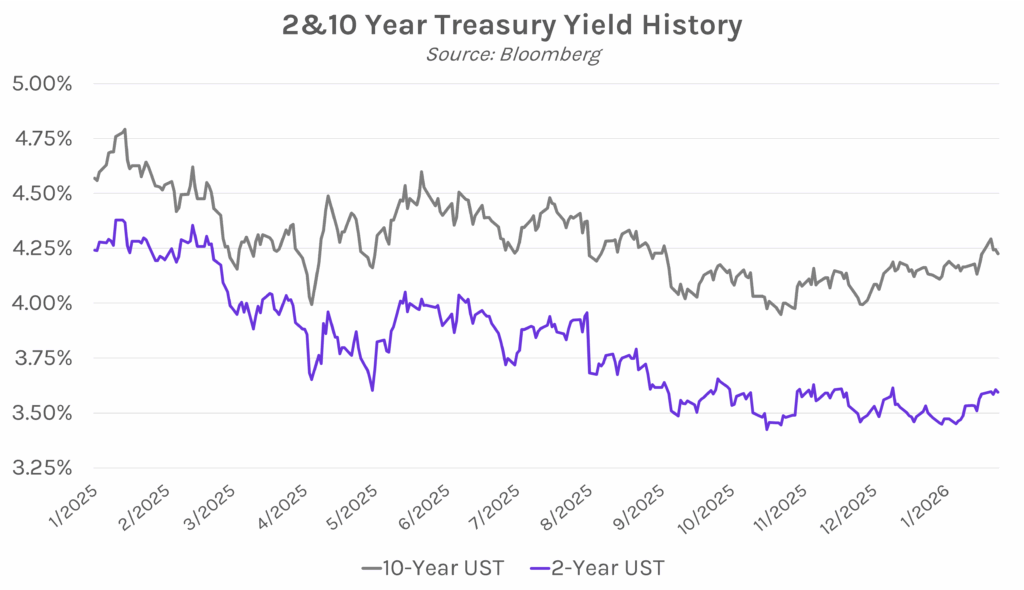

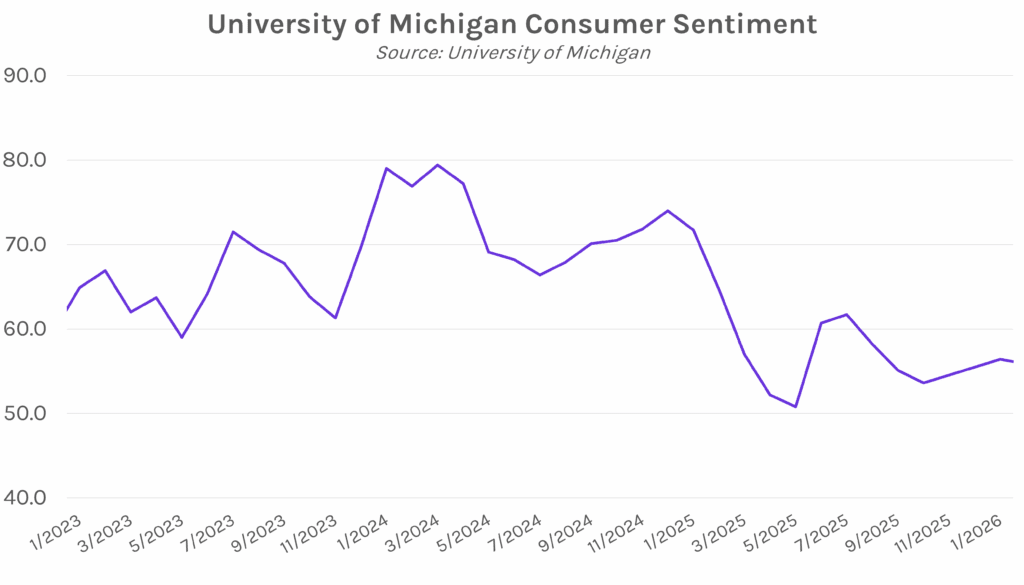

Yields close nearly unchanged despite unexpected rise in consumer sentiment. Treasury yields traded in a 2-4 bp range today, as steady PMI data and better-than-anticipated University of Michigan consumer sentiment data failed to sway markets. The 2-year yield closed 1bp lower at 3.59% and the 10-year yield closed 2 bps lower at 4.23%, both nearly flat on the week. Meanwhile, the NASDAQ closed 0.28% higher, led by gains from Nvidia as China told firms that they can prepare orders for H200 chips. Oil also climbed today, as brent rose above $65 a barrel and WTI above $61, on near-term supply disruptions and geopolitical risks in the Middle East.

US consumer sentiment hits a five-month high. The University of Michigan consumer sentiment came in at 56.4, a five-month high and the largest MoM increase since June (3.5 points). Consumer sentiment saw broad gains across income, age, education, and political affiliation. However, survey director Joanne Hsu said, “national sentiment remains more than 20% below a year ago, as consumers continue to report pressures on their purchasing power stemming from high prices and the prospect of weakening labor markets.” Despite this frustration, data earlier this week showed that consumer spending remains a resilient driver of the US economy.

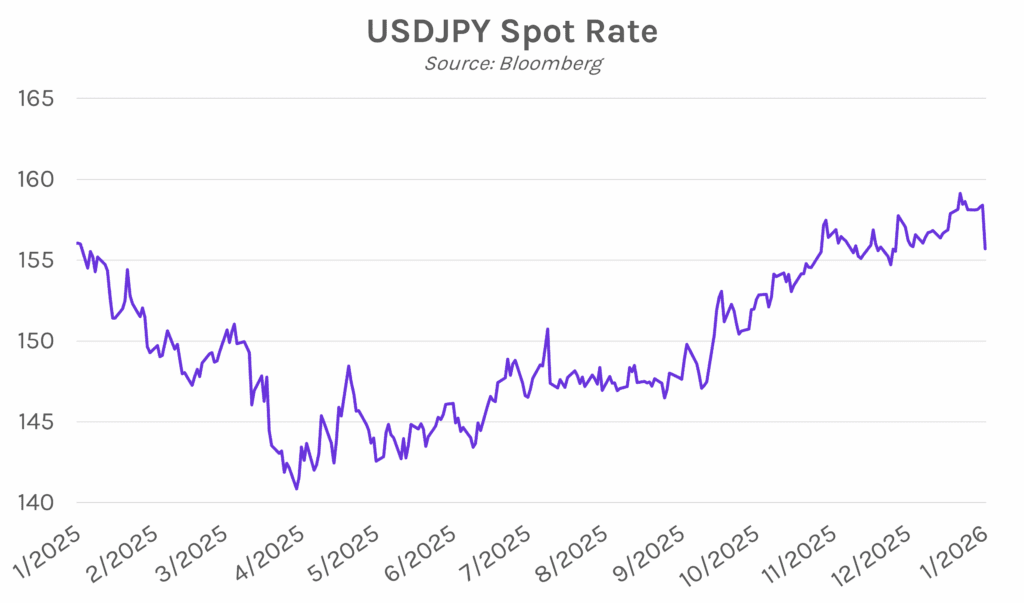

Yen falls near 18-month low. The Japanese yen was volatile today, posting two sudden spikes as the currency weakened to 159.2 per dollar. The level, near 18-month lows, occurred during Governor Ueda’s press conference announcing that the BOJ held policy rates steady. A short while later, the yen suddenly strengthened to 157.3 per dollar, causing markets to speculate that authorities had conducted a rate check. Rate checks, when BOJ authorities informally asses market interest rates with banks, are often a precursor to monetary policy intervention. Since Prime Minister Takaichi took over in October, the yen has fallen more than 4% on fiscal concerns, fueling concerns about intervention.