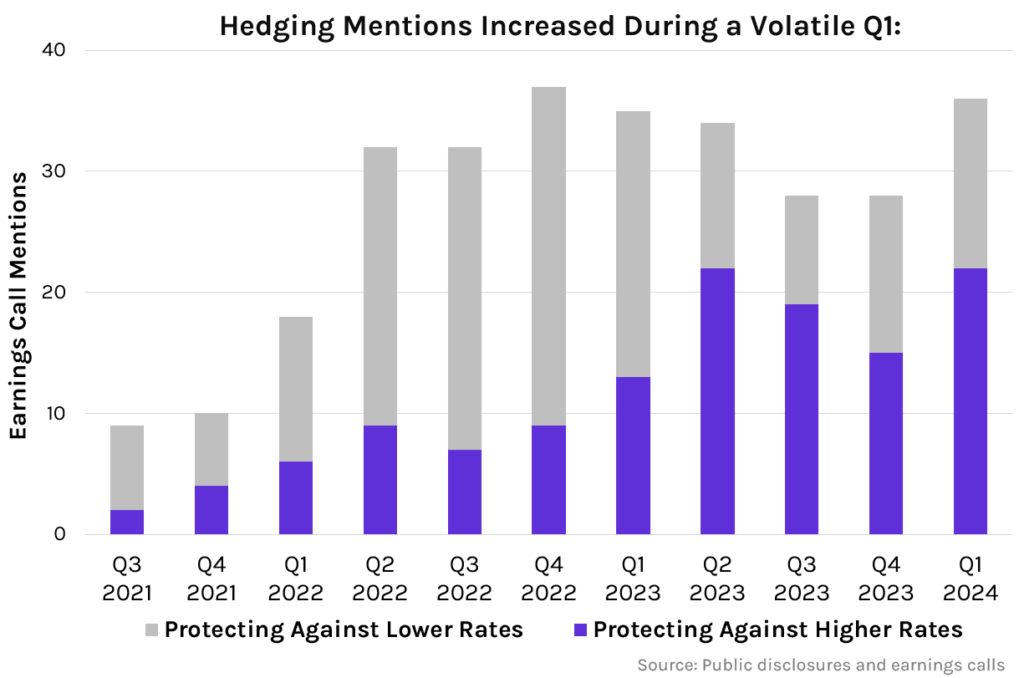

In Q1, many asset-sensitive institutions capitalized on the move in swap rates and added to downside protection. Forward-starting swaps and floors remained popular as institutions sought to defer negative carry to future years.

For institutions exposed to rising rates, mentions of outright new trades were less common, though many referenced the positive earnings impact from existing hedges. Several institutions unwound pay-fixed swaps to crystalize gains and reduce downside.

The range of potential rate outcomes is difficult to handicap. Inflation surprises have continued in Q2, but economic activity may be decelerating. Hedging remains prudent in this uncertain environment and we expect volumes to continue to accelerate.