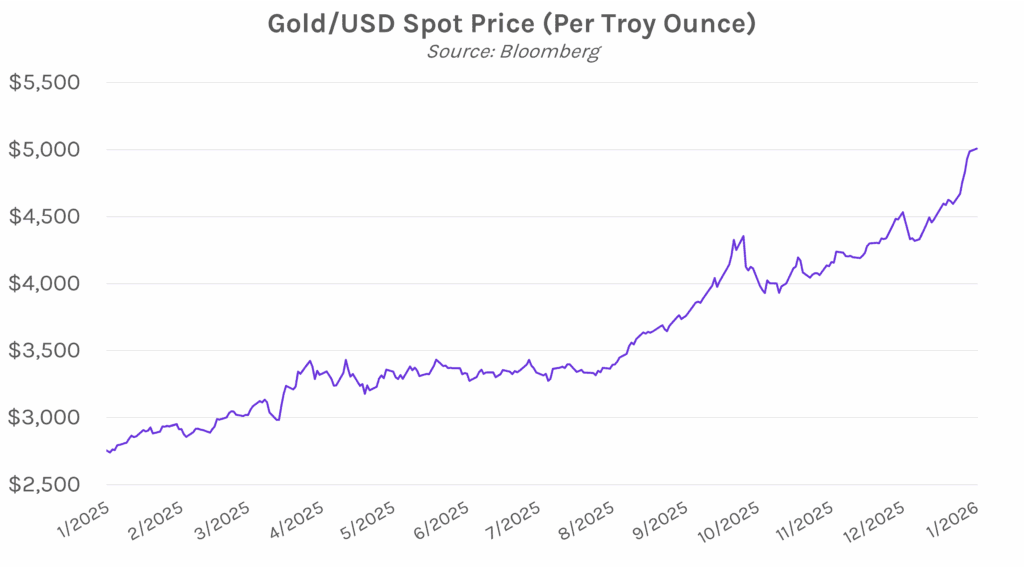

Yields nearly flat as Fed expected to hold rates steady this week. Treasury yields traded in a tight 2-3 bp range today ahead of this week’s FOMC meeting, where Fed officials are expected to hold rates steady. Markets will focus on Chair Powell’s press conference on Wednesday for signals on the policy path forward and his future at the Fed after his chairmanship ends in May. Yields closed nearly flat across the curve, with the 2-year yield at 3.59% and the 10-year yield 1bp lower at 4.21%. Meanwhile, gold surpassed the $5,000 price level for the first time, up ~52% over the last six months. The dollar also dropped to its lowest level since 2022, as speculation emerged that the US may intervene to help support the sliding Japanese yen.

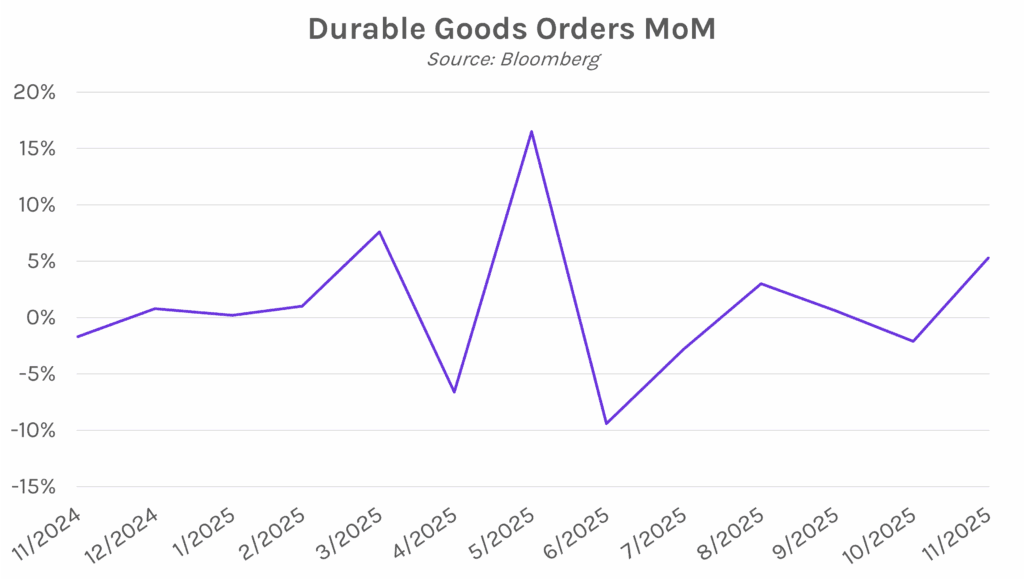

Durable goods orders post largest increase in six months. Preliminary data for November showed durable goods orders increased 5.3%, above estimates of a 4% increase and October’s downwardly-revised 2.1% decrease. Marking the largest uptick in six months, the increase was driven largely by capital equipment and commercial aircraft orders, with the latter seeing a nearly 98% increase MoM. Excluding transportation, durable goods orders increased by 0.5%, above estimates of 0.3% and the prior month’s 0.1% decline. Experts predict business investment will pick up this year, fueled by favorable tax provisions under the Big Beautiful Bill. Stephen Stanley, chief US economist at Santander US Capital Markets said, “The robust core capital goods orders and shipments figures for the second half of last year suggest that momentum in business investment has been building heading into 2026.”

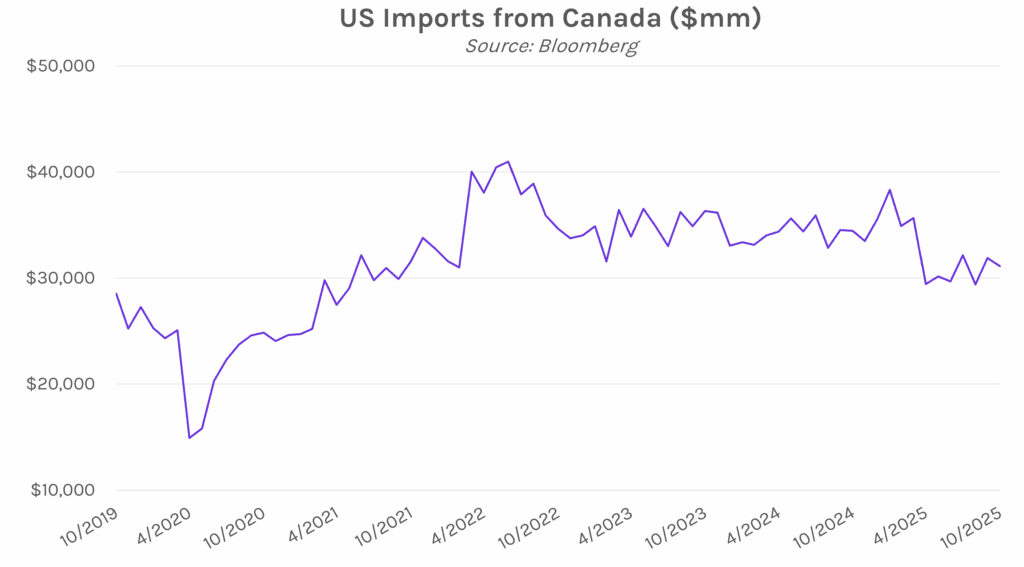

Canada continues to diversify trade away from US. Earlier this month, Canada reached a deal with China to reduce tariffs on Chinese electric vehicles in exchange for food-related trade concessions. In response, President Trump threatened a 100% tariff on all Canadian goods if Canada becomes a “drop off port” for Chinese exports into the US. Canadian Foreign Minister Anita Anand indicated yesterday that these threats will not deter them from diversifying trade, hoping to double non-US exports within 10 years. She explained, “We need to protect and empower the Canadian economy and trade diversification is fundamental to that. That is why we went to China, that’s why we will be going to India and that is why we won’t put all our eggs in one basket.” Still, Anand emphasized that Canada and the US have a strong relationship that she expects to continue.