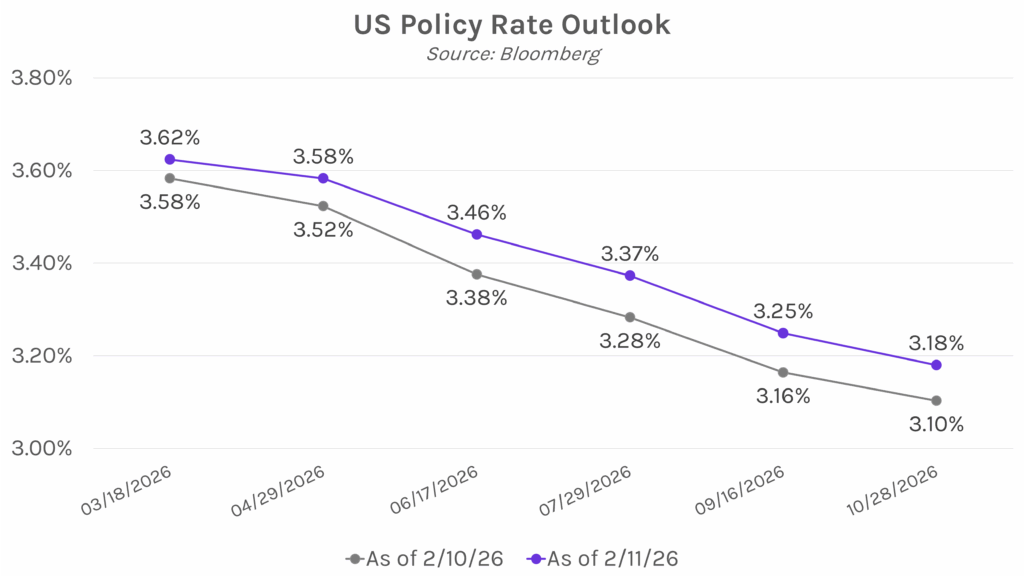

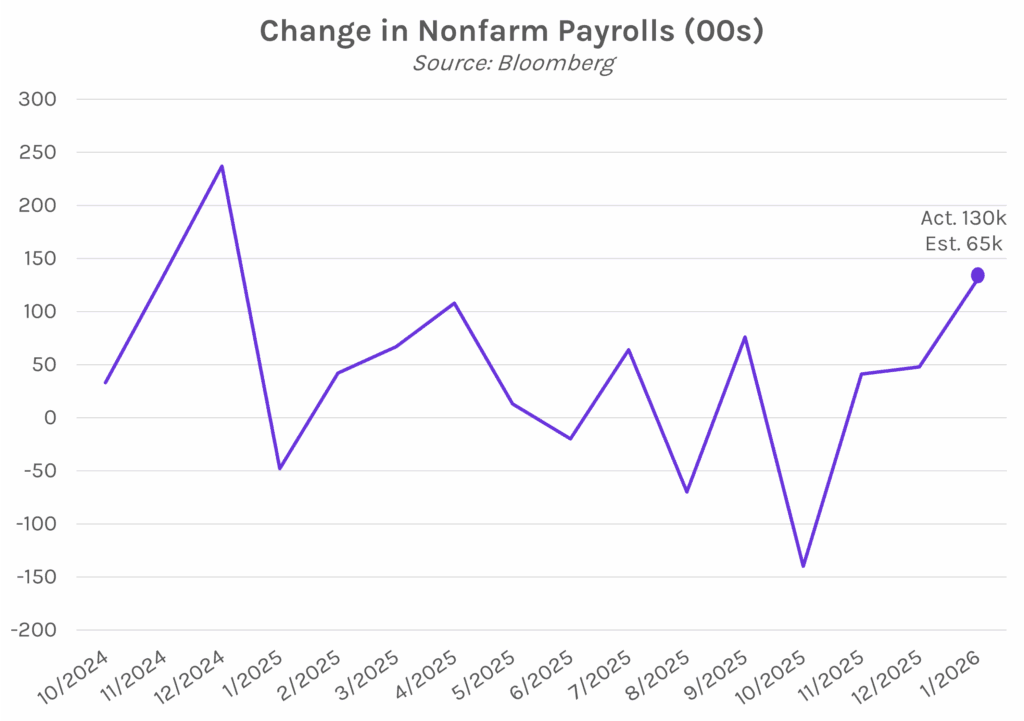

Yields climb on January labor market surprise. Treasury yields spiked as many as 10 bps in the aftermath of January’s job market report, which showed surprising labor market strength. The move partially reversed course in the afternoon, as yields declined ~5 bps from intraday highs and closed just 2-6 bps higher across a flattening curve. The 2-year yield closed at 3.51%, (+6 bps) while the 10-year yield closed at 4.17% (+3 bps). After today’s hot jobs report, markets are not fully pricing in a rate cut until the July FOMC meeting, compared to June previously. Meanwhile, equities initially jumped on the jobs data surprise before ending with the S&P 500 flat and the NASDAQ down 0.16%.

January payrolls show surprise labor market strength. Nonfarm payrolls unexpectedly showed 130k jobs added in January, doubling estimates of 65k jobs and above December’s downward revision showing a 48k increase. The level was the highest in over a year and the first time since late 2024 that US factory employment has increased. While offering a welcome sign that manufacturing activity may be picking up, US employment growth remains concentrated in healthcare sectors. Also of note, the January unemployment rate unexpectedly declined, ticking down to 4.3% versus 4.4% in December. Meanwhile, private payrolls added 172k jobs versus estimates of 68k and the prior month’s upwardly revised 64k jobs. On the whole, today’s release pared market expectations of policy rate cuts this year, reinforcing Fed comments from last month that pointed to a stabilizing labor market as reason to hold rates steady.

Fed’s Schmid advocates for holding rates steady, while Miran still sees reason to cut. Kansas City Fed President Jeff Schmid said the Fed should continue holding rates at a “somewhat restrictive” level in prepared remarks shortly after today’s blow-out jobs report. Schmid explained, “In my view, further rate cuts risk allowing high inflation to persist even longer.” Meanwhile, Fed Governor Miran took the stance that today’s strong labor data does not mean the Fed should hold off on rate cuts. Miran elaborated that there are “a variety of reasons why I want to see lower interest rates, and while today’s jobs data made me feel really good about the economy, I think the truth is that pushing out the supply side of the economy still allows for monetary policies to accommodate that.” Miran dissented in favor of a 25 bp rate cut at the January FOMC meeting alongside Fed Governor Waller.