Swap rates have climbed more than 80 basis points from their September lows, driven by anticipation and subsequent confirmation of Donald Trump’s presidential victory. For the first time in several years, we’re seeing declining rates hedges dominate our flows.

Three strategies stand out:

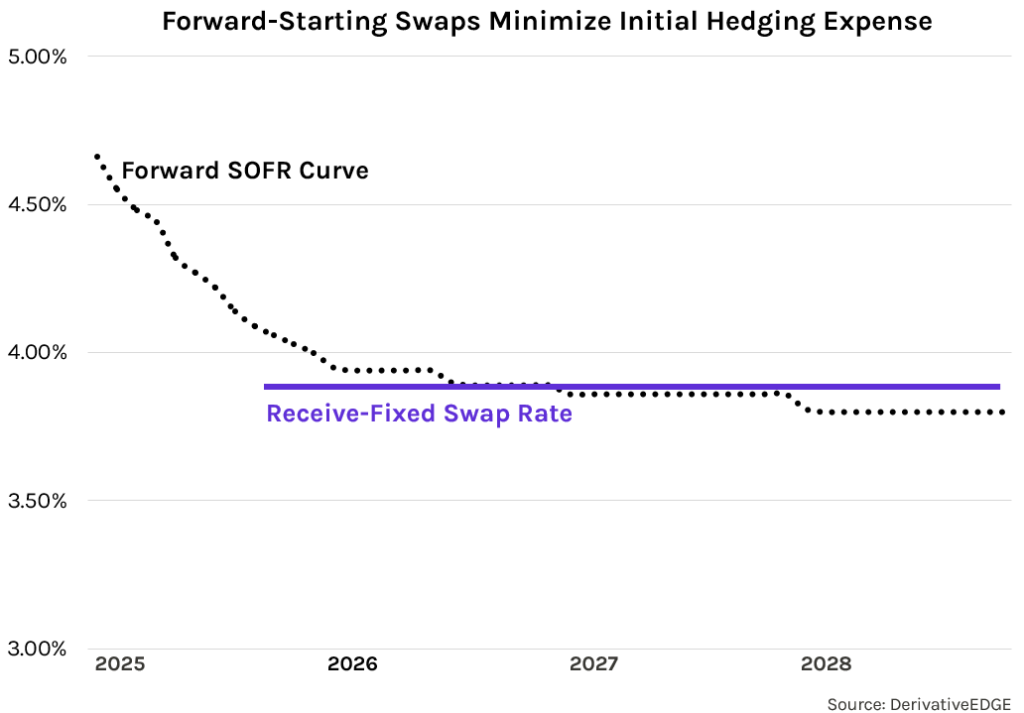

1. Forward-Starting Receive-Fixed Swaps

- Hedge against lower rates without initial negative carry

- Target flattest part of the curve to minimize initial expense

- Forward-starting out of August 2025, approaching carry-neutral levels

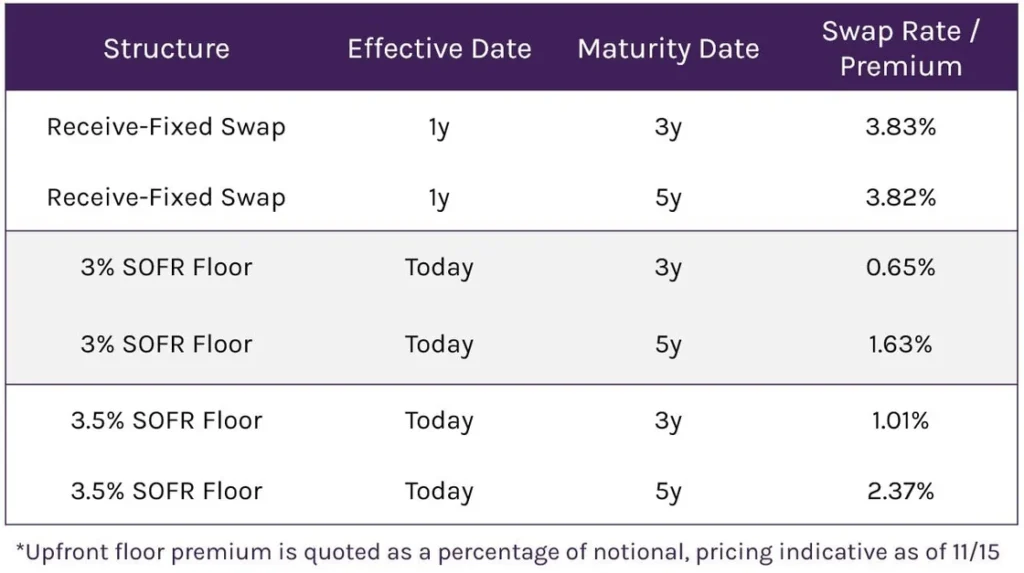

2. Purchased Floors

- Provide one-way downside protection

- Could be standalone or used to protect existing pay-fixed swap gains

- Can be ideal for institutions with two-way rate risk exposure

3. Pay-Fixed Swap Unwinds

- Lock in current gains

- Reduce exposure to falling rates

- Consider alternatives:

- Forward-starting receive-fixed swaps preserve current income

- Interest rate floors preserve upside protection of existing swaps

Additional Resources

- Hedging Strategies from Q3: Part 1 & Part 2

- Hedging Strategies for a 3% World

Don’t hesitate to get in touch with our team with any questions or for pricing on specific structures. Call 212-651-9050 or email us directly – [email protected].