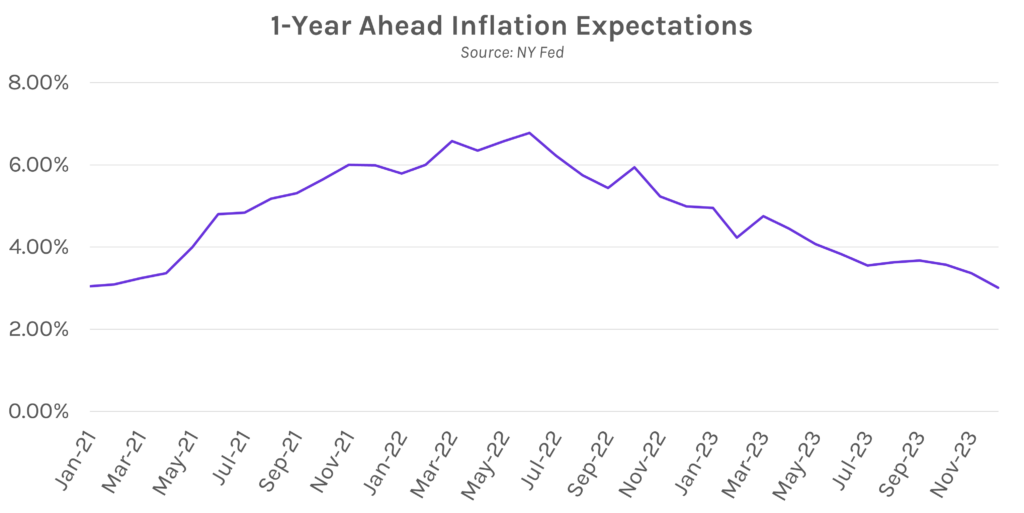

Inflation expectations and lower oil prices drive down yields. Treasury yields and swap rates kicked off the day roughly in-line with last Friday’s closing levels, before falling throughout the morning as oil prices declined up to 5% on Saudi Arabian price cuts and NY Fed data showed that US consumers’ 1-year inflation expectations dropped to 3.0%, the lowest since January 2021. Yields were down 5-8 bps across tenors at midday, with the 5-year UST yield declining nearly 9 bps to 3.92% intraday, but reversed course to end the day 0-2 bps lower across the curve. Equities rallied, with the S&P 500 up ~1.4% and the NASDAQ up ~2.2%, following last Friday’s declines due to mixed economic data.

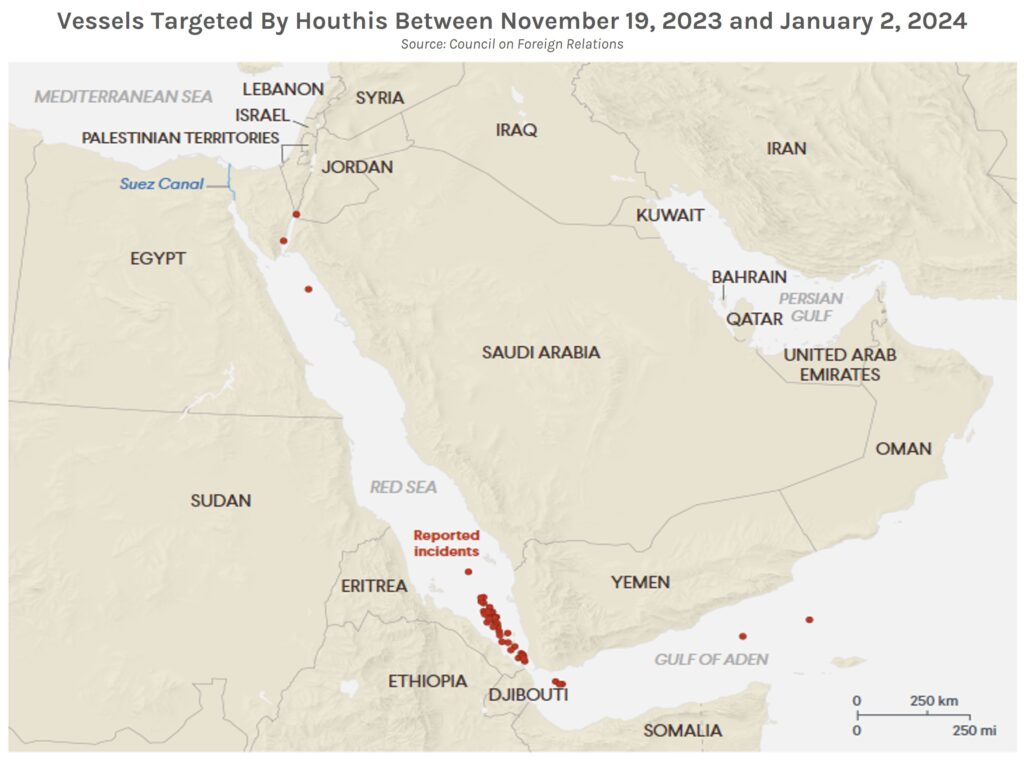

Secretary Blinken continues Middle East tour, warning conflict could “easily metastasize.” As tensions mount in the Middle East, US Secretary of State Antony Blinken is conducting his 4th visit to the Middle East since the October 7th attacks as part of a push to contain escalation. Yesterday, he met with Qatari and Jordanian officials, and highlighted that that the Israel-Hamas war could “easily metastasize, causing even more insecurity and even more suffering.” He also addressed the economic impacts of the conflict, mentioning that Red Sea attacks have disrupted nearly 20% of global shipping. Today he was scheduled to meet with leaders in Abu Dhabi and Saudi Arabia before traveling to Israel.

Disappointing German manufacturing data makes near-term economic rebound less-likely. Germany’s disproportionately important manufacturing sector had a tough 2023, with 6 months of stagnant or negative orders growth (2 of those months saw orders contraction of +10%). November results were similarly disappointing – orders rose 0.3% MoM vs. a 1.1% expected gain and fell 4.4% YoY vs. a 3.4% estimated decline. The weak November results make a substantial rebound in industrial activity over the coming months less-likely, according to ING’s Head of Global Macro Carsten Brzeski. As a result, economists largely expect data on January 15th to show the German economy is in recession, following -0.1% real GDP growth in 3Q23. Germany is the EU’s largest economy, and its performance has a large bearing on ECB decision making. Recently, ECB policymakers have pushed back on rate cuts in the near term.