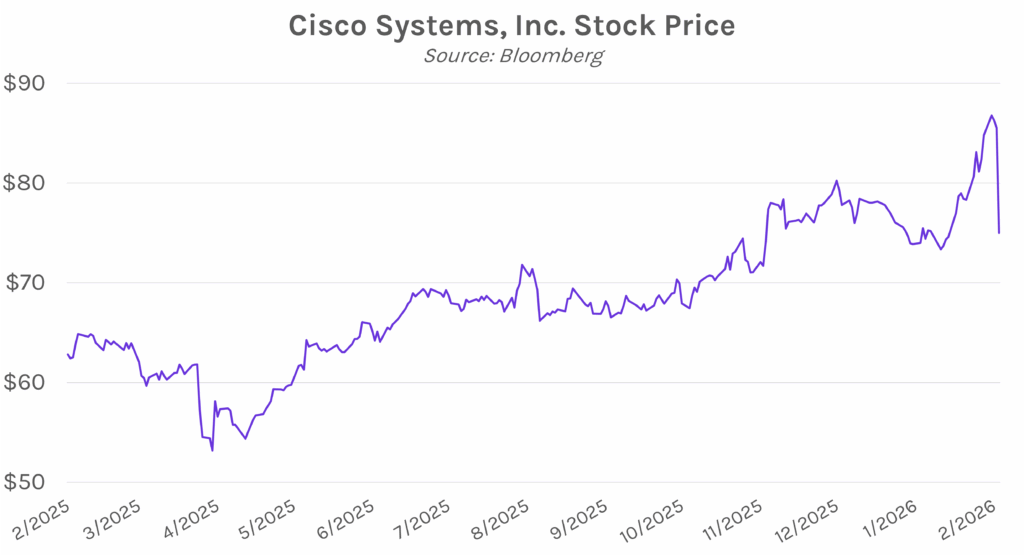

Yields decline on risk-off market sentiment. The recent tech rout continued today amid AI concerns, fueling a flight to quality. Yields plummeted alongside a steep equity sell-off, with yields down 6-9 bps across most of the curve while this afternoon’s 30-year Treasury auction saw the strongest demand in nearly eight years. The slide in equities was led by a ~12% dive in Cisco Systems Inc. following weak margin outlook, and the NASDAQ closed 2.03% lower at 22,597. The focus now turns to tomorrow’s inflation print, where core CPI is expected to come in at 2.5% YoY, a 0.1% slowdown from December.

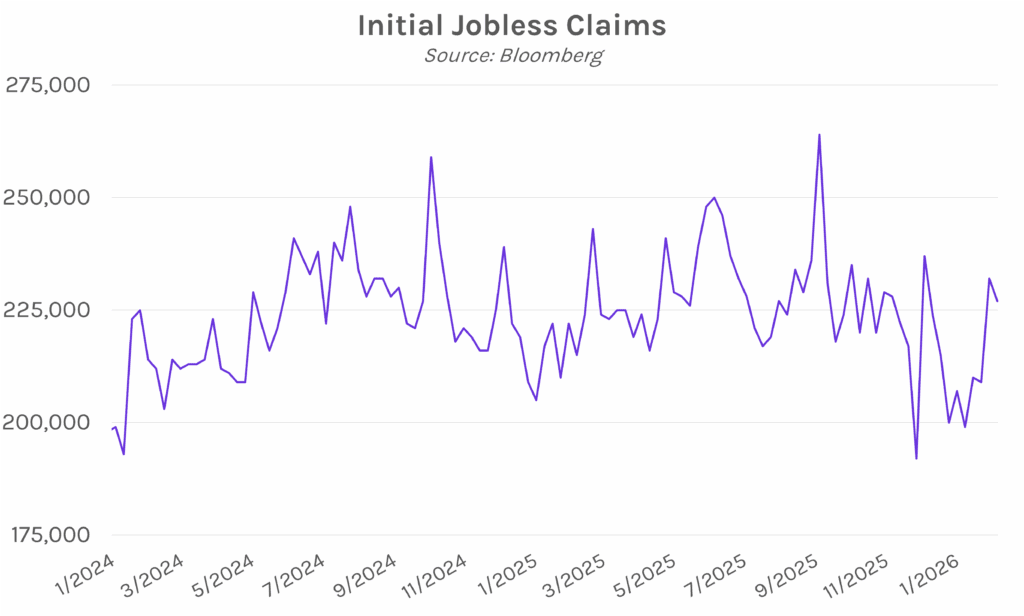

Jobless claims inch lower following hot January job report. Initial jobless claims data came in slightly above expectations today at 227k, a slight improvement from the prior week’s 231k. Continuing claims edged higher from 1.84 million people receiving benefits previously to 1.86 million. Weekly claims data tends to fluctuate due to severe weather, and the slight improvement in new claims suggests that people were able to resume work following the recent winter storm that impacted large areas of the country. Today’s print comes after yesterday’s January labor data showed a strong increase in payrolls and a falling unemployment rate, which further delayed expectations for 2026 rate cuts.

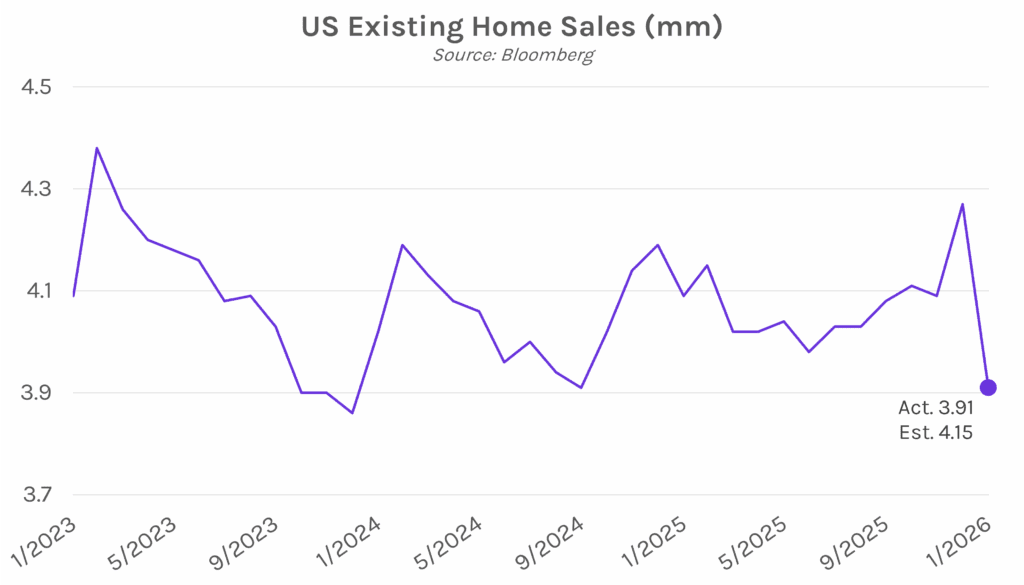

Existing home sales fall by 8.4%. Previously owned US homes sales totaled 3.91mm in January, an 8.4% decrease from December and the largest decline in four years. Experts partially attribute the slump to January’s extreme winter weather, which caused delays with contract closings. Notably, existing home sales in the south fell by 9%, the most of any region. However, one possible bright spot in the housing market is recent signs of improving affordability. The National Association of Realtors housing affordability measure increased in January to the highest level since 2022, though it remains below pre-pandemic levels.