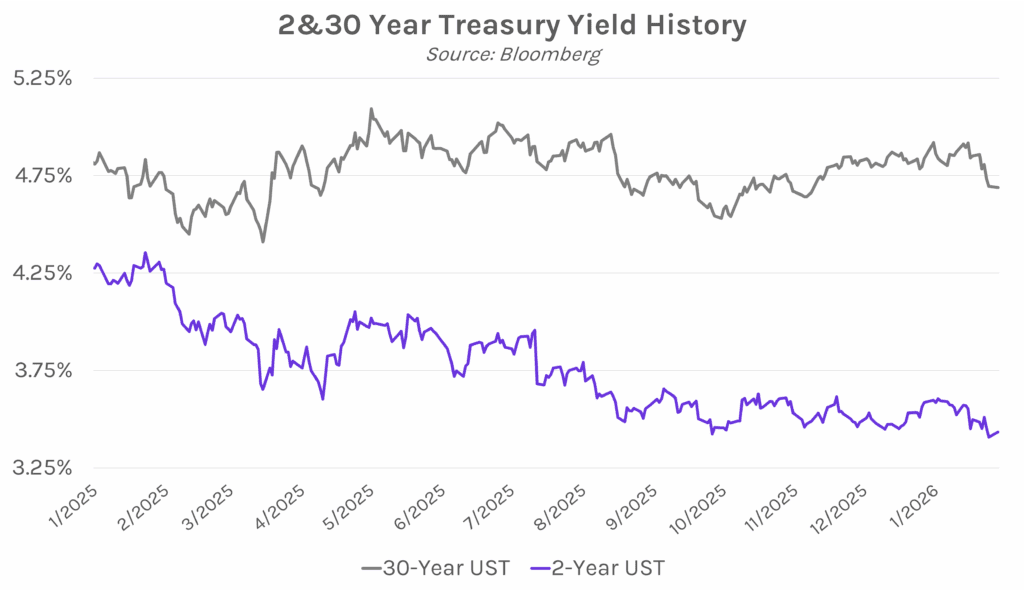

Yields inch higher following strong data. Treasury yields climbed slightly at the front-end of the curve today, supported by private payrolls data and stronger than expected empire manufacturing. Combined with last week’s strong January jobs report, today’s data suggested that there may be reduced need for deeper rate cuts this year, though markets now look to tomorrow’s FOMC meeting minutes that may provide hints on the Fed’s timing. The 2-year yield closed 3 bps higher at 3.43%, while the 30-year yield closed nearly flat at 4.69%. Meanwhile, equities had a volatile session as AI outlook worries continued to rattle markets. The S&P 500 was down nearly 1% today, though ultimately closed 0.10% higher.

The Trump Administration may narrow scope of metal tariffs. Last year, the Trump Administration placed a broad 50% levy on foreign steel and aluminum that was intended to target China but also impacted Canada and the EU, among others. According to an anonymous report, the Office of the US Trade Representative is now working to narrow the scope of the tariffs, though specific details and timing remain unclear. The potential changes would be driven by the sweeping nature of the tariffs, which led to complications in calculating the duty amounts, particularly because the tariffs also apply to some products made with steel and aluminum parts. US Trade Representative Jamieson Greer said, “You may want to sometimes adjust the way some of the tariffs are applied for compliance purposes.” He indicated that the underlying tariffs would remain, though how they are enforced may shift.

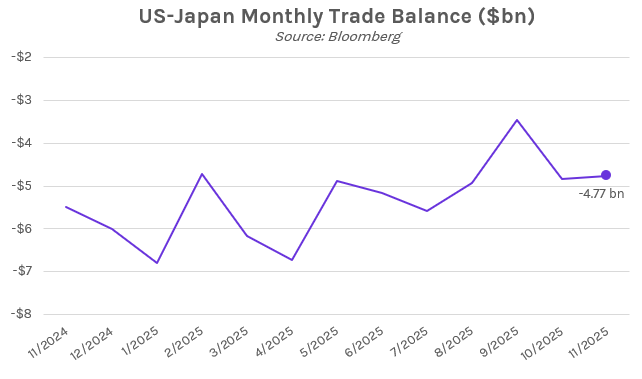

First investment projects announced under US-Japan trade deal. Three projects have been selected in the first tranche of investments for Japan’s $550 billion commitment under the US-Japan trade deal. The projects are a gas power plant in Ohio, a critical minerals site in Georgia, and a liquefied natural gas facility in Texas. The selections were made by President Trump based on recommendations from an investment panel he established, along with input from Japanese officials. Though few specifics were provided on the investments, only 1–2% of Japan’s $550 billion pledge is expected to be in cash, with most funding coming in the form of loans and loan guarantees. Additionally, the Japan Bank for International Cooperation and Nippon Export and Investment Insurance are both expected to play key roles in financing. As per the trade deal, once a project is selected, Japan has 45 business days to fund the effort.