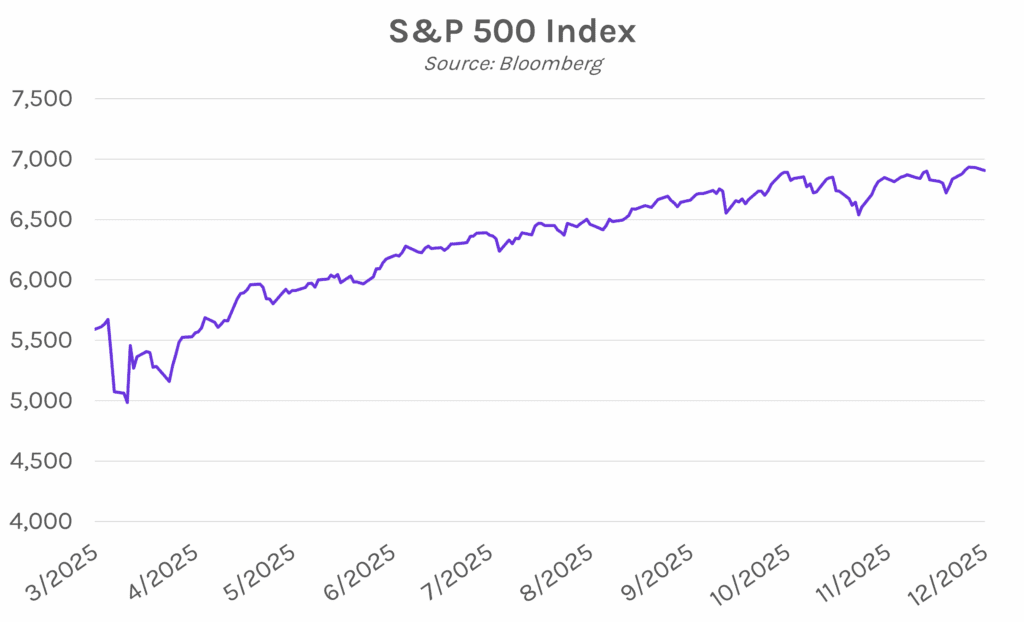

Yields grind lower as volatility remains muted. Treasury yields traded in a tight 4 bp range while gradually declining over the course of the session and closing 1-3 bps lower across the curve. The 2-year closed 3 bps lower at 3.46% and the 10-year dropped 2 bps to 4.11%. Elsewhere, equities slid for the second straight day amid a tech selloff, with the NASDAQ and S&P 500 down 0.50% and 0.35%, respectively.

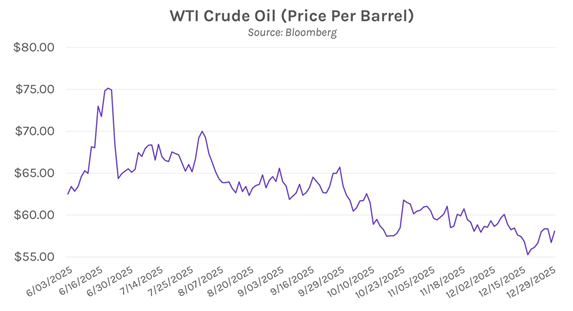

Oil rises as Russia-Ukraine peace progress stalls. Just a day after President Trump and President Zelenskyy had a productive meeting regarding a peace deal, Vladimir Putin reportedly warned that he will revise Russia’s negotiating terms. Putin pinned the setback on a recent Ukrainian drone attack that targeted his house, while Zelenskyy dismissed the claims as a “new lie.” Putin also told Trump that Russia plans to work closely with the US on peace efforts, though his comments signaled that progress will be further delayed. Oil rose as a result, with Brent crude up 1.8% to $61.75 and WTI crude up 2.4% to $58.08.

Silver and gold tumble after posting record highs. Gold fell more than 4% today, down to $4,340 per troy ounce while silver dropped more than 8% after briefly breaking a record $80 per ounce. The sharp decline came after the Chicago Mercantile Exchange increased their margin requirements for certain precious metals, including gold and silver. The change by the CME is not atypical when a commodity goes on a significant run, as silver and gold have in recent months. Rising strength of the two metals have been driven by a variety of factors, including geopolitical tensions increasing demand for safe haven assets. Silver has also rallied on concerns about a possible supply shortage, leading some to view today’s decline as a good thing. Elon Musk weighed in over the weekend, tweeting, “This is not good. Silver is needed in many industrial processes.”