3 Things to Know:

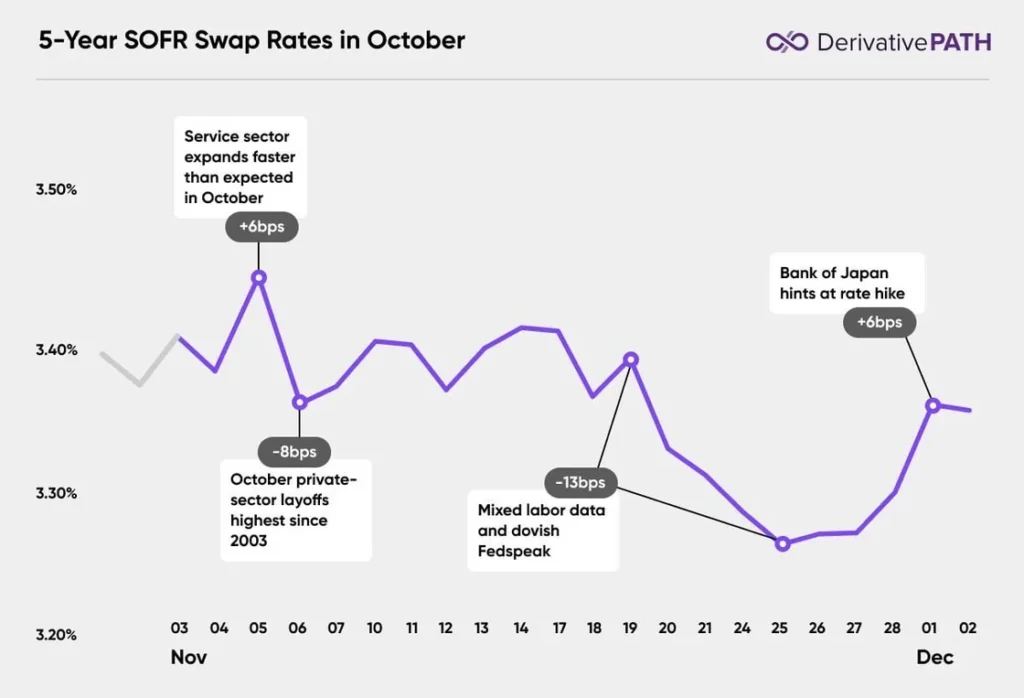

- Rates remain near year-to-date lows. Rates traded within a narrow band throughout November, ending the month just ~10 basis points above September’s year-to-date lows.

- Labor and inflation data delayed. Following the end of the U.S. government shutdown, the BLS canceled the release of October labor and CPI data and delayed the release of November data. The Fed will meet in December without two full months of labor and inflation data, further complicating their decision-making process.

- December rate-cutting hopes rise. Despite hawkish Fed minutes, mixed September labor data and dovish Fedspeak fueled bets that the Fed will cut rates in December. Futures markets are pricing in a ~95% chance of a 25 bp cut, versus ~45% in the middle of November.

Explore More:

- October ISM Services Data (+6 bps)

- October Private Sector Layoffs (-8 bps)

- Labor Data and Fedspeak Summary (-13 bps)

- Bank of Japan Rate Hike (+6 bps)

| Contact us: 415-992-8200 sales@derivativepath.com |