August 2025 Highlights

3 Things to Know:

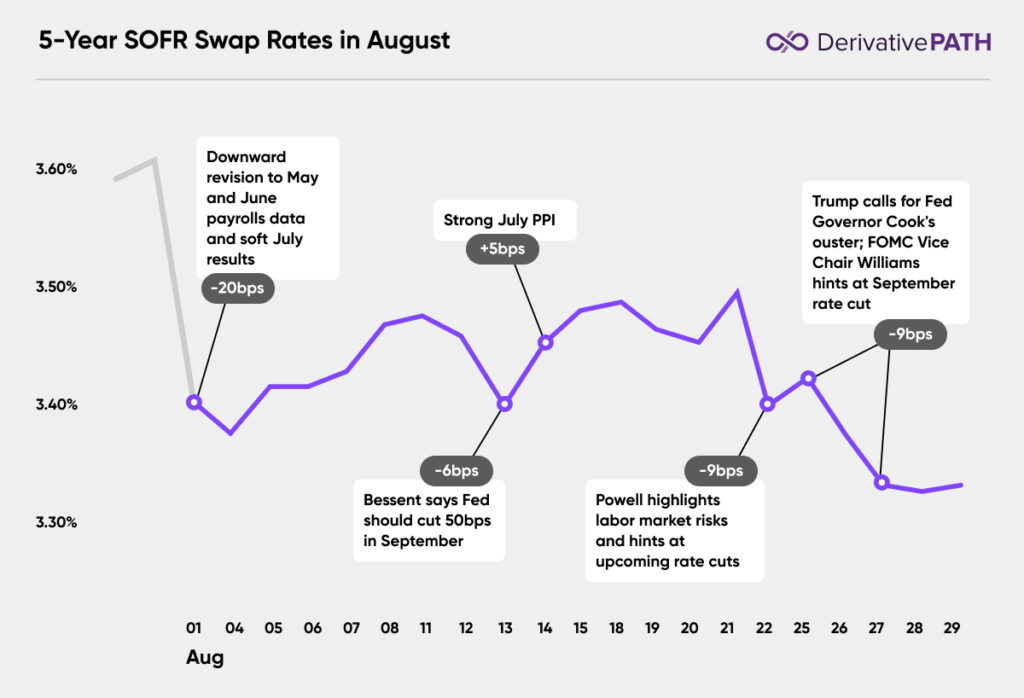

- Rates hit YTD lows. Rates plummeted ~20bps to start August after weak payrolls data and remained within a 10bp range for most of the month. During the final week of August, rates fell ~15bps and set new YTD lows.

- Labor data shifts Fed outlook. July’s weak payrolls data disrupted the narrative of a stable labor market. Chair Powell called Fed policy “appropriate” at the July FOMC Meeting but later acknowledged labor vulnerabilities at Jackson Hole, saying they “may warrant adjusting our policy stance.” Futures markets see a ~90% chance of a 25bp cut in September vs. ~47% on the day of the July FOMC meeting.

- Trump administration pressures the Fed. Secretary Bessenturged the Fed to cut 50bps in September and said policy rates should be 150bps lower considering the latest labor data. Soon thereafter, President Trump accused Fed Governor Cook of mortgage fraud and called for her removal. The move was viewed as an attempt to replace Cook with a more dovish FOMC voter, leading to an immediate decline in rates and, perhaps more importantly, casting doubt on the future independence of the Fed.

Explore More:

- July Labor Data (-20 bps)

- Bessent Calls for 50bp Rate Cut (-6 bps)

- July PPI Data (+5 bps)

- Powell’s Jackson Hole Speech (-9 bps)

- Trump Calls to Remove Cook (-9 bps)

Contact us:

415-992-8200

sales@derivativepath.com