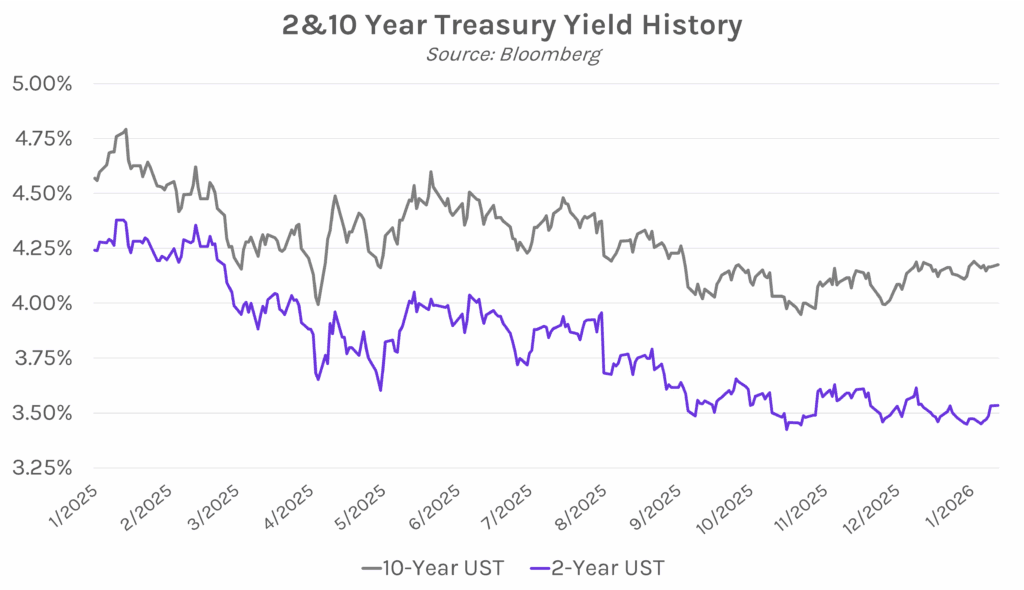

Yields flat ahead of CPI. The yield curve steepened overnight as markets digested news of the DOJ’s criminal investigation into the Fed, with long-term yields up 4 bps this morning on concerns about Fed independence. However, the move reversed over the remainder of the session, with yields closing nearly flat across the curve. The 2-year yield closed at 3.53% and the 10-year yield closed at 4.18%. Meanwhile, equities also rebounded from session lows, with the S&P 500 and NASDAQ closing up 0.16% and 0.26%, respectively.

DOJ opens criminal investigation into Chair Powell and the Fed. The Department of Justice has opened a criminal investigation into Chair Jerome Powell and the Fed over the agency’s headquarters renovation and possible misuse of taxpayer dollars, according to a DOJ spokesperson. Powell responded in rare Sunday remarks that struck a notably defensive tone, saying the move “should be seen in the broader context of the administration’s threats and ongoing pressure” and noting that the FOMC sets interest rates “based on our best assessment of what will serve the public, rather than following the preferences of the President.” He added that the investigation goes to the heart of the Fed’s independence. President Trump has denied knowing about the investigation prior to the DOJ opening it, as the move has already drawn criticism from several Republican congressmen. The investigation comes as Powell’s term as Chair is set to expire in May, setting a contentious stage for whoever takes over the job.

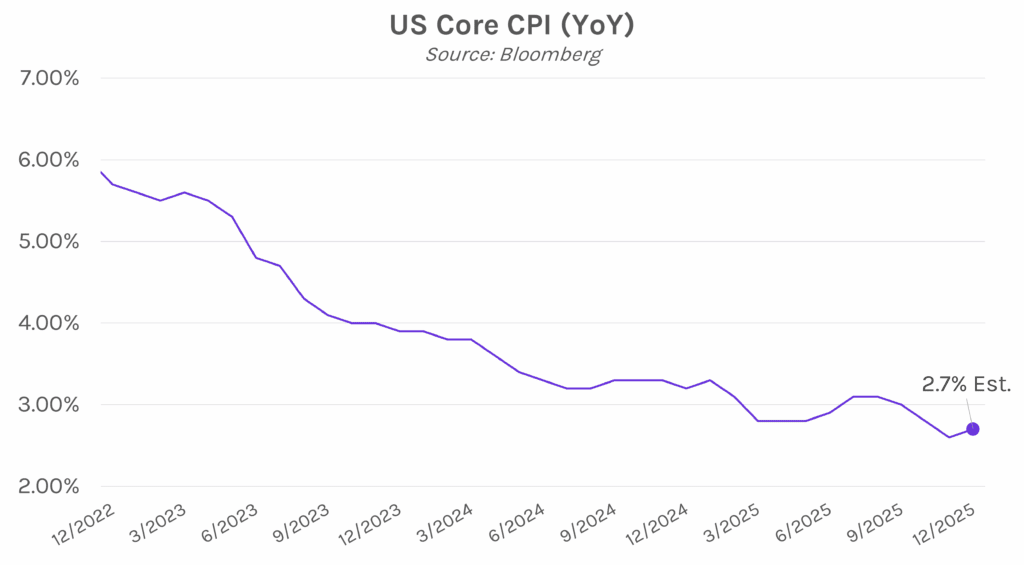

December CPI on deck. Tomorrow’s CPI report is in the spotlight following a surprising drop in November, where core CPI fell to the lowest level since 2021 at 2.6%, though many questioned the validity of the data given the government shutdown. December headline and core YoY CPI are expected to come in at 2.7% tomorrow, and with the BLS operating as usual, markets are anticipating a clearer image of underlying inflation. A weaker than expected print could accelerate the Fed’s rate cut timeline, especially with most Fed officials now prioritizing labor market strength. The market is currently pricing in 2 rate cuts in 2026, with the first move not fully priced in until July.