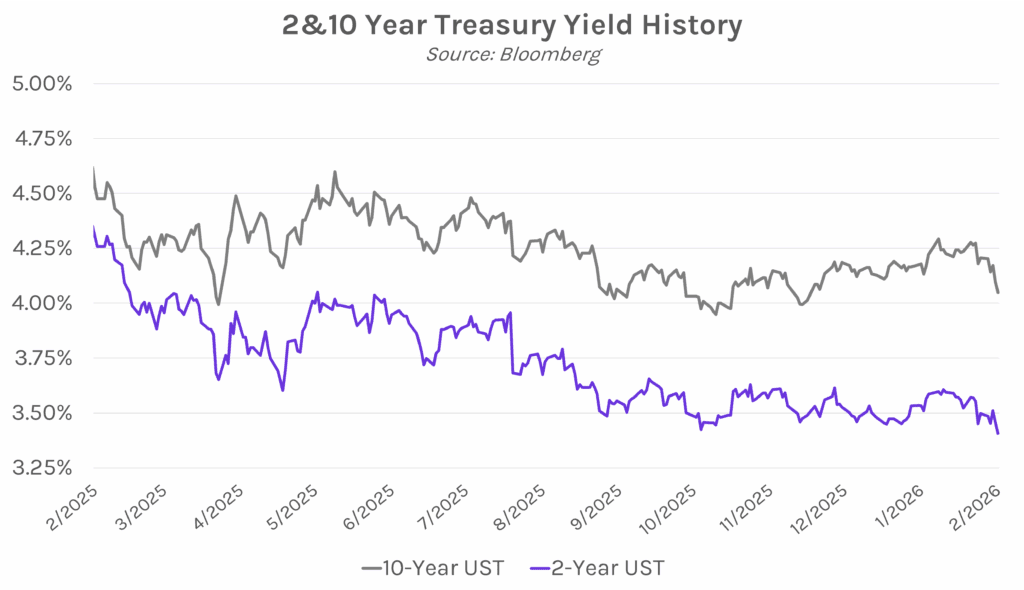

Yields decline as markets digest CPI data. Treasury yields dropped ~3-5 bps in the immediate aftermath of today’s tame CPI print. The move partially reversed shortly thereafter as markets further digested the CPI report’s details, but yields ultimately ended the day 4-6 bps lower across the curve as rate cut expectations in 2026 increased. The 2-year yield closed 9 bps lower on the week at 3.41%, while the 10-year yield closed 16 bps lower on the week at 4.05%. Meanwhile, technology stocks losses pressured major equity indices, with the S&P 500 closing 0.05% higher and the NASDAQ down 0.22%.

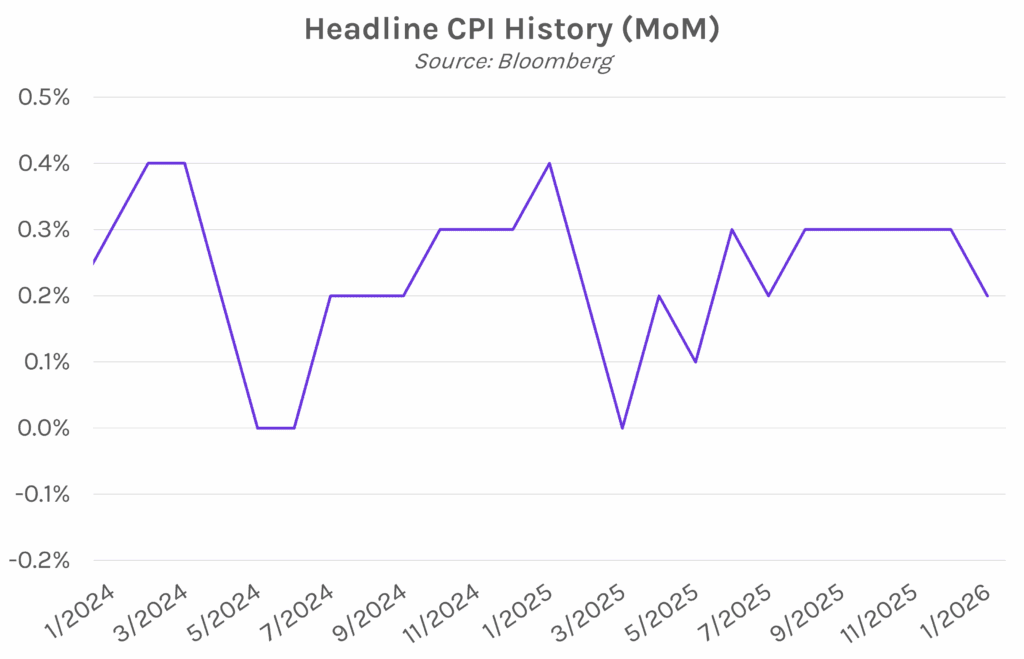

Tame inflation data boosts rate cut expectations. Headline CPI rose 0.2% MoM in January, below estimates of a 0.3% increase and marking the smallest monthly gain since July. Core CPI, which excludes volatile food and energy sectors, increased 0.3% MoM, in line with expectations and up from 0.2% in December. On an annual basis, headline CPI rose 2.4% YoY, below estimates of 2.5%, while core CPI matched expectations at 2.5% YoY. Despite core services prices increasing by the most in a year, ultimately the report was viewed positively as a sign of moderating inflation. Markets are now pricing in an ~86% chance of a rate cut by the June FOMC meeting, up from ~70% on Wednesday.

Bessent expects Warsh’s Fed chair hearing to happen, despite Tillis’ vow to block vote. Treasury Secretary Scott Bessent shared that, after meeting with a group of Republican senators, he has reached an agreement to hold a hearing for President Trump’s Fed chair nominee, Kevin Warsh. Bessent’s announcement on CNBC today comes after Republican Senator Thom Tillis, the head of the Senate Banking Committee which reviews Fed nominees, vowed to block any Fed nominee vote until the Justice Department investigation into the Fed is resolved. Bessent said, “Senator Tillis wants to keep a hold on any vote… But I think it’s important to get the hearings underway. And I think we have an agreement to do that.”