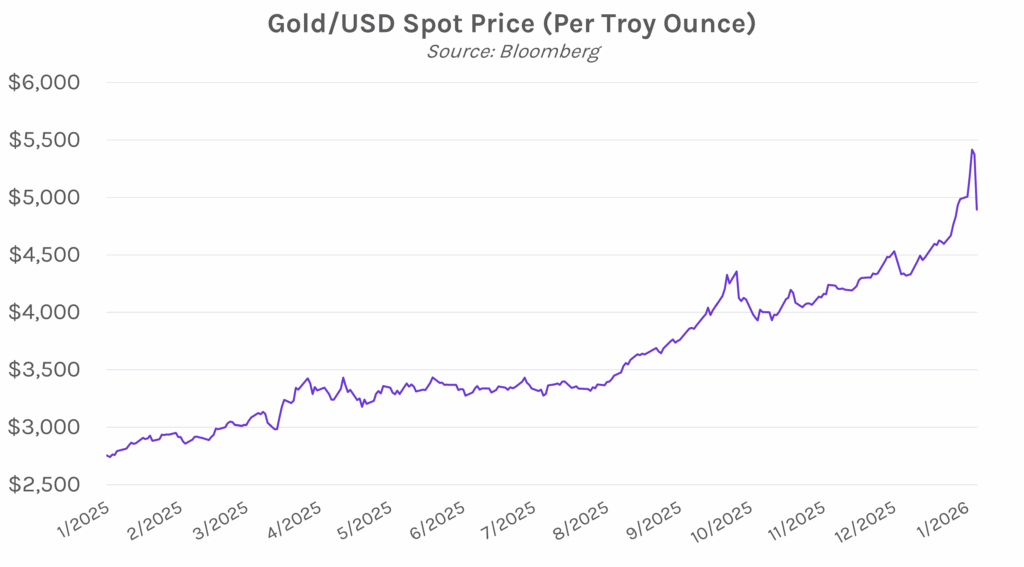

Yields mixed as Trump announces Fed Chair pick. The yield curve steepened today after President Trump announced former Fed Governor Kevin Warsh as his Fed Chair nominee. Yields declined at the front-end of the curve despite Warsh’s reputation as a relative hawk, though he has voiced support for rate cuts over the past year. The 2-year yield closed 4 bps lower at 3.52% (down 7 bps on the week), while the 30-year yield closed 2 bps higher at 4.87% (up 5 bps on the week). Meanwhile, the dollar saw its biggest jump since May, closing 0.9% higher, driven by Trump’s Fed Chair pick. Precious metals plunged, with gold falling below the $4,900 price level after surpassing $5,500 earlier this week, its biggest slide in decades.

Trump selects Kevin Warsh as his pick to be the next Fed Chair. President Donald Trump announced that he will nominate Kevin Warsh to succeed Fed Chair Jerome Powell when his term ends in May. Kevin Warsh previously served as a Fed governor and as an advisor to Trump on economic policy. In 2025, Warsh appeared aligned with Trump as he publicly argued for lower rates, going against his reputation as a hawk. Speaking to reporters on Friday, Trump said that he had not asked Warsh to commit to rate cuts. Warsh now potentially faces a complicated Senate confirmation as Republican Senator Thom Tillis, who sits on the Senate Banking Committee that oversees the Fed, reaffirmed today that he will oppose the confirmation of any nominee until the Department of Justice probe into the Fed is resolved.

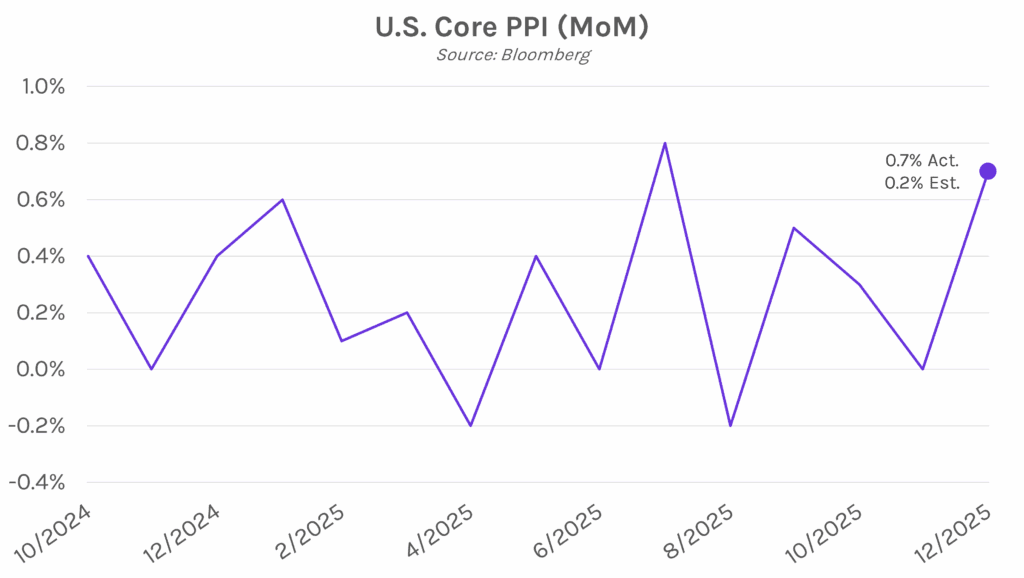

Wholesale prices rise, suggesting tariff costs are falling on consumers. Headline PPI for the month of December rose 0.5% MoM, above estimates and November’s level of 0.2%, marking the largest increase in three months. Core PPI, which excludes food and energy prices, rose 0.7%, one of the largest increases in a year that was well above forecasts of 0.2% and the prior month’s 0% stagnation. Prices also jumped on an annual basis, with headline PPI increasing 3% YoY and core PPI increasing 3.3% YoY, both above estimates of 2.8% and 2.9%, respectively. Services costs mostly drove December’s increase as hotel prices and airline fares ticked up. Prices of goods remained unchanged, but widening wholesale margins suggest that companies are increasingly passing tariff costs on to consumers. Some experts worry it is a sign that inflation may pick up in the months ahead.