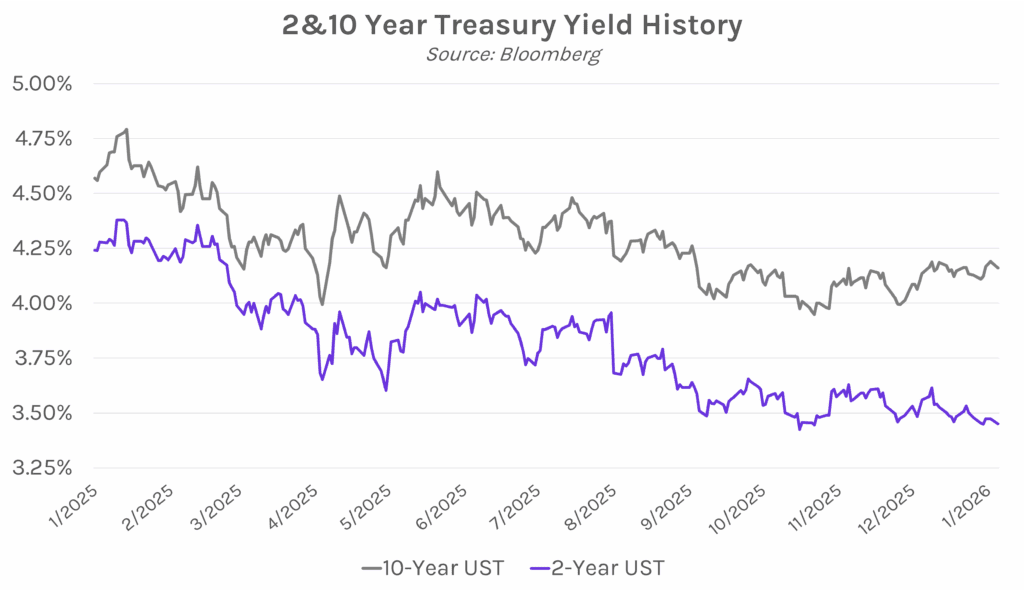

Yields decline, markets largely unperturbed by the capture of Venezuelan president. Treasury yields gradually declined today and closed within 4 bps of opening levels across the curve, with this weekend’s news of the US capture of Venezuelan leader Nicolás Maduro having a relatively subdued impact on rates. The 2-year yield closed 2 bps lower at 3.45% and the 10-year yield closed 3 bps lower at 4.16%. Oil reacted more strongly as WTI crude futures closed 1.7% higher following the Maduro news. Meanwhile, equities climbed as technology megacaps led gains, with the S&P 500 and NASDAQ up 0.64% and 0.69%, respectively.

US manufacturing sinks to one-year low in December. The December ISM Manufacturing Index came in at 47.9, below estimates of 48.4 and November’s 48.2. The reading marks the largest monthly decline since December 2024 and, by remaining below 50, signals contraction for the tenth consecutive month. ISM New Orders rose slightly to 47.7 from 47.4 but remained in contractionary territory for a fourth straight month. Meanwhile, ISM Prices Paid held steady at 58.5, as elevated materials costs continue to strain US manufacturers. Though unchanged from November, the index sits six points higher than a year ago. The lone bright spot was consumer inventories, which fell at the fastest pace since 2022, potentially setting the stage for a pickup in factory orders and production in the months ahead.

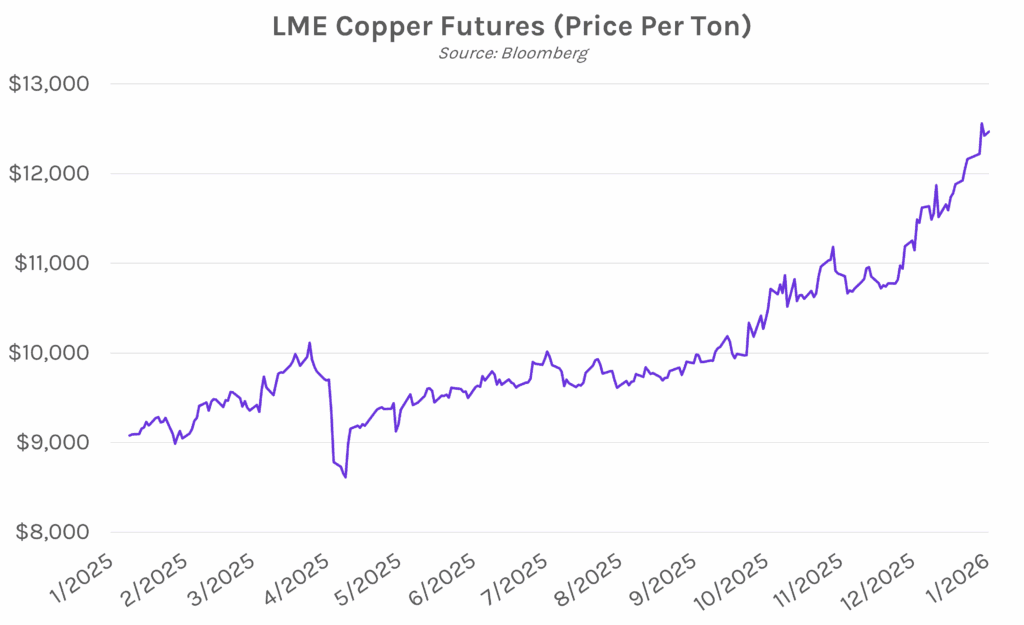

Copper hits a record $13,000 per ton, fueling supply shortage concerns. Copper prices broke $13,000 per ton for the first time ever as the London Metal Exchange (LME) benchmark rose 4% today, bringing gains to nearly 20% since November. The rally has been driven partly by uncertainty around President Trump’s tariff threats and a surge in US copper imports, pushing US prices to a premium over the LME and raising fears of tighter supply elsewhere. Investor demand was already strong given copper’s key role in everything from data centers to EV batteries. Additionally, the rally has been supported by a broader rise in precious metals as geopolitical turmoil boosts demand for safe-haven assets. The US capture of Venezuelan President Maduro, for one, has renewed concerns about critical mineral supply chains around the globe.