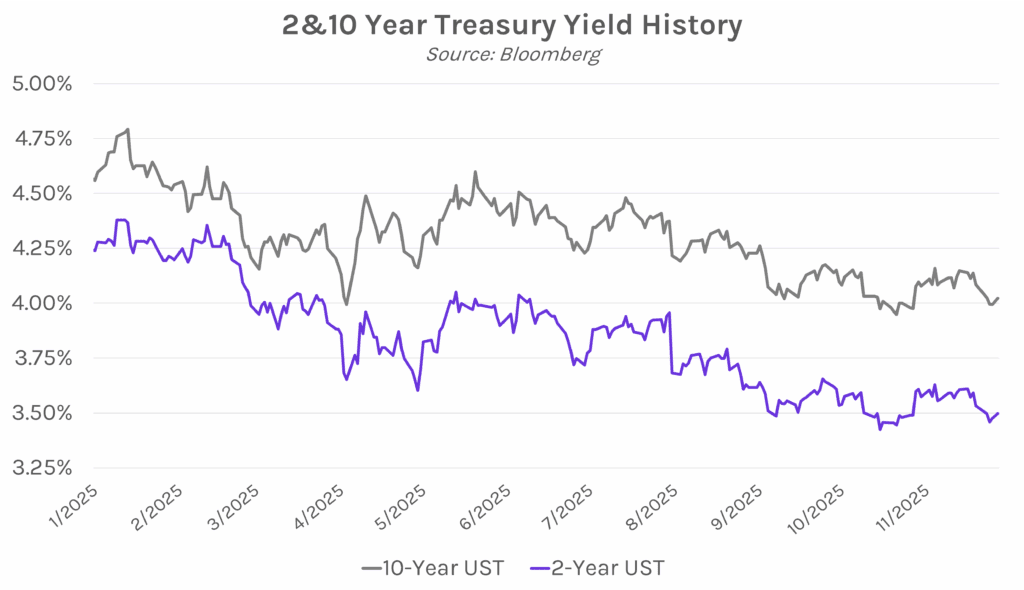

Yields close mixed as CME outage impacts flow. The Chicago Mercantile Exchange experienced a ~10-hour technical outage today, disrupting swap markets and tightening liquidity in the US bond market. Treasury yields were nearly unchanged from Wednesday’s close until CME’s futures and options markets resumed trading at 8:30 am EST. Yields ultimately closed 1-4 bps lower on the short end and 1-3 bps higher on the long end of the curve, with the 2-year yield at 3.49% (a 2 bp decline on the week), and the 10-year yield at 4.01% (a 5 bp decline on the week). Meanwhile, equities rose today with the S&P 500 and NASDAQ up 0.54% and 0.65%.

Black Friday underwhelms as consumers remain wary of high prices. Halfway through what is usually one of the busiest shopping days of the year, Bloomberg reports stores largely lacked the long lines typically associated with the retail holiday. Shoppers Bloomberg surveyed reported fewer discounts and deals than in previous years, underscoring the impact of tariffs on many companies’ ability to offer promotions. US retailers usually earn about 20% of their annual sales in November and December, though this year they report gearing up for extremely price-sensitive consumers. Seasonal hiring has also been reduced, falling to its lowest level since 2009. Marshal Cohen, chief retail adviser at research firm Circana, is “not expecting it to be an overzealous, exciting holiday.” While Circana does expect overall holiday spending to match last year’s levels, they predict unit sales could drop by as much as 2.5%, indicating people may spend more to buy less. While the US consumer appetite held steady for much of the year, recent signs show a pullback among low-income shoppers, and US consumer confidence in November saw its largest decline in seven months.