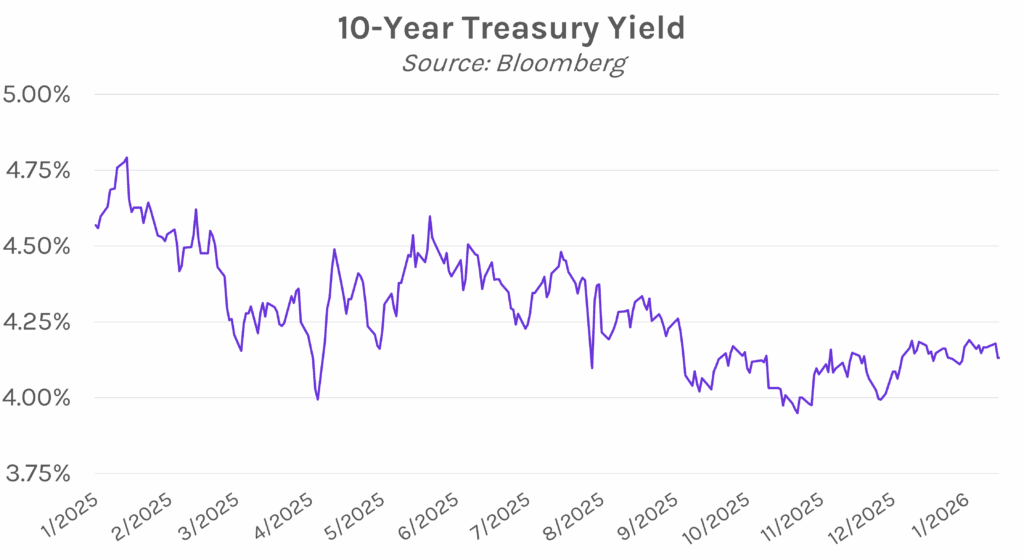

Yields decline on Miran’s comments, US-Iran de-escalation. Treasury yields rose in the aftermath of this morning’s PPI data, which was generally above expectations due to rising energy costs. However, the move reversed on dovish comments from Fed Governor Miran and Trump’s announcement that the US will be holding off a military response on Iran, causing crude futures to decline. The 2-year yield closed 2 bps lower at 3.51%, while the 10-year yield closed 5 bps lower at 4.13%. Meanwhile, equities declined as the “Magnificent Seven” slid, and the NASDAQ saw its worst session in a month, closing 1% lower.

Fed officials speak on DOJ probe. Minneapolis Fed President Kashkari today became the first official to explicitly back Powell’s argument that the DOJ’s Fed investigation aims to pressure on the central bank to further lower rates. He said, “The escalation over the course of the past year is really about monetary policy.” Fed officials Goolsbee, Bostic, and Williams also spoke similarly on the importance of the Fed to set rates without political interference. Goolsbee said, “The independence of the Fed couldn’t be more important for the long-run inflation rate in this country.” Fed Governor Miran on the other hand, when asked for his thoughts on the investigation’s potential to undermine Fed independence and raise inflation expectations, said, “I don’t really buy that. I think that inflation is very much headed in the right direction…this other stuff is just noise.”

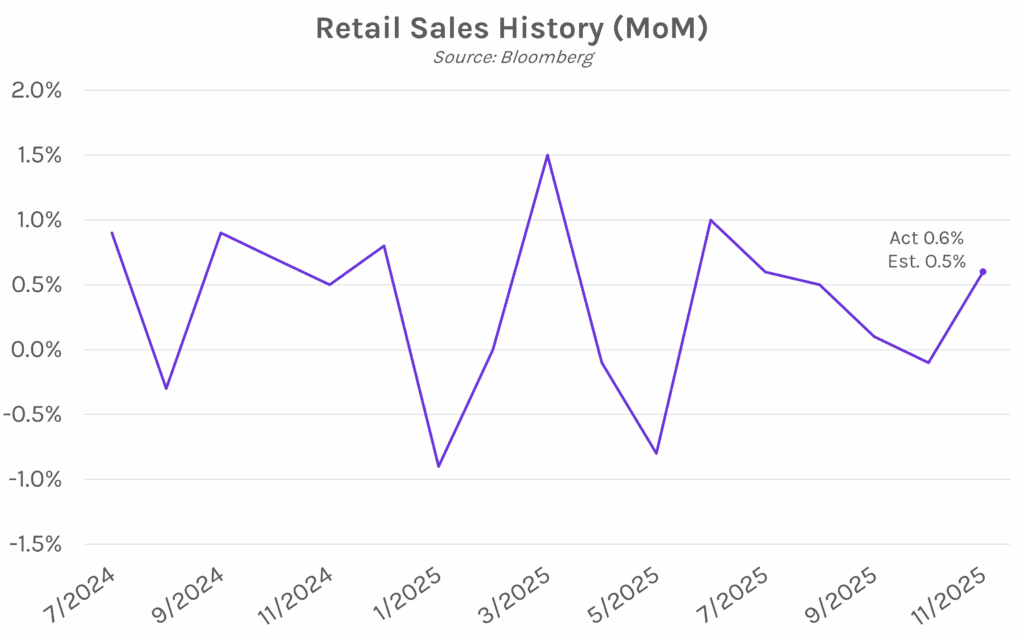

Retail sales jump by most since July. Headline retail sales increased 0.6% MoM in November, beating estimates of a 0.5% gain and landing well above October’s 0.1% decrease, which was downwardly revised from 0.0%. Marking the largest increase since July, the rebound in retail sales was driven mostly by autos and holiday shopping. Ten of thirteen categories saw increases, including sporting goods, building material retailers, and clothing outlets. Spending at restaurants and bars, the only service sector category in the report, saw a 0.6% increase against the prior month. Retail sales excluding autos also posted gains, increasing 0.5% MoM, above estimates of 0.4% and October’s 0.2% gain.