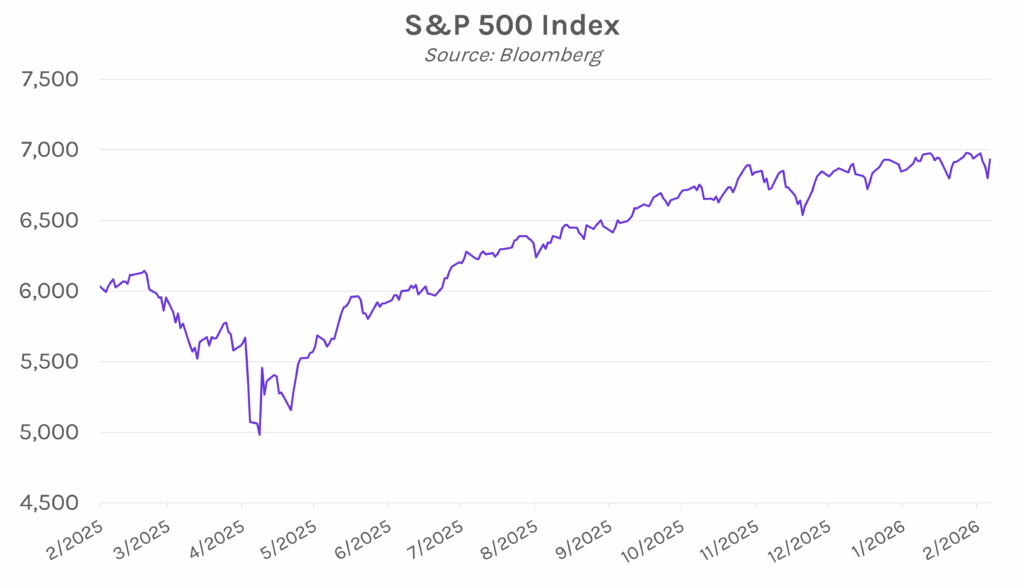

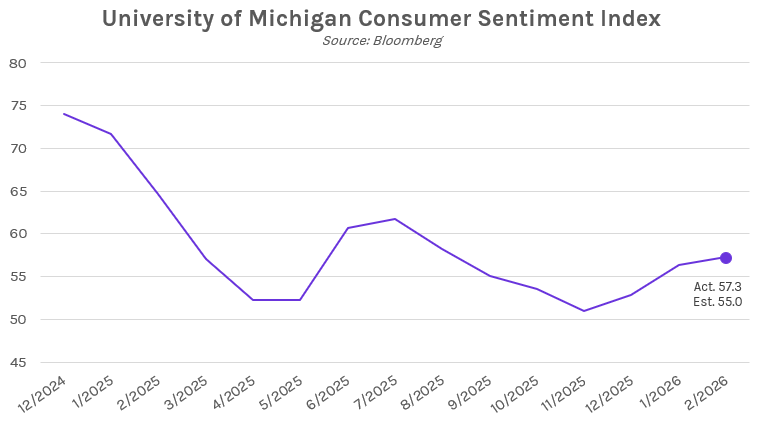

Yields rise on best consumer sentiment data in six months. Treasury yields reversed course after yesterday’s ~10 bp decline, with stronger-than-expected consumer sentiment the main catalyst. Yields climbed 3-4 bps in the immediate aftermath of the data, and the 2-year yield closed 5 bps higher at 3.50% (down 2 bps on the week) while the 10-year yield closed 1bp higher at 4.85% (down 3 bps on the week). Meanwhile, equities rebounded today after a multi-day sell-off, with the S&P 500 and NASDAQ up 1.97% and 2.18%, respectively.

Consumer sentiment unexpectedly rose to six month high. University of Michigan consumer sentiment came in above expectations today. Preliminary February data showed headline sentiment at 57.3, above estimates of 55.0 and January’s 56.4. The increase was driven largely by wealthier Americans with stock holdings, as the S&P 500 hovered near record highs during the survey period, though sentiment among respondents without stock holdings remained low. Consumer expectations rose to 58.3 versus estimates of 53.7 and January’s 55.4. Meanwhile, the short-term inflation outlook improved, with consumers expecting prices to rise 3.5% over the next twelve months, the lowest level in a year and well below estimates of 4.0%. Longer-term inflation expectations edged higher, to 3.4% annualized over the next 5–10 years. Labor market concerns also persist, with Americans reporting the highest perceived risk of job loss since July 2020.

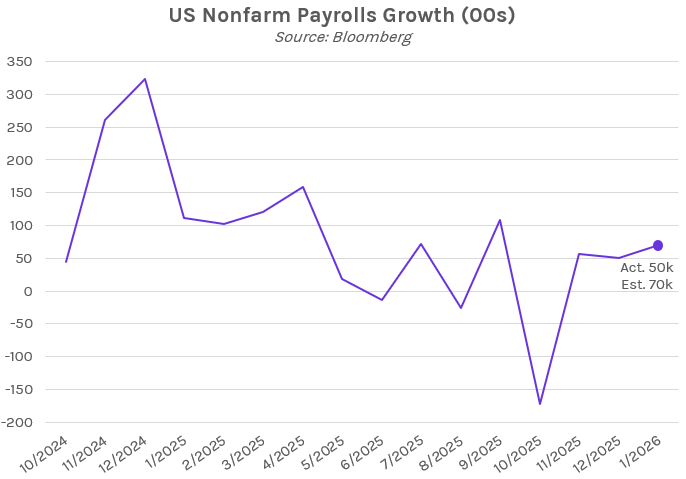

The week ahead: Nonfarm payrolls and CPI on deck. Highly anticipated nonfarm payrolls data is expected to be released on Wednesday after having been delayed by the partial government shutdown. Forecasts call for 70k jobs added in January, up from 50k in December. Private payrolls are also expected to increase by 75k jobs, above the 37k in the prior month. Markets will also look at the unemployment rate, expected to hold steady at 4.4%. Meanwhile, January CPI data will be released on Friday, with headline CPI expected to rise 0.3% MoM, flat against the prior month. CPI YoY is expected to increase 2.5%, down from December’s 2.7%. The labor report will likely be more highly scrutinized, after weak labor data yesterday caused a ~10 bp drop in treasury yields.