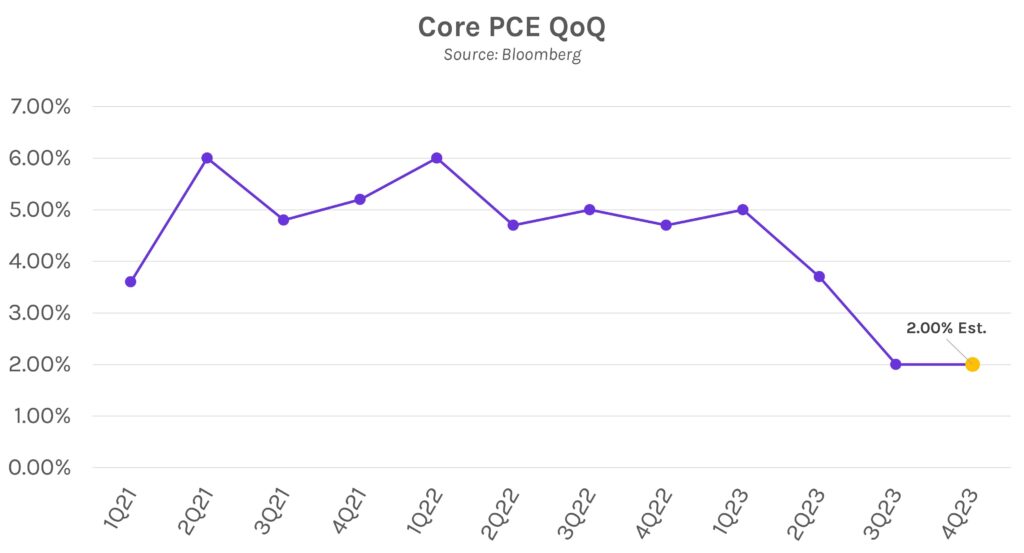

Rates rise ~5bps ahead of GDP, PCE figures. Swap rates rose around 5bps across the curve today after preliminary January US PMI was above expectations and increased from December. The move comes ahead of upcoming GDP and PCE data, where the latter is expected to stay flat at 2.0% QoQ in 4Q2023. Long-term rates are at their highest levels since early December, up 35-45bps from recent lows. Meanwhile, WTI crude oil closed above $75 per barrel after US stockpiles fell by more than 9 million barrels, the largest decline since August.

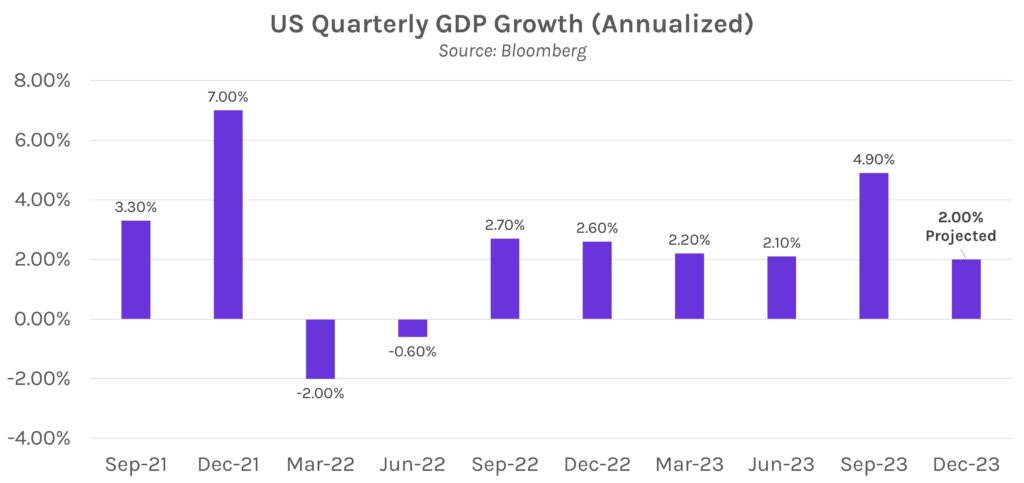

Consumer spending expected to drive 4Q23 GDP growth. US Quarterly GDP growth will be released tomorrow, and forecasters expect a decline (on an annualized basis) to 2.0% in Q4. The drop would be the latest in a steady march downward from 2.7% growth in 3Q22, excluding a spike to 4.9% in 3Q23. Tomorrow’s growth is expected to be driven by a 2.5% climb in household spending, higher than economists expected prior to last Wednesday’s retail sales data. Looking ahead, the IMF expects US real GDP to grow 1.5% in 2024.

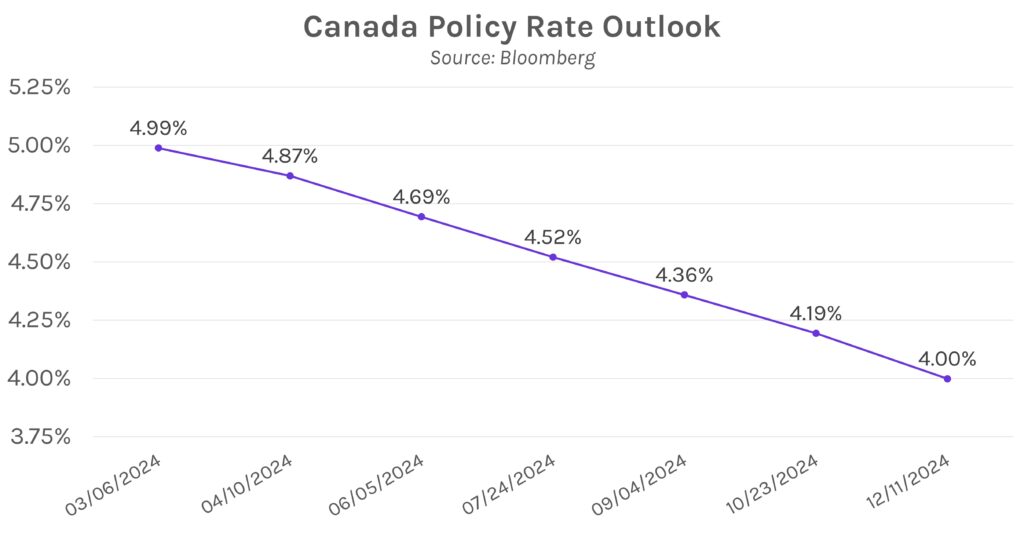

Bank of Canada holds rates at 5%, suggests that rate hike cycle is likely over. The Bank of Canada unanimously decided to hold rates steady at 5% today, the fourth consecutive hold after 475bps of hikes over the past two years. Incremental rate hikes seem unlikely, as the bank eliminated language from its previous policy statements that cited preparedness to hike again. Instead, Governor Macklem said that discussions will shift to the timing of rate cuts, as long as the economy performs in-line with current forecasts. Rate cuts are expected as early as April, and futures currently have four 25bp cuts priced in for 2024.