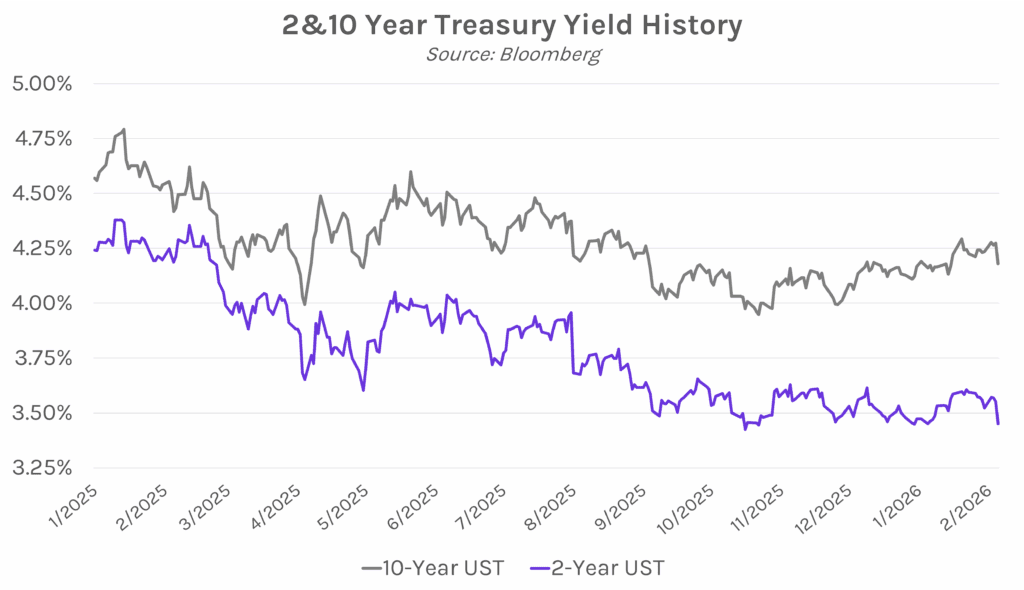

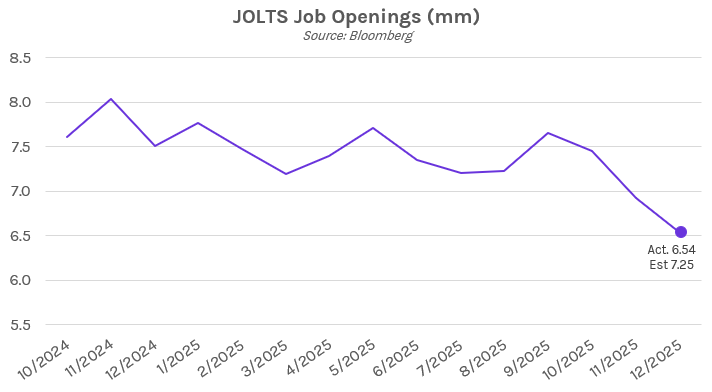

Yields plunge as labor data misses expectations. Treasury yields declined today in response to several weak labor market prints, which fueled bets that the Fed will be more aggressive with rate cuts in 2026. Challenger data showed the largest amount of announced job cuts in January since 2009, initial jobless claims ticked up slightly, and JOLTS job openings unexpectedly dropped to the lowest level since 2020. The 2-year yield closed 10 bps lower at 3.45%, while the 10-year yield declined 9 bps to 4.18%. The market is now nearly 50/50 between two or three rate cuts this year, a stark shift from yesterday’s strong lean towards two moves. Meanwhile, equities continued to sell off, with the S&P 500 and NASDAQ down 1.23% and 1.59%, respectively. Crypto also continued its tumble, with Bitcoin now below the $65,000 level.

Jobs data misses hint at possible cracks in the labor market. Initial jobless claims for the week ending January 31 came in higher than expected at 231k, above estimates of 212k and the prior month’s 209k. Also today, JOLTS data showed that job openings slid to 6.54 million in December, well below the forecasted 7.25 million. The figure was the lowest openings level since 2020, a sign of sluggish demand for workers, with the pullback driven by the professional and business services industries, as well as retail trade. JOLTS layoffs figure also ticked up, to 1.76 million, above estimates of 1.73 million and led by job cuts in the transportation and warehousing sectors. Meanwhile, the quits rate, a measure of people voluntarily leaving their jobs, hovered at 2.0%, flat against the prior month and near the lowest level since the pandemic.

Fed’s Bostic, Cook continue push to keep policy rates steady. Atlanta Fed President Raphael Bostic re-emphasized his preference to keep rates unchanged in the near term, saying, “For me, inflation has been too high for too long. It’s important that our policy stay at a moderately restrictive posture, because that is a posture that increases the likelihood that we will get inflation back to our 2% target.” Bostic announced last fall that he is retiring when his term ends at the end of this month, with the January FOMC meeting his last. His comments align with Fed Governor Lisa Cook’s yesterday, where she emphasized the importance of the Fed to bring inflation down. She noted that her focus will be pointed to controlling inflation, as long as unexpected shifts in the labor market do not occur.