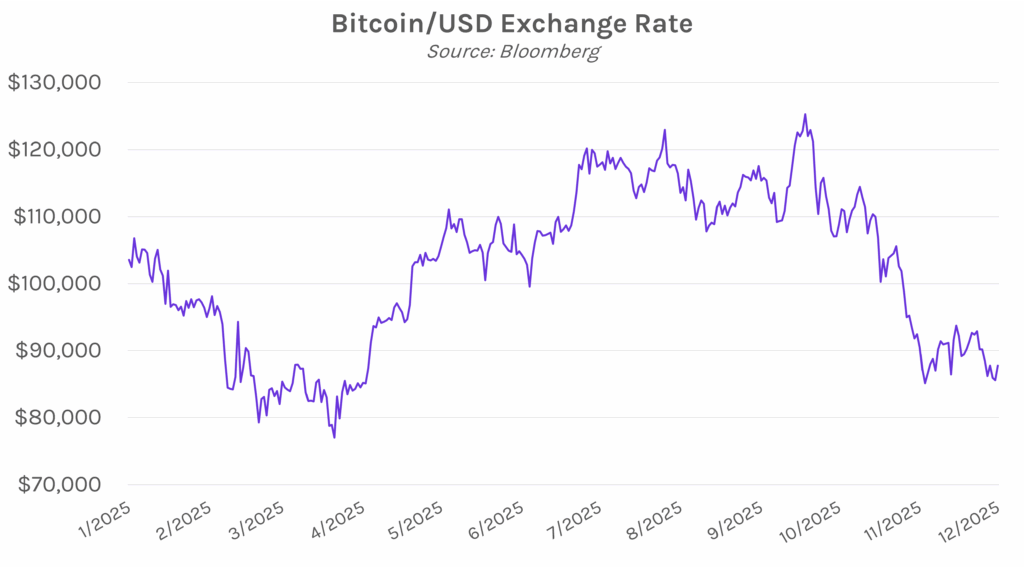

Yields edge higher on risk-on sentiment. Treasury yields gradually climbed 2-3 bps across the curve as buyers favored risk assets to conclude the week. The 2-year yield closed at 3.48% (a 4 bp decline on the week) and the 10-year yield closed at 4.15% (a 3 bp increase on the week). US equity exchanges saw more than 50% higher volume than the 12-month average, as an estimated $7 trillion notional of derivatives were set to expire today. The S&P 500 and NASDAQ closed 0.83% and 1.31% higher, respectively, led by tech names such as Nvidia and Oracle. Headlining crypto markets, Bitcoin gained nearly 3% today, a reversal of yesterday’s selloff.

Yen weakens despite BOJ benchmark rate hitting three-decade high. The Bank of Japan’s December monetary policy committee meeting adjourned today with the decision to raise interest rates by a quarter point to 0.75%. The benchmark is now at its highest level in 30 years. The move was widely anticipated and came as the central bank pointed to growing confidence in their economic outlook, citing strong wage growth trends and decreased concern over US tariffs. Notably, the BOJ signaled that further rate hikes are likely, but the yen weakened following the remarks as markets had been expecting a stronger commitment to tightening. Investors were also looking for clearer guidance on Governor Ueda’s view of the neutral rate, though he reiterated that it remains difficult to determine.

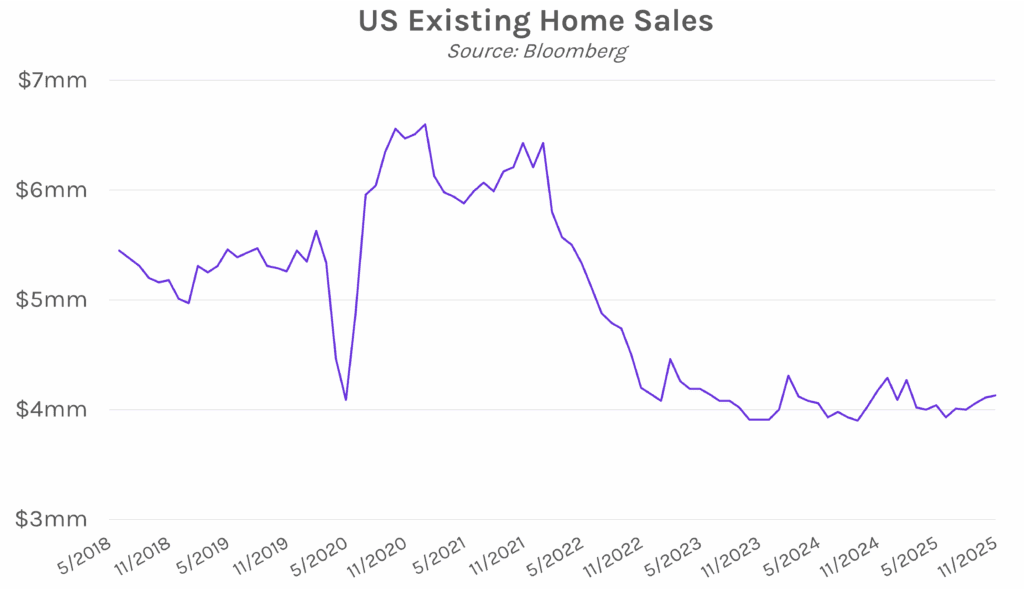

Existing home sales inch up as price growth cools. Existing home sales rose 0.5% last month to bring the annual rate of contract closings to 4.13 million, the highest level since February, though still down 7% from a year ago. Meanwhile, the median sales price rose 1.2%, one of the weakest gains since mid-2023. NAR Chief Economist Lawrence Yun said, “Existing-home sales increased for the third straight month due to lower mortgage rates this autumn. However, inventory growth is beginning to stall.” In November, the supply of existing homes ticked down to 1.43 million, after remaining relatively flat in the 1.52-1.54 million range since May.