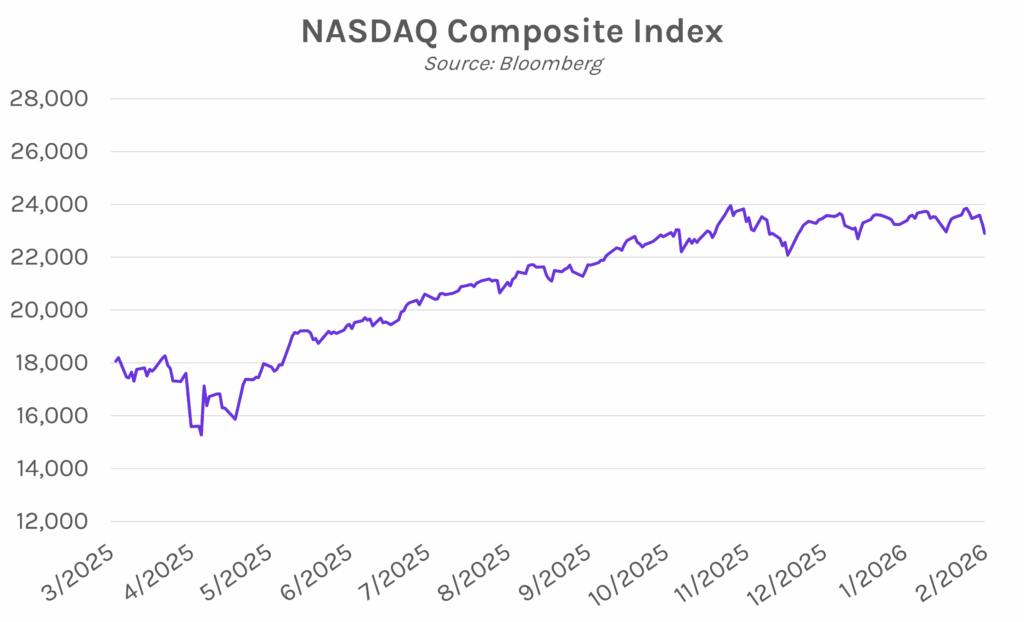

Yields mixed as risk-off sentiment continues. The front-end of the curve had a muted reaction to a miss in private labor data while the long-end rose as many as 3 bps in the immediate aftermath. The yield curve steepened throughout the remainder of the session, with the 2-year yield closing 2 bps lower at 3.55% and the 30-year yield 2 bps higher at 4.92%. Meanwhile, equities extended their selloff today as markets rotated out of software names, with the iShares Expanded Tech-Software Sector ETF dropping 1.8% today. The S&P 500 and NASDAQ ultimately closed 0.51% and 1.51% lower, respectively. Bitcoin also continued its decline, briefly dipping below the $73k level.

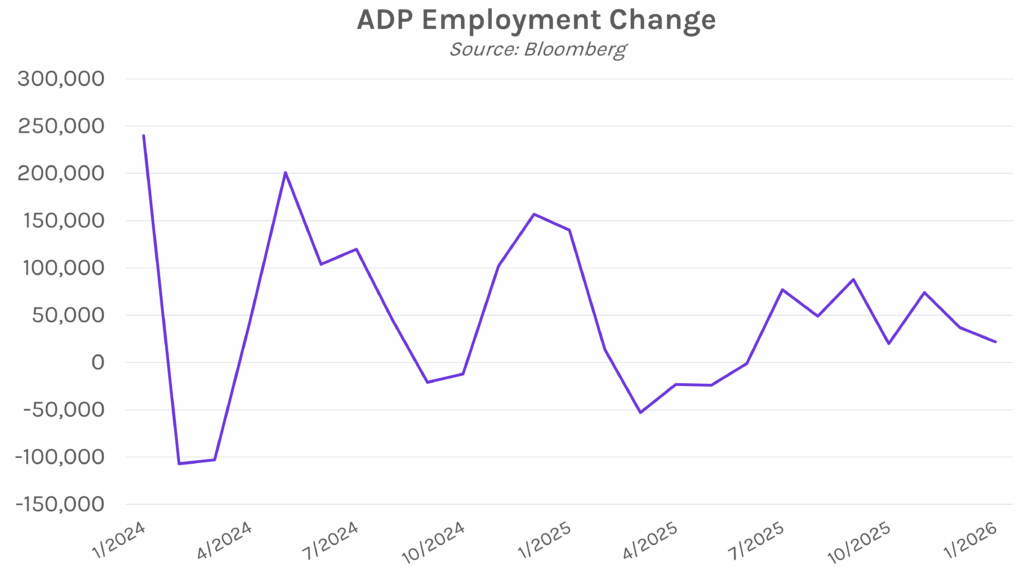

US companies hire less than anticipated in January. ADP’s private sector payrolls data showed 22k jobs added in January compared to estimates of 45k, as well as a downward revision to the prior month. Despite signs of labor market stabilization in recent months, this weaker-than-anticipated payrolls data indicates some cooling in January. Education and health services led the advance in hiring, while professional and business services shed the most jobs since June. Nela Richardson, chief economist at ADP, said, “The last two years of stability has been one that I’ve been watching with weariness, and the fact that it is such a narrow path of hiring has also been a concern.”

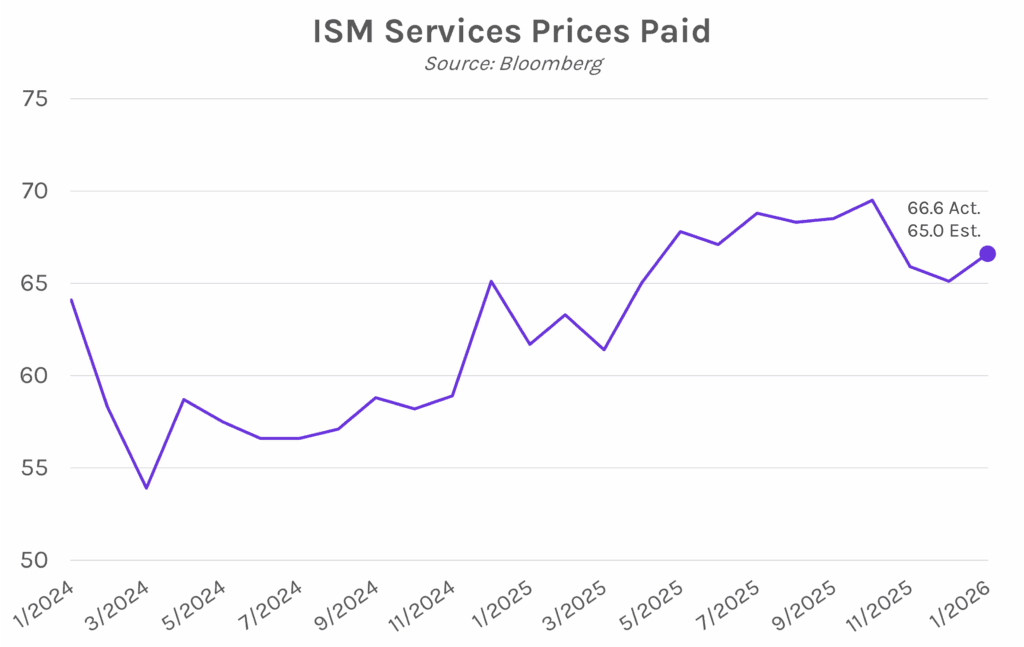

ISM services index shows solid business activity but marginal employment growth. Headline ISM services data came in at 53.8 in January, matching the highest level since October 2024. The figure was solidly above the expansionary threshold of 50 and edged past the forecasted 53.5. Eleven industries reported growth, including healthcare, utilities, construction, and retail trade, while five sectors contracted, including transportation and warehousing. Despite overall business activity picking up, services employment came in at 50.3, barely in expansionary territory and below estimates of 51.8. A gauge of prices paid for services also hit a three-month high at 66.6, though consumer spending appeared to remain strong. A measure of services inventory dropped nine points to 45.1, a sign that consumer-facing services providers were left with low inventories after a robust holiday shopping season.