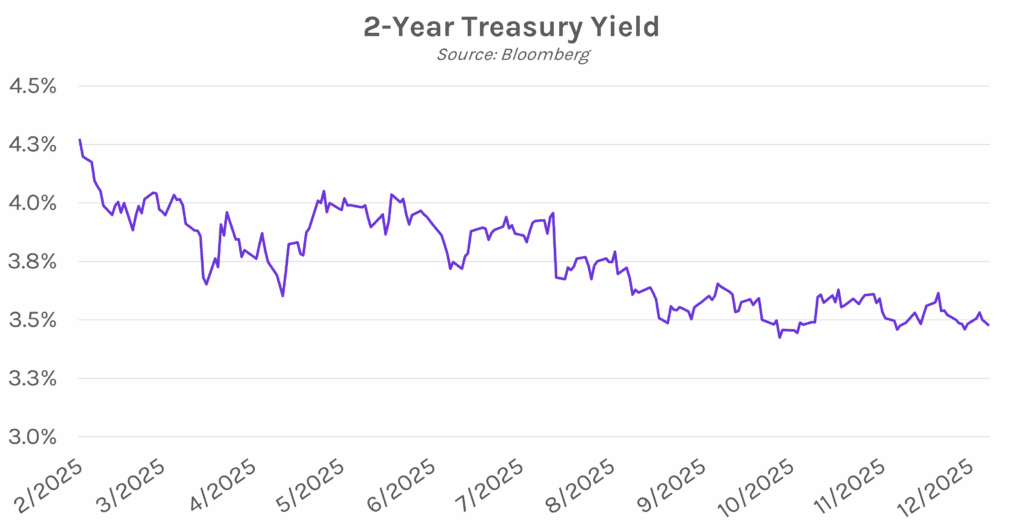

Treasuries steady post-holiday, on pace for best year since 2020. Yield volatility was muted in a quiet session today as markets returned from Christmas break. While on track to post a loss on the month, Treasuries are likely to deliver their strongest annual performance since 2020, supported by the Fed’s three rate cuts this year. Yields ultimately closed 1-2 bps lower across the curve, with the 2-year yield at 3.48% (no change on the week) and the 10-year at 4.13% (a 2 bp decline on the week). Meanwhile, equities edged slightly lower as investors look ahead to a potential ‘Santa Claus Rally’, referring to typical gains seen during the final five trading days of December and the first two sessions of the new year.

Yen weakens as Tokyo’s inflation cools more than expected. Consumer prices in Tokyo, excluding fresh food, came in at 2.3% YoY in December, below estimates of 2.5% and the prior month’s 2.8%. This marked the first decline since August. Despite the slowdown, headline inflation remains above the BOJ’s 2% target, and the central bank is still seen as being on track for further policy tightening. However, the sharper-than-expected drop in inflation has markets questioning whether the central bank will delay its next rate hike. Tokyo inflation data, which is seen as a leading indicator of nationwide price trends, caused the Yen to fall as low as 156.49 per dollar, having traded at 155.80 before the release. This move brought the currency near its lowest level against the dollar since January, with Yen weakness continuing to raise import costs and domestic prices.

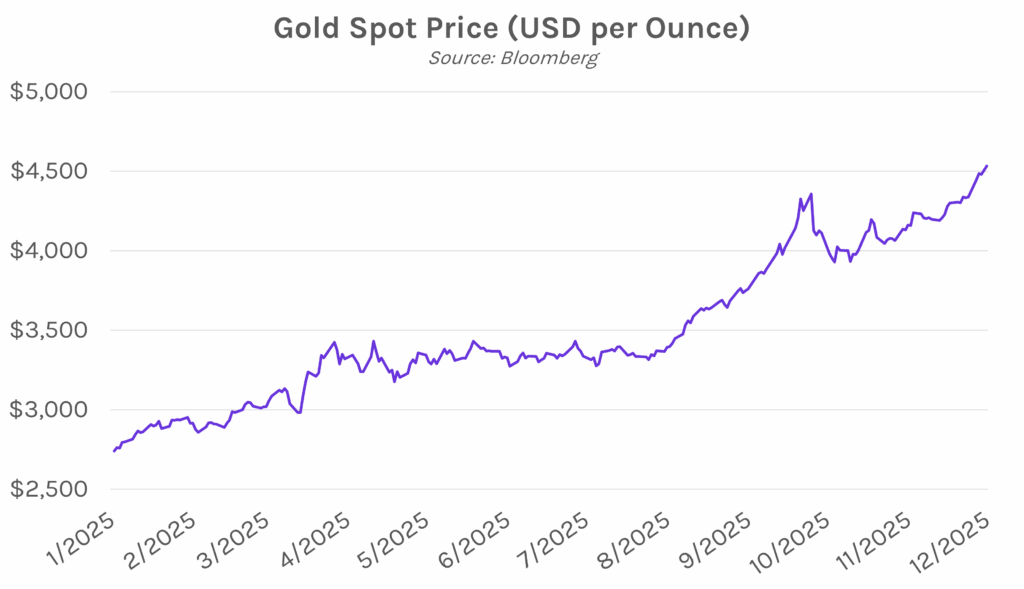

Gold, silver, and platinum hit all-time highs. Spot gold climbed 1.6% to trade above $4,540 an ounce today, while silver jumped 7.7% to break above $77 an ounce, underscoring renewed interest in safe-haven assets. Platinum also reached an all-time high of $2,437 an ounce. The rally comes on the back of rising geopolitical tensions, including the US blockade of oil tankers near Venezuela and the Trump Administration’s strikes targeting Islamic State affiliates in Nigeria. On the year, gold is up roughly 70% and silver has gained about 150%, marking their strongest annual performances since 1979. Gains have also been fueled by elevated central bank purchases, continued ETF inflows, and support from the Federal Reserve’s three interest rate cuts this year.