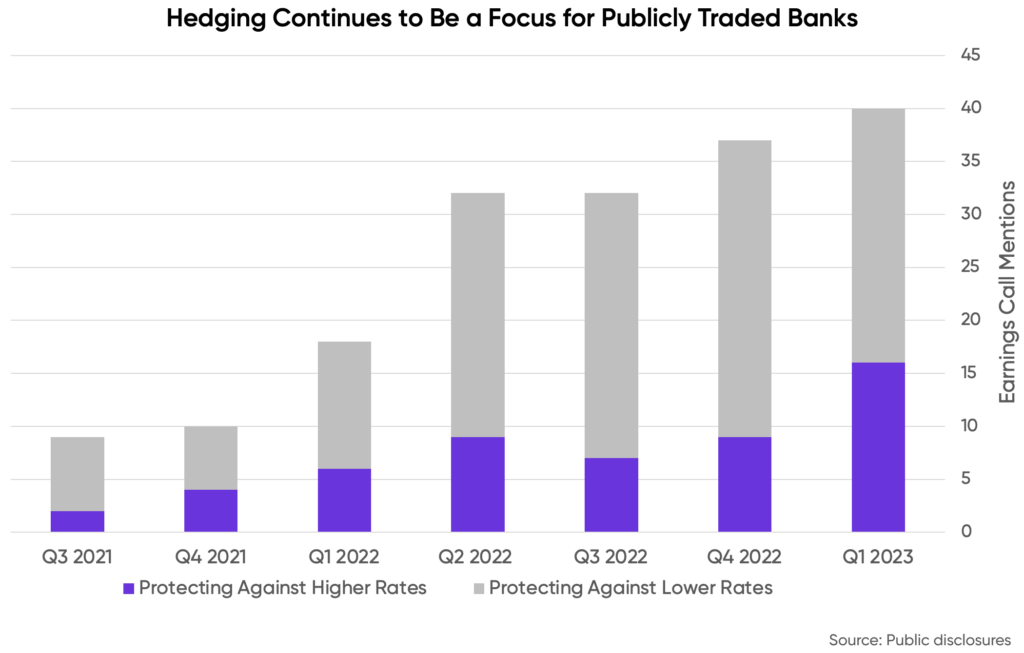

We saw a pronounced uptick in references to hedging on Q1 earnings calls, both from banks who highlighted their risk management efforts and from the analyst community looking to understand bank exposures to rates:

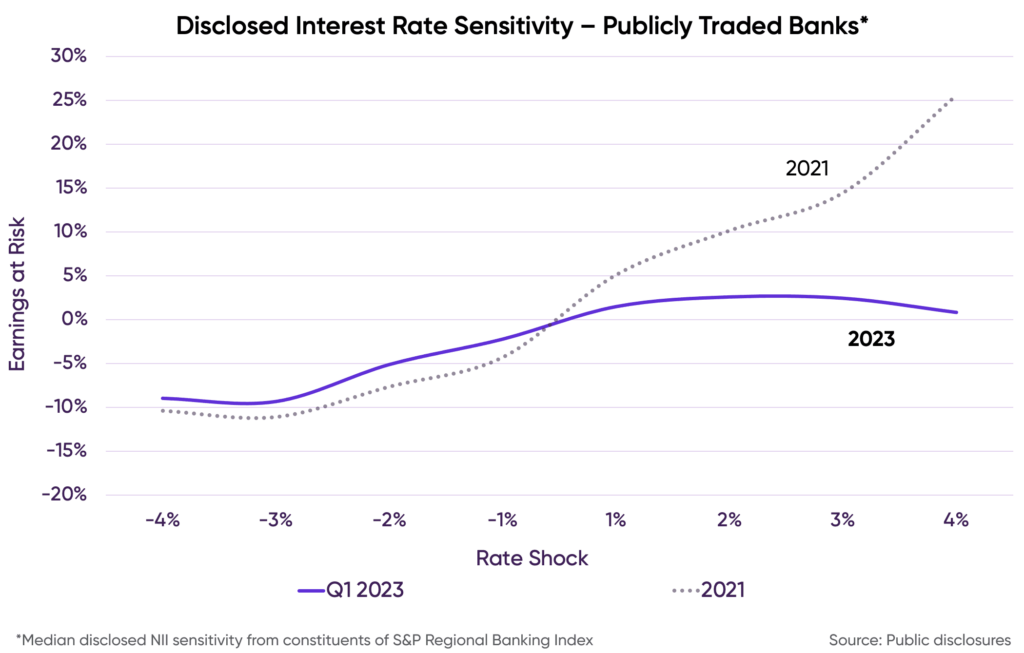

Over 40% of the strategies discussed were hedges against rising rates, the highest percentage we’ve seen in two years. In part, this reflects the dynamic nature of interest rate risk. Our review of public interest rate risk disclosures found that the median bank is significantly more exposed to rising rates than in years past.

The inverted swap curve has also improved the attractiveness of rising rate strategies. That inversion allows liability-sensitive institutions to execute pay-fixed swaps that reduce risk to higher rates and increase immediate earnings. Those institutions hedged a variety of different exposures in Q1, but the majority chose to hedge AFS securities, while a subset opted to hedge new wholesale borrowings or fixed rate loans.

Asset-sensitive institutions were also subject to significant inquiry from the analyst community, no doubt spurred on by the fear that the Fed may reduce policy rates. The same market dynamics that create an attractive entry point for pay-fixed swaps make receive-fixed swaps less attractive. To avoid negative carry, we saw institutions execute alternative strategies, including forward-starting receive-fixed swaps and interest rate floors.

For a more in-depth look, we’ve compiled a complete list of hedging commentary from first-quarter earnings calls: