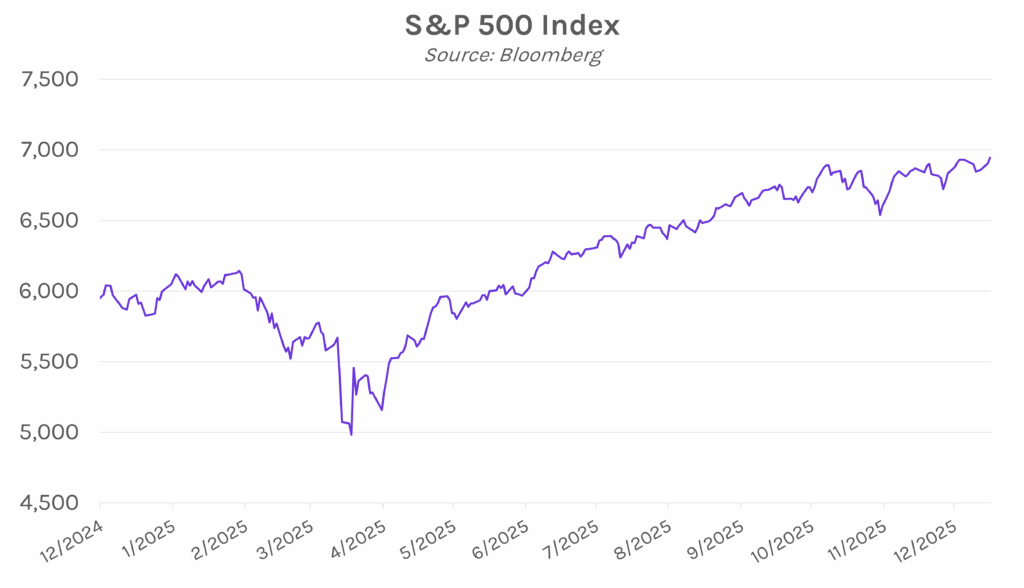

Yields largely unchanged despite services PMI miss. Treasury yields traded in a ~4 bp range today as markets shrugged off services PMI data that came slightly below expectations of 52.9 at 52.5. Yields closed ~1bp higher across the curve, with the 2-year yield at 3.46% and the 10-year yield at 4.17%. Meanwhile, equities rallied today, with the S&P 500 climbing 0.62% to close at a new all-time high of 6,944.82. Gold also rose over 1% as the recent rally in precious metals continued.

Fed’s Miran says over 100 bps of cuts needed in 2026. In an appearance on Fox Business Network today, Fed Governor Stephen Miran said, “I think policy is clearly restrictive and holding the economy back. I think that well over 100 basis points of cuts are going to be justified this year.” Miran dissented in favor of 50 bps of cuts at the last three FOMC meetings, and his comments come as other officials have expressed that they believe policy rates are near neutral. Richmond Fed President Tom Barkin earlier described policy rates as “within the range of its estimates of neutral.” The current benchmark rate is 3.5%-3.75%, with the FOMC’s median estimate of the neutral rate at 3%.

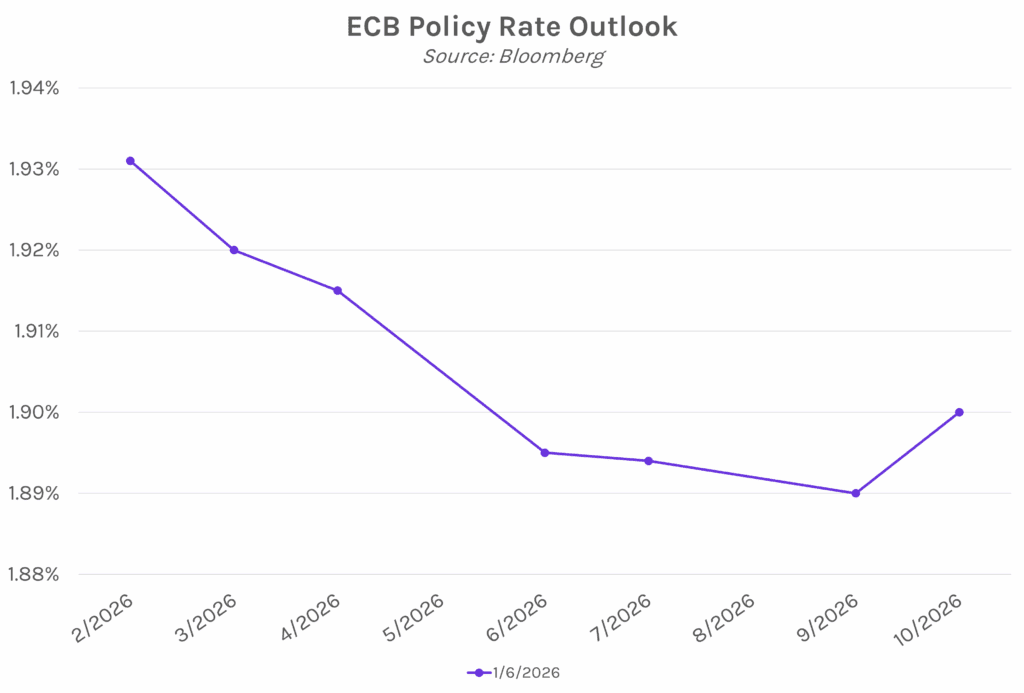

German inflation falls past expectations. German inflation data released today showed prices rose just 2% YoY in December, below estimates of 2.2% and the prior month’s 2.6%. The decline was led by leisure, clothing, and food prices, though core inflation figures, which exclude volatile food and energy sectors, also fell to 2.4% from 2.7% in November. Carsten Brzeski, global head of macro at ING, foresees German inflation hovering around 2% throughout 2026. Brzeski expects prices to rise just under 2% in the coming months, followed by slightly higher levels in the latter half of the year. Eurozone inflation data is due to release tomorrow, but as Europe’s largest economy, today’s data from Germany gives the ECB little reason to change course, having held policy rates steady since June.