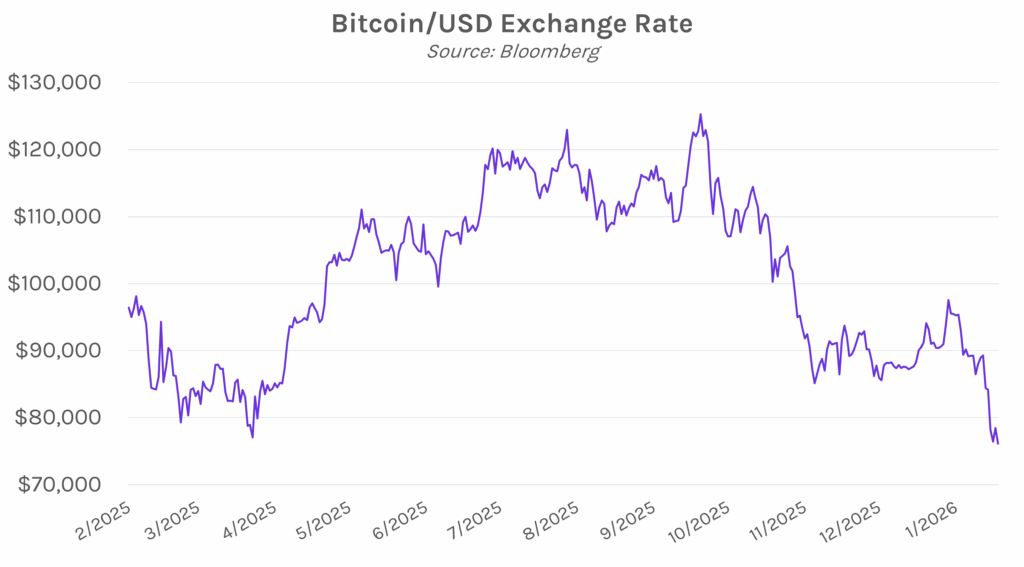

Yields inch lower as markets shift risk-off. Treasury yields traded in a tight 3-4 bp range today before closing nearly flat across the curve, with the 2-year yield unchanged at 3.57% and the 30-year yield down 2 bps to 4.89%. Meanwhile, technology stocks led a broad equity sell-off, with the S&P 500 and NASDAQ down 0.84% and 1.43%, respectively. The flight to quality was also apparent in crypto and precious metals, as Bitcoin hit its lowest level since President Trump’s election win, briefly dipping below $75,000, while gold surged over 6%. Oil prices soared as news emerged that the US Navy shot down an Iranian drone near an aircraft carrier.

House passes funding bill, bringing partial government shutdown to likely end. In a 217-214 vote, the House approved a funding measure that had previously passed the Senate, sending it to President Trump’s desk. It appears likely that Trump will sign the bill after he implored Republican members of Congress to support it, which would officially end the partial government shutdown. The bill extends government funding through September 30, including for the Bureau of Labor Statistics and Bureau of Economic Analysis, hopefully minimizing further economic data disruptions. However, the partial shutdown did delay today’s JOLTS data release, which is now expected to print Friday, as well as highly anticipated nonfarm payrolls data, originally expected Friday and now likely to release next week.

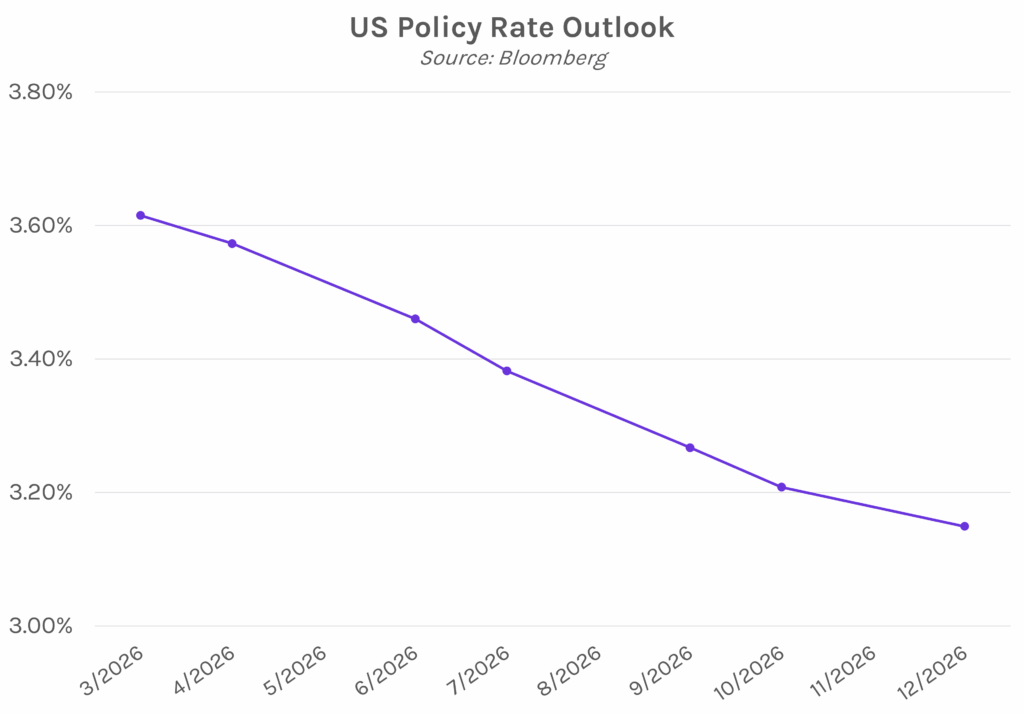

Fed’s Barkin focused on inflation, while Miran calls for over 100 bps of rate cuts this year. Richmond Fed Tom Barkin explained his preference to focus on controlling inflation today, though he noted that labor market risks still exist as hiring is concentrated in a few sectors. Barkin said, “I think of these cuts as having taken out some insurance to support the labor market as we work to bring inflation back to target.” Meanwhile, Fed Governor Stephen Miran sees a “little bit more than a point of interest-rate cuts” throughout the year. Miran views current policy rates as restrictive and says, “When I look at underlying inflation, I don’t really see a lot of very strong price pressures in the economy… So I think we’re keeping rates too high, mostly because of quirks of how we measure inflation, rather than actual price pressures themselves.”