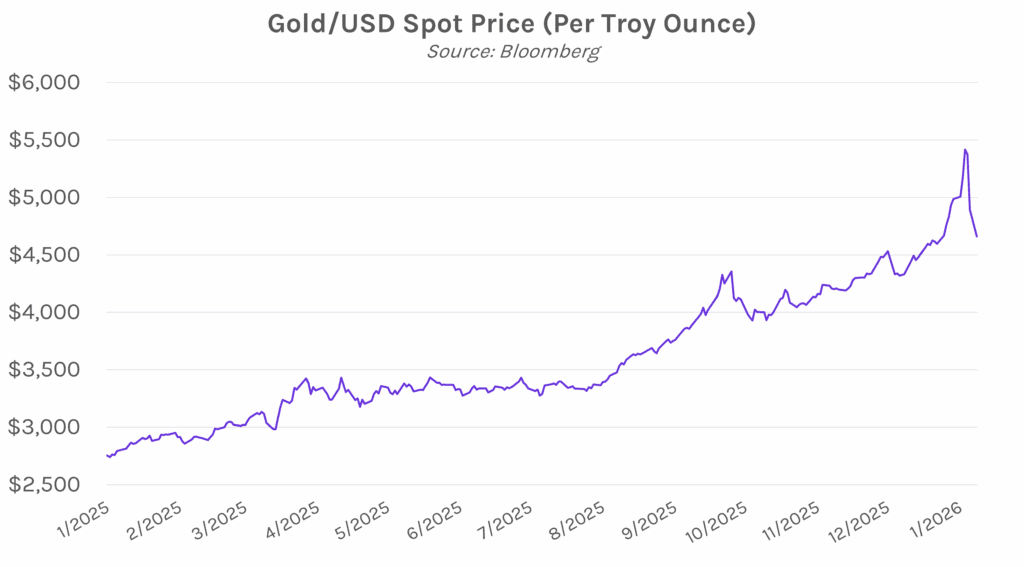

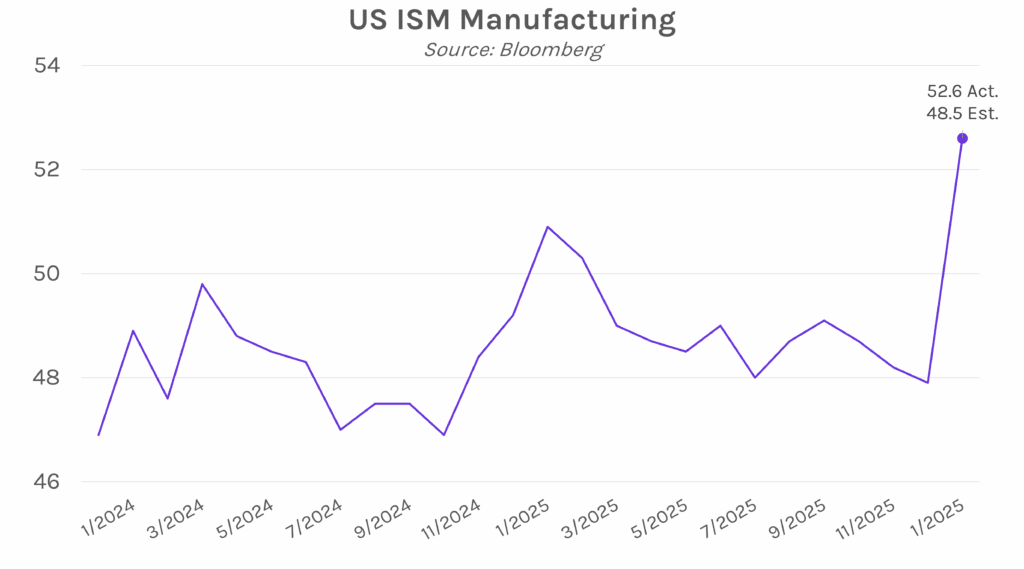

Markets turn risk-on following strong manufacturing print. Treasury yields climbed 3-4 bps after a surprise surge in ISM manufacturing, which came in at its strongest level since 2022. The move sustained throughout the session, and the 2-year yield closed 5 bps higher at 3.57%, while the 10-year yield closed 4 bps higher at 4.28%. Meanwhile, the S&P 500 and NASDAQ climbed 0.54% and 0.56%, respectively, while the dollar rose 0.29% and saw its biggest two-day gain since April. Safe-haven gold continued its slide from Friday as investors poured into riskier assets, declining by 4.76% today to close at $4,661 per ounce.

US manufacturing activity surges on new orders and production. ISM manufacturing in January climbed into expansionary territory at 52.6, compared to estimates of 48.5 and 47.9 in December. After nearly a year of contraction, this surprise upside was the fastest pace of growth since 2022 and driven by demand; the new orders gauge saw nearly a 10-point increase, coming in at 57.1 versus 47.7 in December. The increased demand stemmed from a decline in customer inventories, which contracted by the most since mid-2022. Susan Spence, chair of the ISM Manufacturing Business Survey Committee, noted that, “Although these are positive signs for the start of the year, they are tempered by commentary citing that January is a reorder month after the holidays, and some buying appears to be to get ahead of expected price increases due to ongoing tariff issues.” Overall, nine industries reported growth last month, while eight contracted.

BLS data releases delayed due to partial shutdown. January’s nonfarm payrolls data, originally set to release this Friday, has been delayed due to the partial government shutdown. The release was expected to show 55k jobs added last month, with the unemployment rate holding steady at 4.4%. Emily Liddel, associate commissioner of the BLS, said the agency “will suspend data collection, processing, and dissemination,” to be rescheduled when government funding resumes. In addition to monthly payrolls and unemployment data, markets were awaiting annual employment revisions for the period from March 2024 to March 2025, which were expected to show much weaker job growth than previously reported. It is possible that the data delay is short lived, as the Senate has already passed a bill to extend funding, and House Speaker Mike Johnson is hopeful the measure could pass Tuesday.