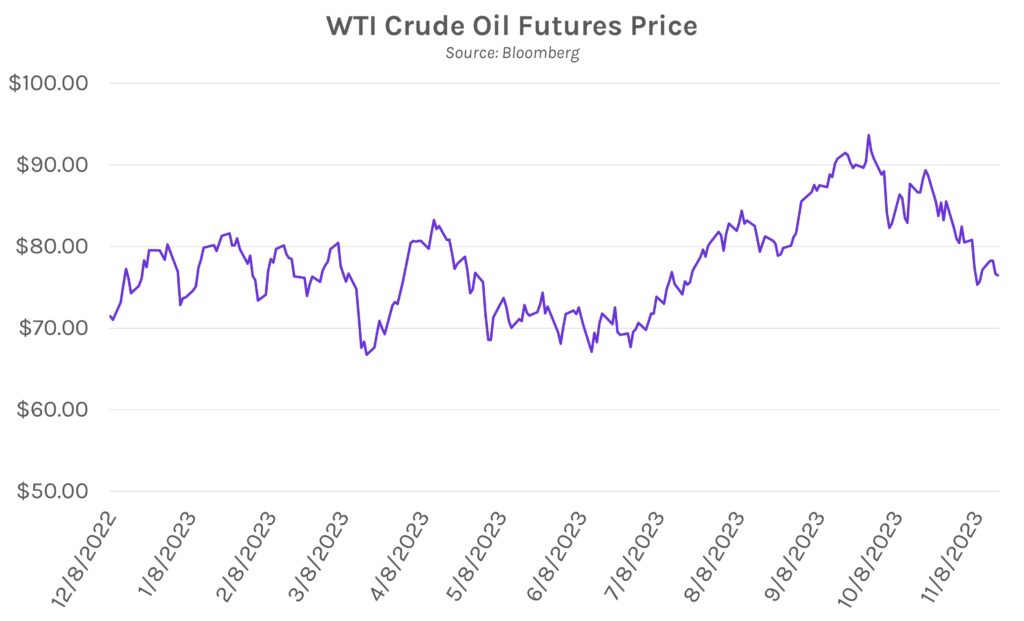

Treasury markets reverse course during risk-on day. UST rates were up across the curve today, ending 8-9bps higher on the long end, as markets partially reversed yesterday’s reaction to October CPI data. The yield moves strengthened the USD against major currencies, including the Yen which rose above 151 per Dollar. Equities were also up across the board, with the S&P and NASDAQ up 0.16% and 0.07%, respectively, though the advance was much smaller than yesterday’s moves which were driven by short covering and unwinding of Fed hiking bets. WTI Crude was down ~2.15% on the day, following the EIA’s crude oil report that showed elevated US crude inventories.

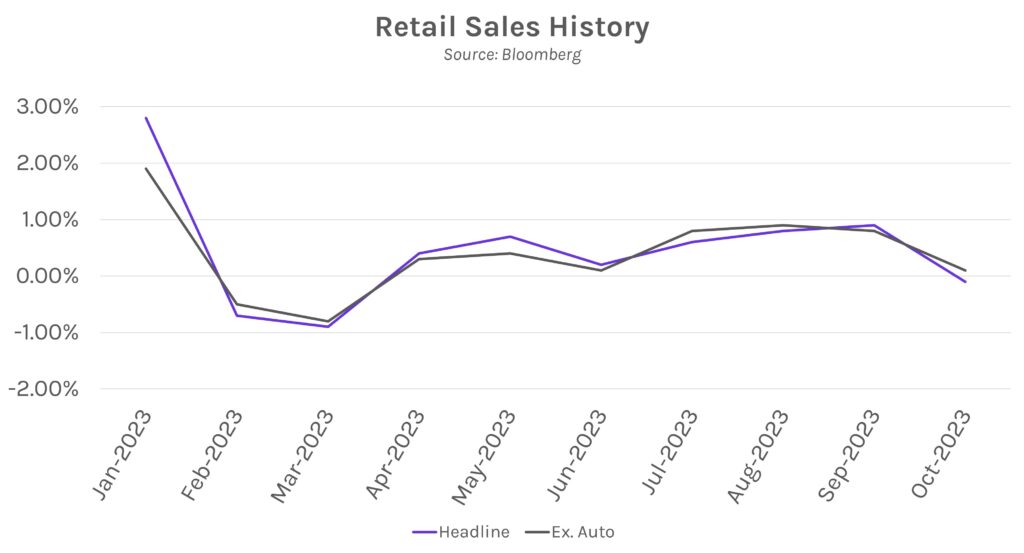

Retail sales slowed in October. Overall, retail sales slowed by less than expected in October compared to September’s upwardly revised figures as seasonal summer spending declined. Headline retail sales declined 0.1%, while all core measures increased during the month. The pullback offers a sign that restrictive Fed policy is working. Bill Adams, chief economist at Comerica, forecasts that consumer spending will continue to grow in 2024, and that the economy has a “good shot at returning to a more normal rate of inflation and pace of growth without slipping into recession.”

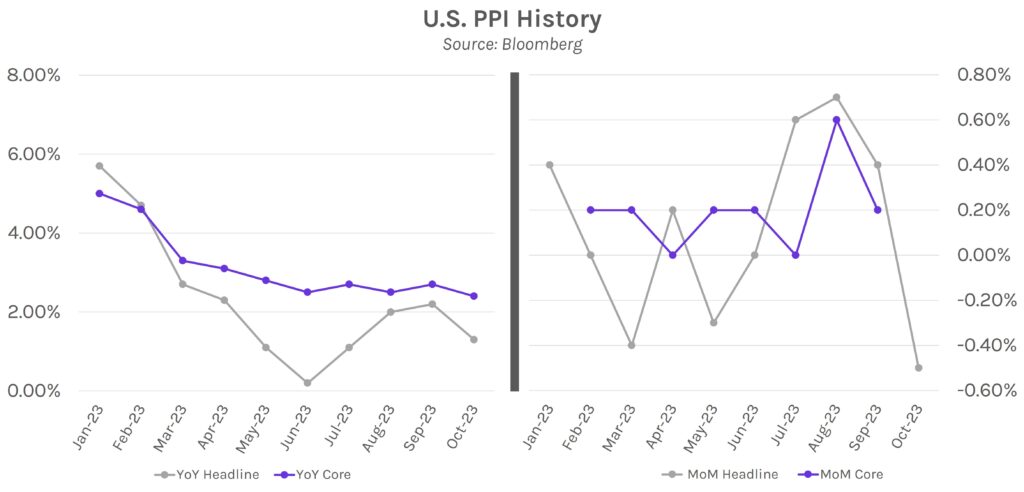

Lower gas prices drive steepest PPI decline since April, 2020. Headline prices paid to US producers in October declined 0.5%, far below expectations of 0.1% growth, while core PPI increased was 0.0%, vs. expected growth of 0.3%. Over 80% of the decrease in goods prices was driven by a 15.3% decline in gas costs during the month. Meanwhile, service costs were flat after rising for 6-straight months. PPI is closely watched because several categories feed into the PCE calculation, the Fed’s preferred measure of inflation.