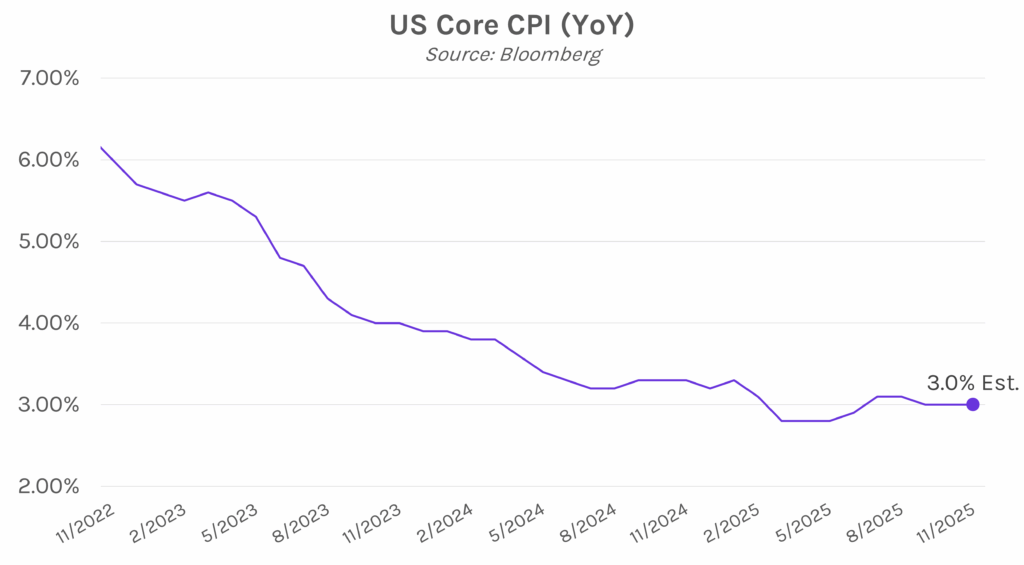

Yields flat ahead of CPI data. Treasury yields traded in a 3-4 bp range today and closed nearly flat across the curve, with the 2-year yield at 3.48% and the 10-year yield at 4.15%. Markets are largely looking ahead to tomorrow’s CPI release, where core CPI is expected to rise 3% year-over-year in November, flat from the most recent report in September. Meanwhile, equities declined as AI concerns took focus, with the S&P 500 and NASDAQ down 1.16% and 1.81%, respectively.

Fed’s Waller supports lower rates, but in no rush. Fed Governor Christopher Waller spoke in support of additional rate cuts today to move policy rates closer to neutral, though he noted that there is no rush to do so. He explained, “Because inflation is still up, we can take our time – there’s no rush to get down. We just can steadily, kind of bring the policy rate down towards neutral.” Waller believes that current monetary policy is up to 100 bps above neutral in a scenario where inflation continues to slow in 2026. Waller is expected to meet with Trump later today and may still be under consideration to be the next Fed Chair, though Kevin Hassett and Kevin Warsh appear to be the more likely candidates.

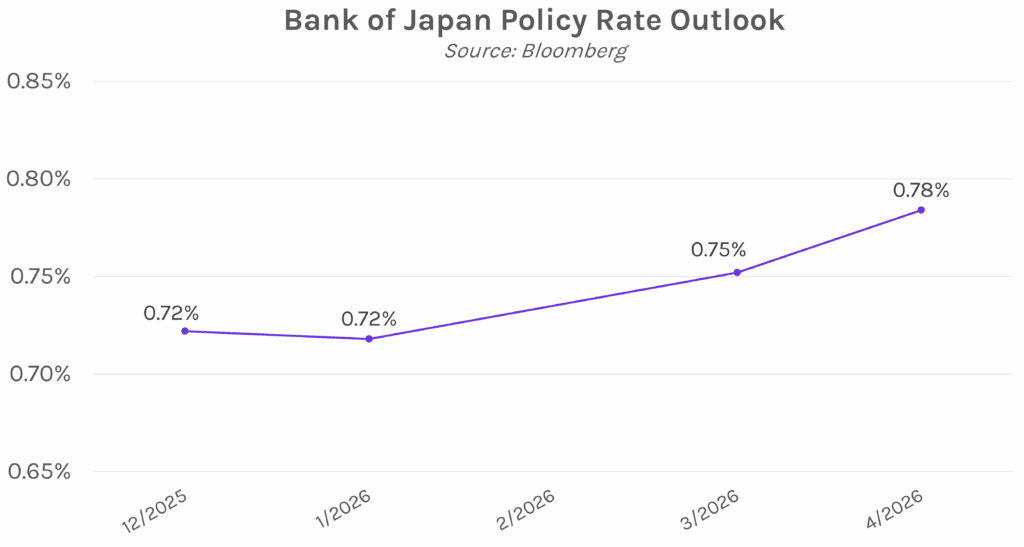

BOJ likely to raise rates, benchmark to hit 30-year high. The Bank of Japan’s two-day monetary policy meeting starts tomorrow, with an interest rate decision coming Friday. The BOJ is widely expected to raise the overnight rate by a quarter point to 0.75%, which would be the highest benchmark rate in 30 years. Market confidence in the hike is a sign of growing assurance that the central bank will meet its stable inflation target. The move is expected to be unanimous, after two board members at each of the last two meetings called for higher rates, and would be the first increase since January. The bigger question, however, will be what tone the BOJ strikes in their messaging. A dovish policy outlook could weaken the Yen because Friday’s rate cut is largely priced in. Hawkish signals would avoid this but could drive up bond yields, threatening newly-sworn in PM Takaichi’s government as it works on next year’s fiscal budget.