July and Early August 2025 Highlights

3 Things to Know:

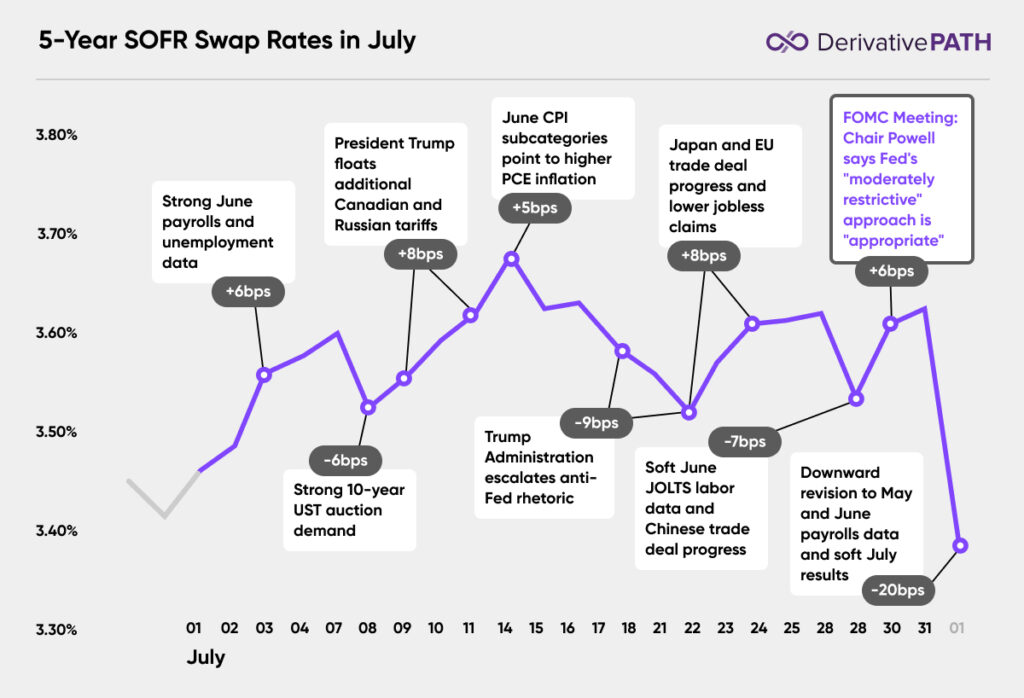

- Rates march higher, then plummet. Rates rose ~15bps throughout July, only to fall ~20bps to start August after weak payrolls data. Rates are now just ~5bps above April’s YTD lows.

- Labor market cracks. Payrolls growth was weaker than expected in July, while May and June figures were revised lower by 125,000 and 133,000 to 19,000 and 14,000, respectively. Excluding COVID-era adjustments, the June and May combined revisions were the largest on record, and indicated that labor conditions may not have been as strong as previously thought.

- Powell calls current Fed stance appropriate. As expected, the Fed held rates steady for a fifth consecutive meeting, but two FOMC voters dissented in support of rate cuts. Still, Chair Powell said he views the Fed’s “moderately restrictive” approach as “appropriate” given uncertain tariff-related inflation risks. Following the latest labor data, futures markets now see a ~90% chance of a 25bp cut in September, vs. ~47% on the day of the FOMC meeting.

Explore More:

- June Labor Data (+6 bps)

- 10-year UST Auction Results (-6 bps)

- Canada Tariff Threats (+8 bps)

- June CPI Data (+5 bps)

- Bessent Calls for Review of Fed (-9 bps)

- Japan, EU Trade Deal Progress (+8 bps)

- June JOLTS Data (-7 bps)

- July FOMC Meeting Transcript (+6 bps)

- July Labor Data (-20 bps)

Contact us:

415-992-8200

[email protected]