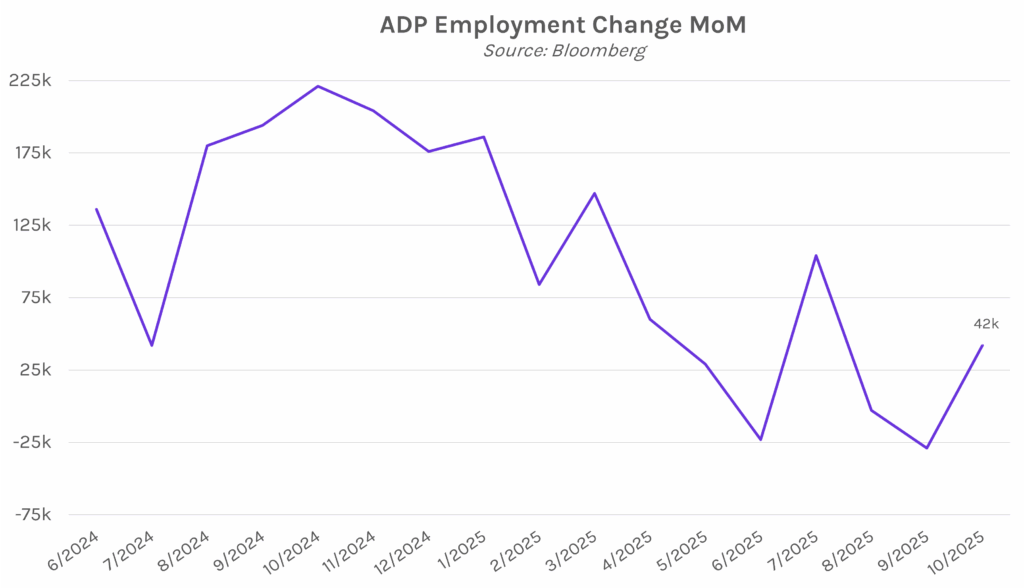

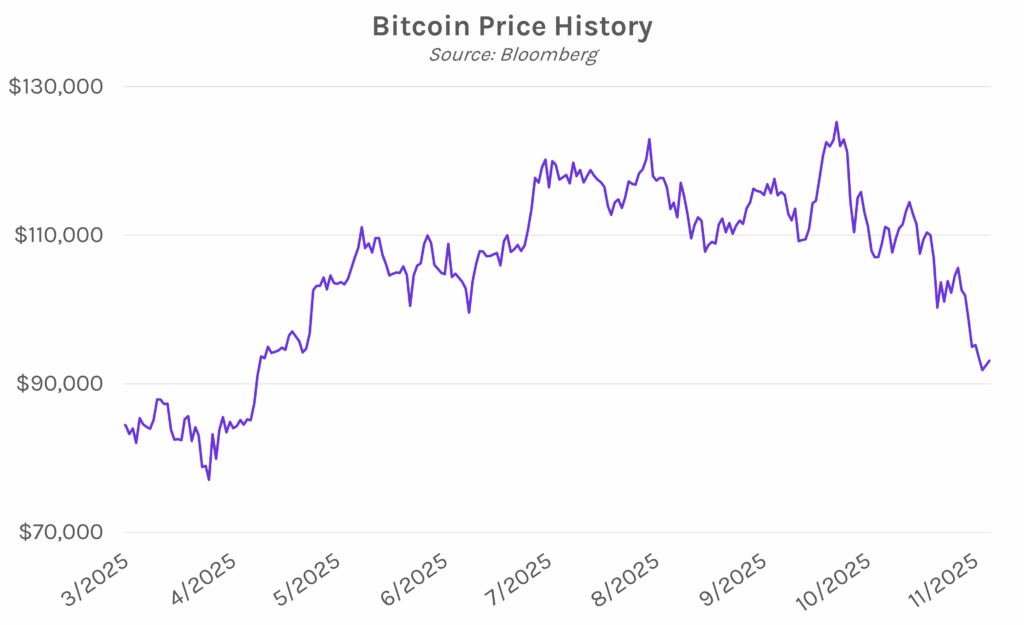

Yields fall on labor data as markets await Nvidia earnings. Treasury yields declined today as markets got another glimpse into the state of the labor market following the government shutdown. Jobless claims showed 232,000 initial unemployment benefit applications for the week ending October 18, 13k above recent lows, while ADP data showed declines in private payrolls on average for the four weeks ending November 1. The 2-year yield closed 4 bps lower at 3.57%, and the 10-year closed 3 bps lower at 4.11%. Meanwhile, equities declined on a sell-off in technology names ahead of tomorrow’s Nvidia earnings, with the S&P 500 closing 0.83% lower, down for the fourth straight day. Bitcoin rebounded after briefly falling below $90,000, currently up 1.14% on the day.

Fed’s Barkin more focused on labor than inflation. Richmond Fed President Tom Barkin remains optimistic that inflation “isn’t likely to increase much,” leaving him to stay focused on limiting downside risks to the labor market. Barkin explained, “Our outreach suggests a somewhat weaker labor market than these numbers suggest,” with recent layoffs from large companies such as Amazon and Target giving “additional cause for caution.” Barkin did not specifically share his outlook for the December FOMC meeting, but his focus on uplifting the labor market adds to ongoing debate among Fed officials about whether controlling employment or inflation should take priority in the Fed’s dual mandate.

ADP Research data shows 2.5k weekly job losses last month. ADP data released today reported private payrolls shedding an average 2.5k jobs per week for the four weeks ending November 1. Bigger picture, the data showed the labor market losing momentum in October, though preliminary figures point to the rate of losses seeming to slow thus far in November. Concern for the labor market, however, continues to grow, as 55% of employed Americans now report being concerned about losing their job. ADP private payrolls have become increasingly important in recent weeks as government data has been delayed by the shutdown, however the BLS is expected to finally release September labor data on Thursday, with estimates foreseeing 55k jobs added versus the prior month.