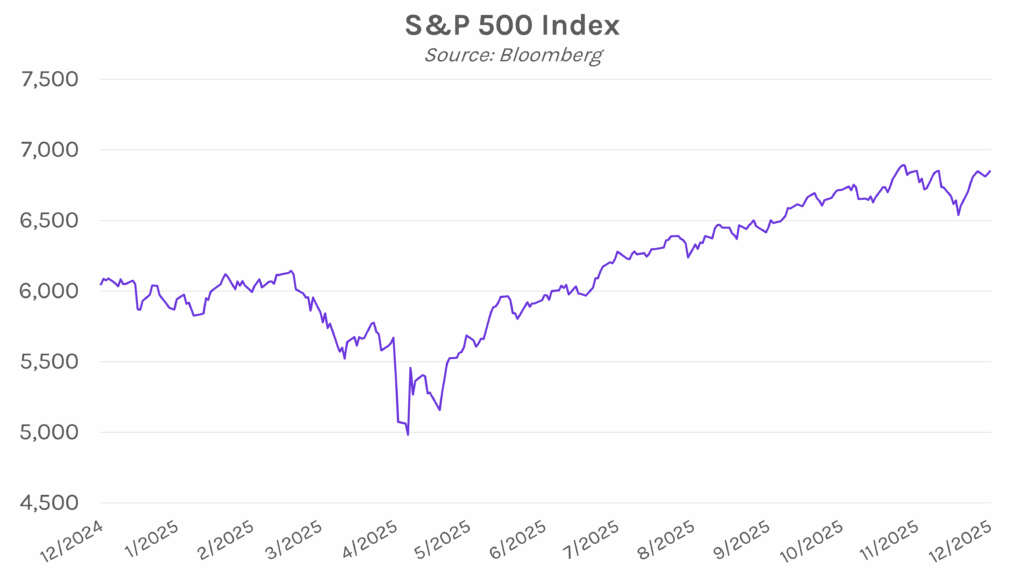

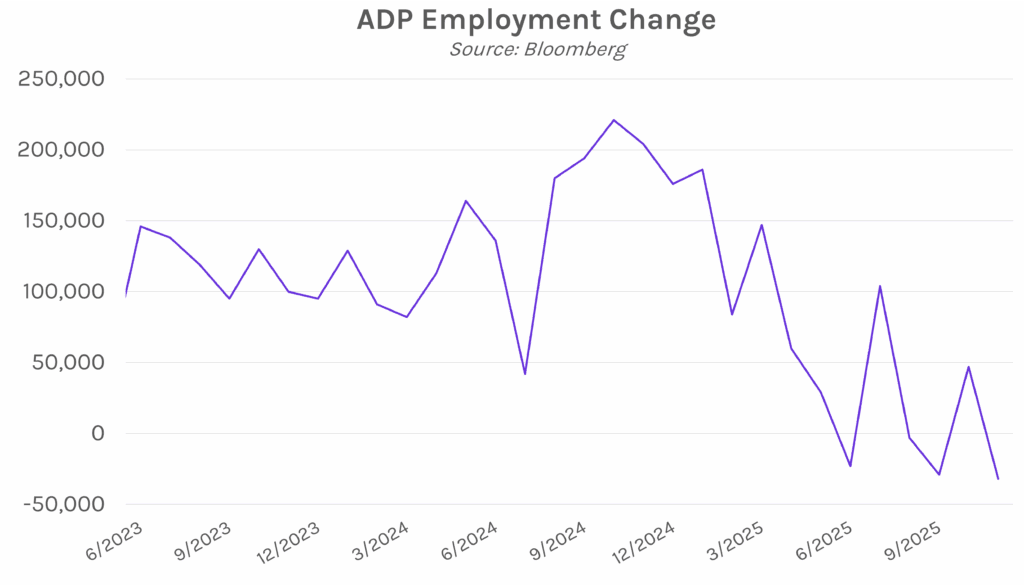

Yields decline on weak private payrolls data. ADP data released today showed that private payrolls saw its largest monthly decline since 2023, another signal that labor market strength is deteriorating. Yields declined to intraday lows in the aftermath, as the labor print supported market expectations for a 25 bp cut in December. Yields closed 2-3 bps lower across the curve, with the 2-year yield at 3.48% and the 10-year yield at 4.06%. Meanwhile, equities climbed on the reinforced December rate cut bets, with the S&P 500 and NASDAQ closing 0.30% and 0.17% higher, respectively.

US private payrolls plummets in November. ADP Research data showed private-sector payrolls decreased by 32k in November against estimates of 10k jobs added, marking the fourth consecutive month of declines. ADP data has been under greater scrutiny as the government shutdown caused delayed reports, with the November government labor report being pushed back to release after the December FOMC meeting. Nela Richardson, chief economist at ADP, said, “Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment. And while November’s slowdown was broad-based, it was led by a pullback among small businesses.” Companies with fewer than 50 employees cut 120,000 jobs, the largest one-month decline since 2020, while larger businesses overall increased headcount. Professional and business services, information, and manufacturing sectors were the largest contributors to the hiring slowdown, while education and health services saw added jobs.

ISM services data lands at nine-month high. Today, the ISM services index for November came in at 52.6, marking the highest level in nine months. The index was slightly above October’s level of 52.4 and estimates of 52. 12 industries reported growth, including retail trade, entertainment and recreation, and accommodation and food service. Five sectors contracted, led by construction. Also notable in today’s print, prices paid for services and materials reported the slowest growth in seven months, with the index coming in at 65.4, below estimates of 68. While some view this as a sign of easing inflationary pressures, the level is still historically high and well above the growth threshold of 50. Today’s ISM services data stands at odds with the struggling US manufacturing industry, as separate ISM data earlier this week showed November factory activity shrank for a ninth consecutive month.