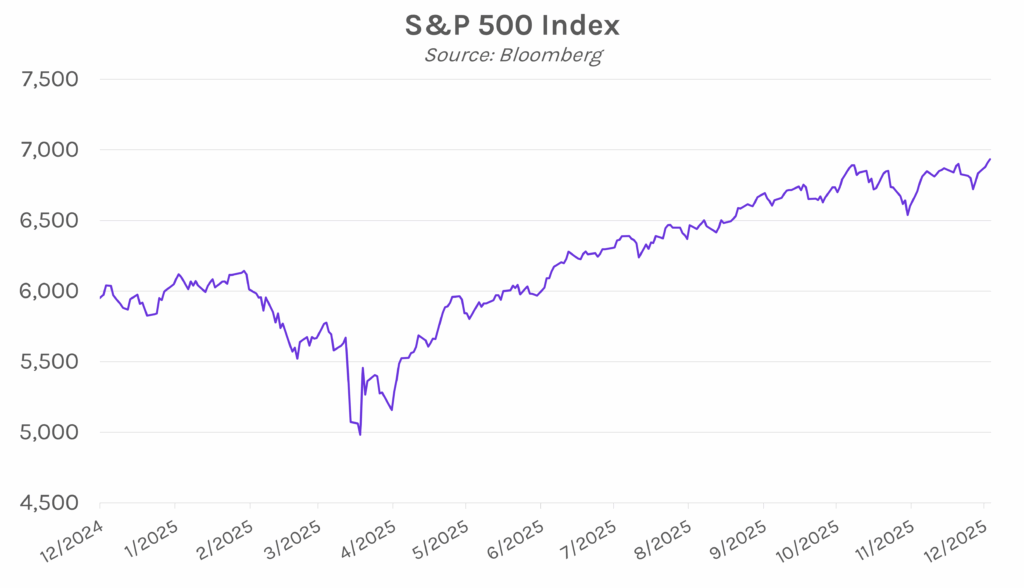

Rates inch lower on shortened trading day. Treasury yields traded in a tight 2-3 bp range this morning, with a muted reaction to slightly better-than-expected initial jobless claims data. A strong $44B 7-year treasury auction later helped push yields lower, with the 2-year yield closing 3 bps lower at 3.50% and the 10-year yield closing 3 bps lower at 4.13%. Meanwhile, the S&P 500 hit a new all-time high of 6,934.77, closing the day up 0.32%.

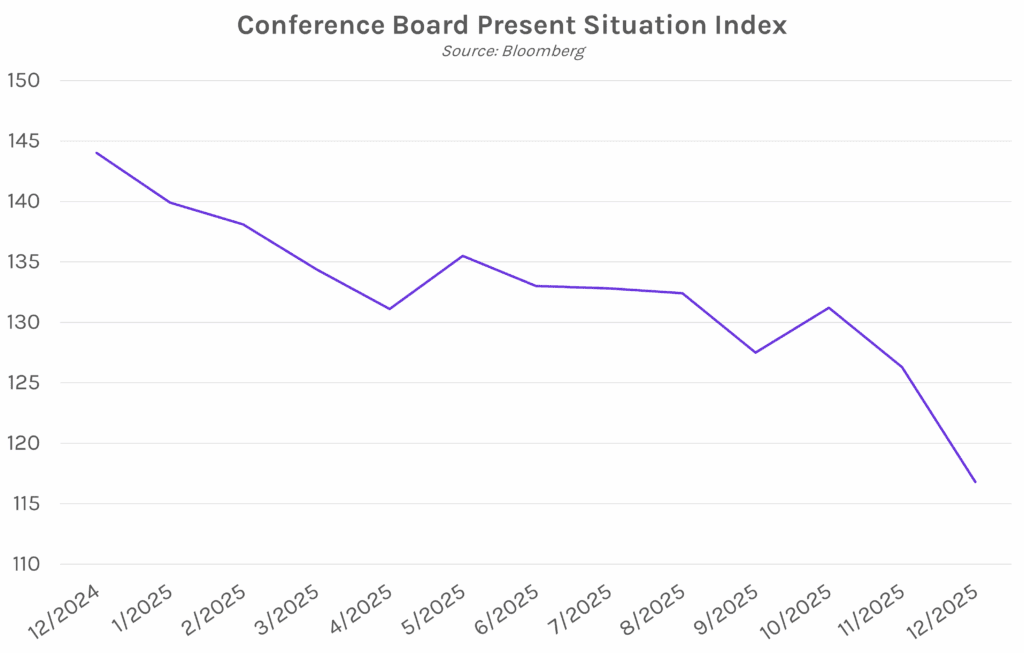

Holiday shopping remains resilient despite low consumer confidence. Although data released yesterday showed consumer confidence falling in December for the fifth straight month, Americans have continued to spend this holiday season. Mastercard released their annual holiday spending report today, showing consumer spending increased 3.9% from last year for the period from November 1 to December 21. This figure includes both in-store and online retail sales and excludes automotive sales, but is not inflation adjusted. However, Mastercard’s report also highlighted that consumers are in search of value, performing price comparisons and looking for discounts. Michelle Meyer, Mastercard Economics Institute’s chief economist said, “There’s still consumers who are a little on edge…but that hasn’t constrained them from spending in the short term.”