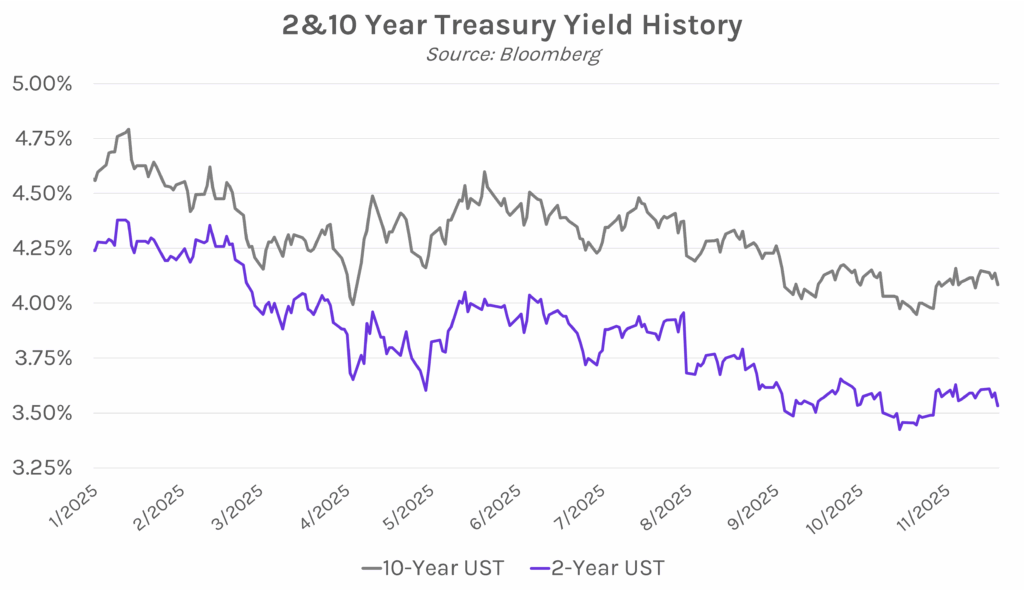

Yields decline on mixed labor data. Treasury yields edged lower after the September unemployment rate increased to 4.4%, the highest in almost four years, although the report showed more nonfarm payrolls added than the prior month. Yields closed 3-6 bps lower across the curve, with the 2-year yield at 3.53% and the 10-year yield at 4.08%. Meanwhile, equities tumbled today in a reversal of this morning’s rally driven by yesterday’s strong after-market Nvidia earnings report. The S&P 500 and NASDAQ ended 1.56% and 2.15% lower, respectively.

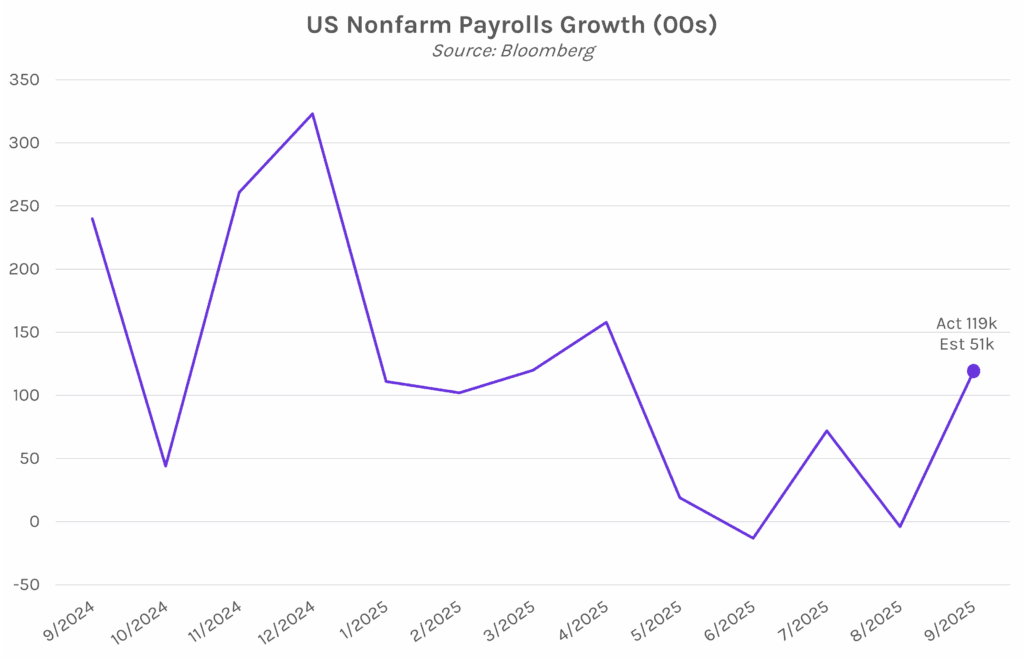

September posts surprising job growth, though unemployment rate rose. In the first BLS labor data release since the government shutdown, change in nonfarm payrolls showed 119k jobs added in September, well above estimates of 51k jobs added and August’s 4k job loss. Sectors leading the job growth include healthcare (43k), bars and restaurants (37k), and social assistance (14k). Meanwhile, transportation and warehousing saw 25k jobs lost, and professional and business services jobs declined by 20k. Also released today was the September unemployment rate, which edged up to 4.4%, a 0.1% increase from the month prior that marks the highest level since October 2021. Taken together, today’s print offers a mixed picture, however it is the first government data release since the government shutdown began, and the last jobs report expected before the December FOMC meeting. The Fed will have to weigh employment figures and inflation concerns as they decide whether to hold or ease policy rates next month.

Hawkish Fed officials continue to speak out against December cut. Following yesterday’s October FOMC minutes which highlighted a divided Fed and growing hesitation to further ease policy rates this year, more officials reiterated a cautious stance today. Fed Governor Michael Barr emphasized concern over further rate cuts given inflation, saying, “I am concerned that we’re seeing inflation still at around 3% and our target is 2%… we need to be careful and cautious now about monetary policy, because we want to make sure that we’re achieving both sides of our mandate.” Cleveland Fed President Beth Hammack similarly voiced that additional rate cuts in support of the labor market could prolong elevated inflation and heighten financial stability risks. Chicago Fed President Austan Goolsbee echoed this caution, expressing “unease about too many front-loaded rate cuts before we actually see evidence that the uptick in inflation is transitory.”