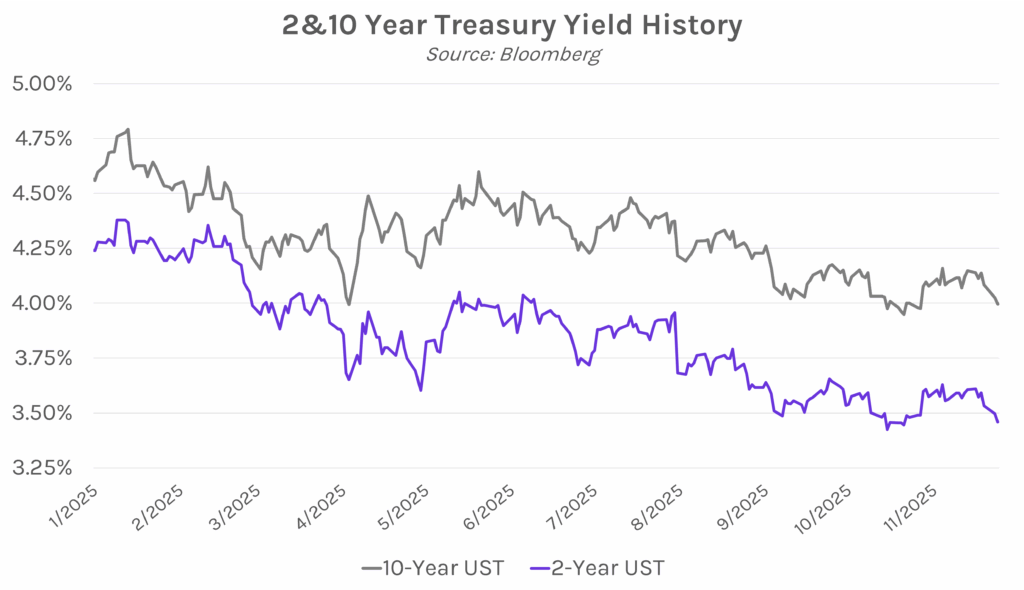

Yields decline on weak data, Fed Chair nomination rumors. Treasury yields rose overnight but slipped after weekly ADP showed a lagging labor market, with private payrolls shedding an average of 13.5k jobs per week through November 8. Yields then whipsawed on weak retail sales data and mixed PPI figures which showed softer monthly price pressures, but remained elevated on an annual basis. Then, mid-day reports that Kevin Hassett, a close Trump ally, is the front-runner to be the next Fed Chair, pushed yields down ~3 bps, with the 10-year yield dipping below 4% for the first time in a month. Yields closed 2-4 bps lower across the curve, with the 2-year at 3.46% and the 10-year at 4%. Meanwhile, equities ended the session higher on continued rate cut optimism, with the S&P 500 and NASDAQ closing 0.91% and 0.67% higher, respectively.

Hassett seen as top choice for next Fed Chair. White House National Economic Council Director Kevin Hassett is viewed by Trump’s close circle as the leading candidate for the next Fed Chair, according to people familiar with the discussions. The sources, who spoke anonymously, described Hassett as a close ally of Trump’s and someone likely to bring the President’s approach to rate cutting to the Fed. Hassett signaled his stance on November 20th, telling Fox News that he would be “cutting rates right now” because “the data suggests that we should.” No nomination for Fed Chair is final until it is announced to the public, with White House Press Secretary Karoline Leavitt saying in a statement, “nobody actually knows what President Trump will do until he does it. Stay tuned!”

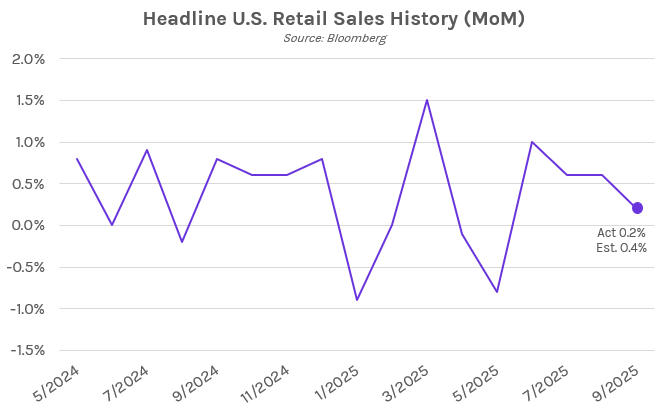

Retail sales data points to consumer tariff fatigue. Headline retail sales rose just 0.2% in September, below estimates of a 0.4% increase and August’s 0.6% rise. Excluding cars and gasoline, retail sales were up just 0.1% MoM, falling short of expectations of a 0.3% increase. Today’s September figures were originally supposed to report in October but were delayed by the government shutdown. The data suggest that consumers are starting to feel the impact of higher prices caused by tariffs and remain concerned about the state of the labor market, as the unemployment rate sits at a 4-year high.